Reshoring Initiative® 2020 Data Report

Reshoring Reaches New Record in 2020, Plus, COVID Drives Cumulative Jobs Announced Past 1 MILLION JOBS

View downloadable pdf here

.

Executive Summary

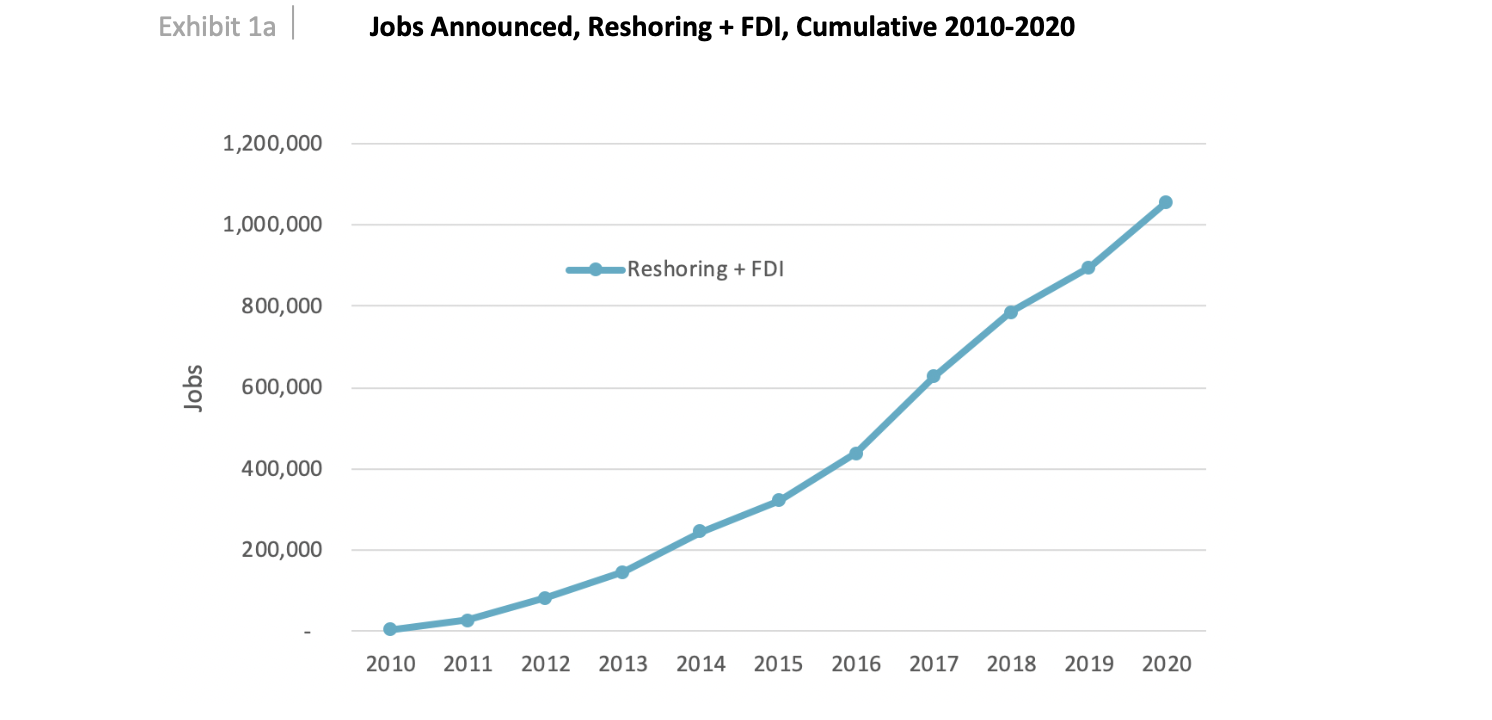

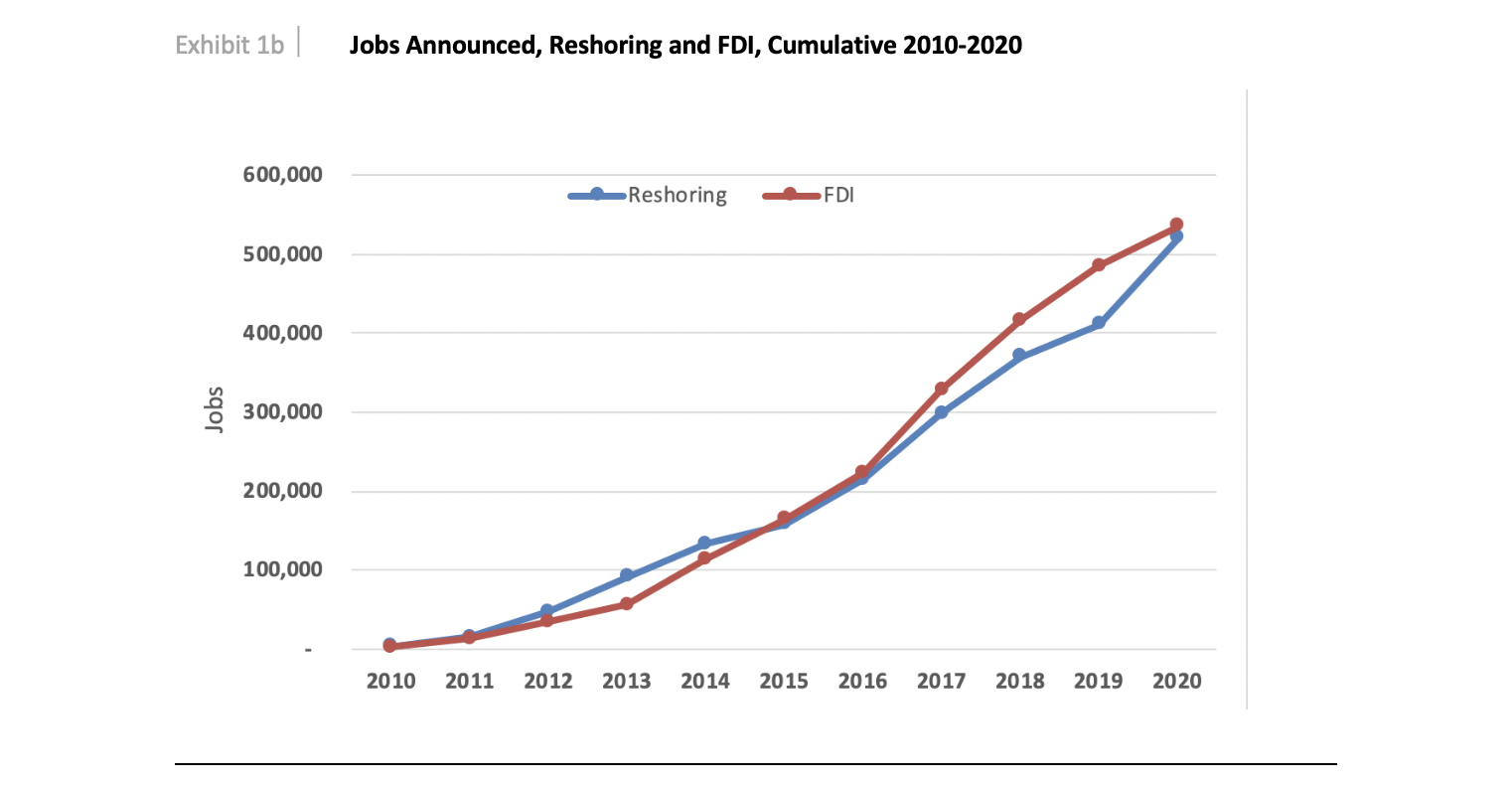

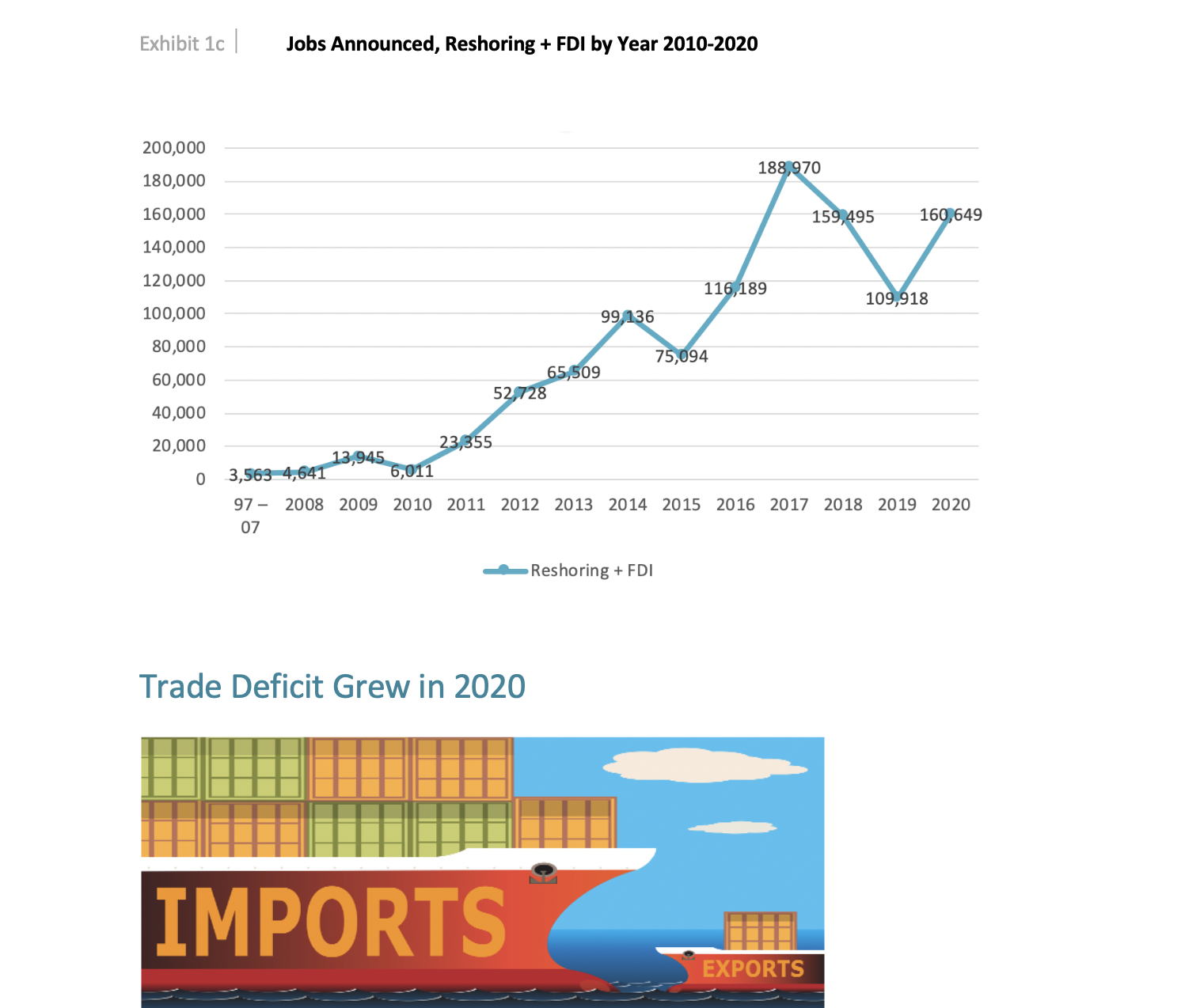

One bright silver lining to the pandemic is the broad public and corporate realization and acknowledgement of the need to shorten supply chains and produce goods at home. Despite COVID, reshoring numbers were up in 2020. Reshoring and foreign direct investment (FDI) job announcements for 2020 were 160,649, bringing the total jobs announced since 2010 to over 1 million (1,057,054). Also of significant importance: reshoring exceeded FDI by nearly 100%, the first beat for reshoring since 2013. Additionally, the number of companies reporting new reshoring and FDI set a new record: 1,484 companies. Reshoring will continue to be key to U.S. manufacturing and economic recovery in 2021 and beyond.

This report contains data on trends in U.S. reshoring announcements by U.S. headquartered companies and FDI by foreign companies that have shifted production or sourcing from offshore to the U.S. The cumulative data includes 2010 - 2020.

Data Index

1. Cumulative Manufacturing Jobs

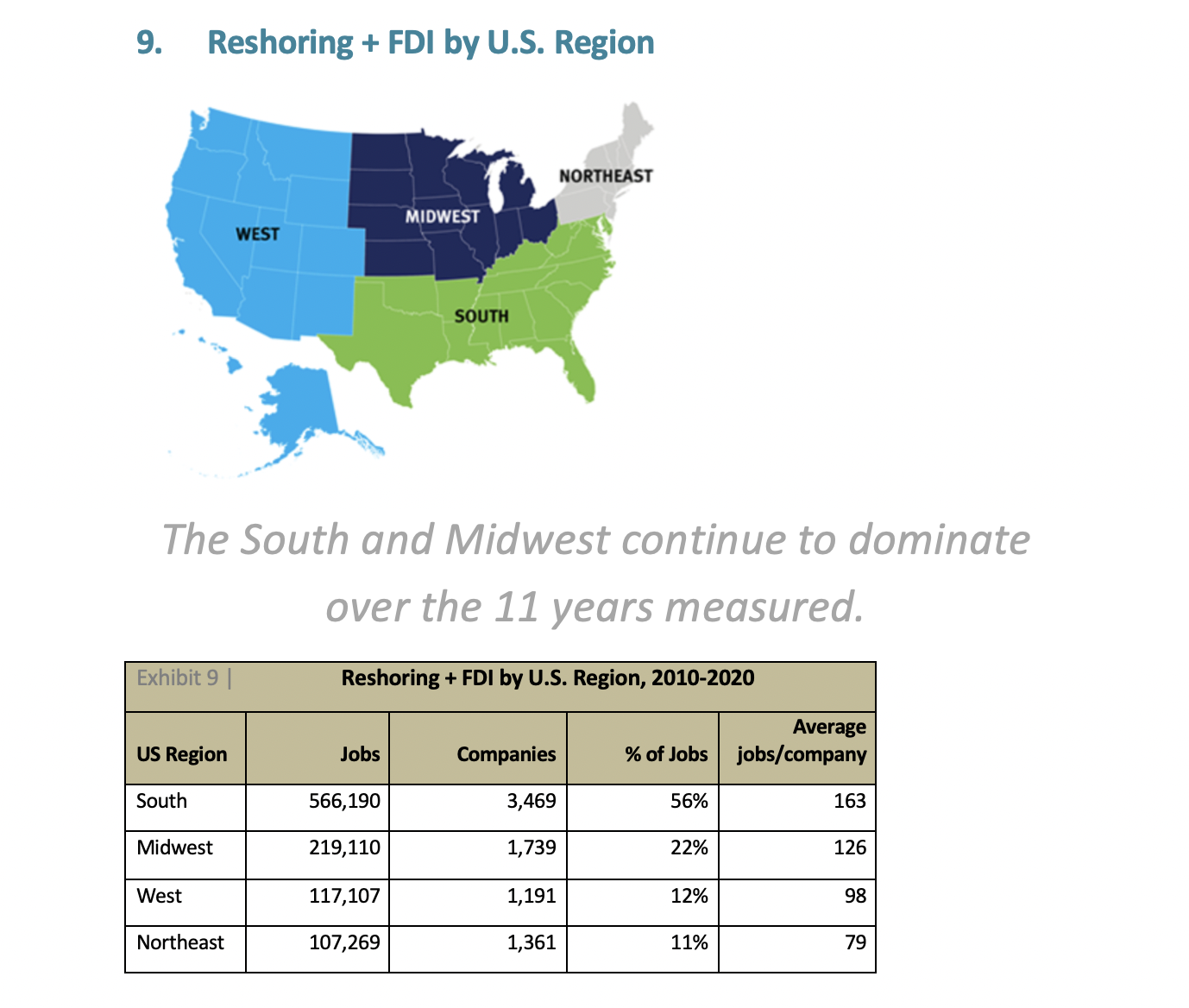

2. Manufacturing Job Announcements by Year 3. Factors Cited 4. Industry 5. Tech Level 6. Countries From 7. International Regions From 8. State 9. U.S. Region 10. Nearshoring 11. 2021 Trends and ProjectionsAll data is for reshoring plus FDI, 2010 to 2020, unless otherwise noted.

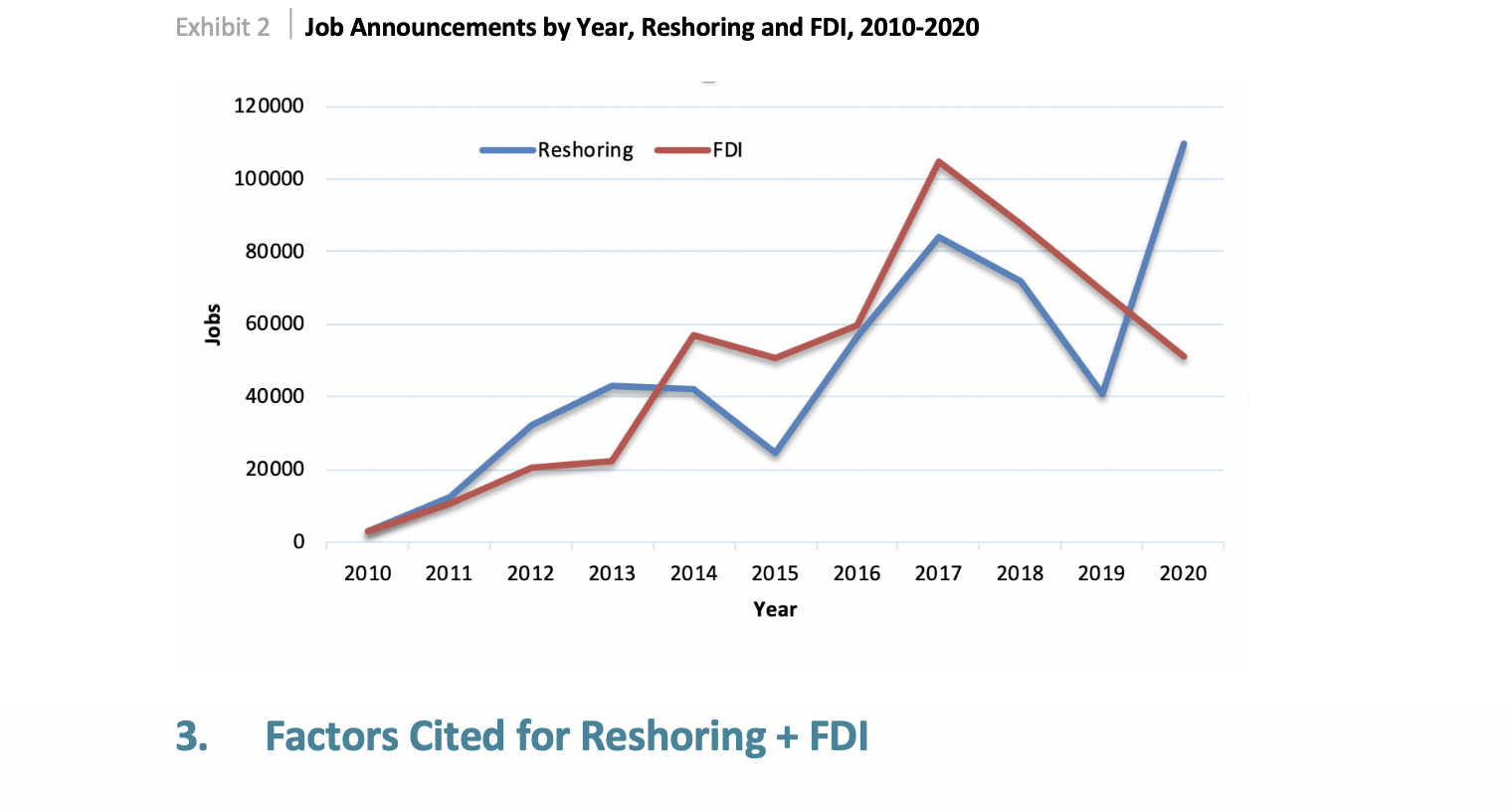

In 2020 reshoring surged to a record high of 109,000 jobs announced. We believe the strength of the trends in recent years is largely based on a combination of greater U.S. competitiveness due to corporate tax and regulatory cuts, increased recognition of the total cost of offshoring and rising concern over China’s competitiveness and favoritism for Chinese state-owned enterprises. The decline from the 2017 peak is due to business uncertainty caused by President Trump’s tariffs. The 2020 recovery-jump in reshoring was driven by import shortages observed during the pandemic. The high rate of 2020 reshoring vs. FDI also indicates that U.S. headquartered companies are starting to understand the same benefit to U.S. production that foreign companies have understood over the last decade.

In 2020 reshoring surged to a record high of 109,000 jobs announced. We believe the strength of the trends in recent years is largely based on a combination of greater U.S. competitiveness due to corporate tax and regulatory cuts, increased recognition of the total cost of offshoring and rising concern over China’s competitiveness and favoritism for Chinese state-owned enterprises. The decline from the 2017 peak is due to business uncertainty caused by President Trump’s tariffs. The 2020 recovery-jump in reshoring was driven by import shortages observed during the pandemic. The high rate of 2020 reshoring vs. FDI also indicates that U.S. headquartered companies are starting to understand the same benefit to U.S. production that foreign companies have understood over the last decade.

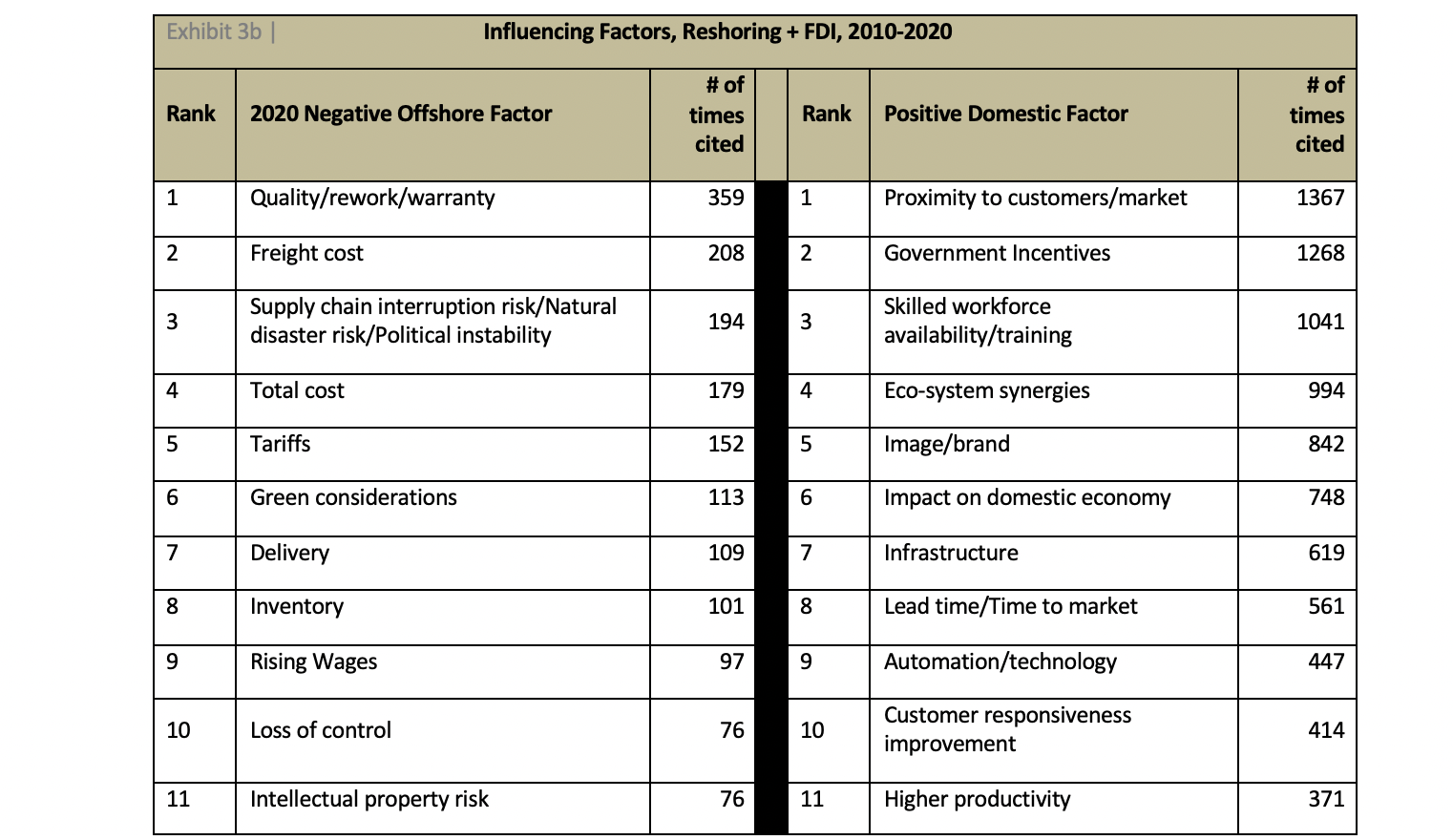

Positive Factors are the values that attracted the company to their U.S. site and that they achieved here. These factors are similar for reshoring and FDI with the following exceptions.

- Reshoring places higher emphasis on Made-in-USA image (695 vs 147), redesign of the product (284 vs 75 mentions), and impact on domestic economy (483 vs 265).

- FDI places more emphasis on government incentives (795 vs 472), skilled workforce (607 vs 424), and Proximity to customers (894 vs 472).

- Since reshoring is almost all from low-wage countries, reshoring companies have increased automation to make up for higher domestic hourly labor cost. This trend more recently also applies to FDI.

- Since most FDI is primarily from other developed countries, Made-in-USA is a less powerful sales argument. Shifting from Made-in-Germany to Made-in-USA has less brand value than shifting from Made-in-China.

- Foreign companies can be recruited by all 50 states and often have larger projects; thus, they receive more government incentives. This may be shifting to include reshoring, with the essential products push by the U.S. government.

Negative Factors are the negative issues experienced offshore. Most of the issues are related to distance: freight, delivery, inventory, etc. Others are country specific: rising wages, IP risk, political instability, etc.

Companies have consistently reported Positive Factors more often than Negative, probably because the companies place more value on demonstrating the wisdom of their current reshoring decision than on what went wrong with their earlier offshoring decision. Companies also do not want to offend the country they are leaving.

Overall, reporting of factors influencing reshoring and FDI has continued at a high rate, indicating heightened public interest and industry awareness of the previously “hidden costs”. In 2020, cases reported an average of 8.6 factors.

Not surprisingly, the largest shifts in factor reporting in 2020 were pandemic related. Covid-19 itself was the #1 cited factor in 2020. Negative Offshore Factors with substantial increases included: Supply chain disruption (1000% increase), Loss of Control, and Strained offshore relationships. Additionally, Green considerations saw the largest citing on record. We predicted Green considerations to become more relevant due to the new emission reduction initiative by the International Maritime Organization, along with other imminent mandates related to climate change. With heightened public awareness of climate change issues, consumers are increasingly demanding environmentally sound products. Local sourcing is intrinsically conducive to clean, sustainable production. Quality/rework/warranty remained the highest reported negative factor, cumulatively.

The rate of positive factor reporting remained similar to recent years. The biggest increases in positive factors were in Lead Time to market (pandemic related) and Underutilized Capacity (Perhaps due to decreased consumer demand in some categories due to COVID?) Citing of Tariffs, which increased 118% in 2019, fell by 50% in 2020. It is unclear if companies have adjusted to the tariffs, are waiting for them to be removed or view the topic as too politically charged.

Other factors mentioned in 2020, but not recorded in these Exhibits, include: national security, price gouging, Chinese ban on imports of recyclables, and investing to improve competitiveness.

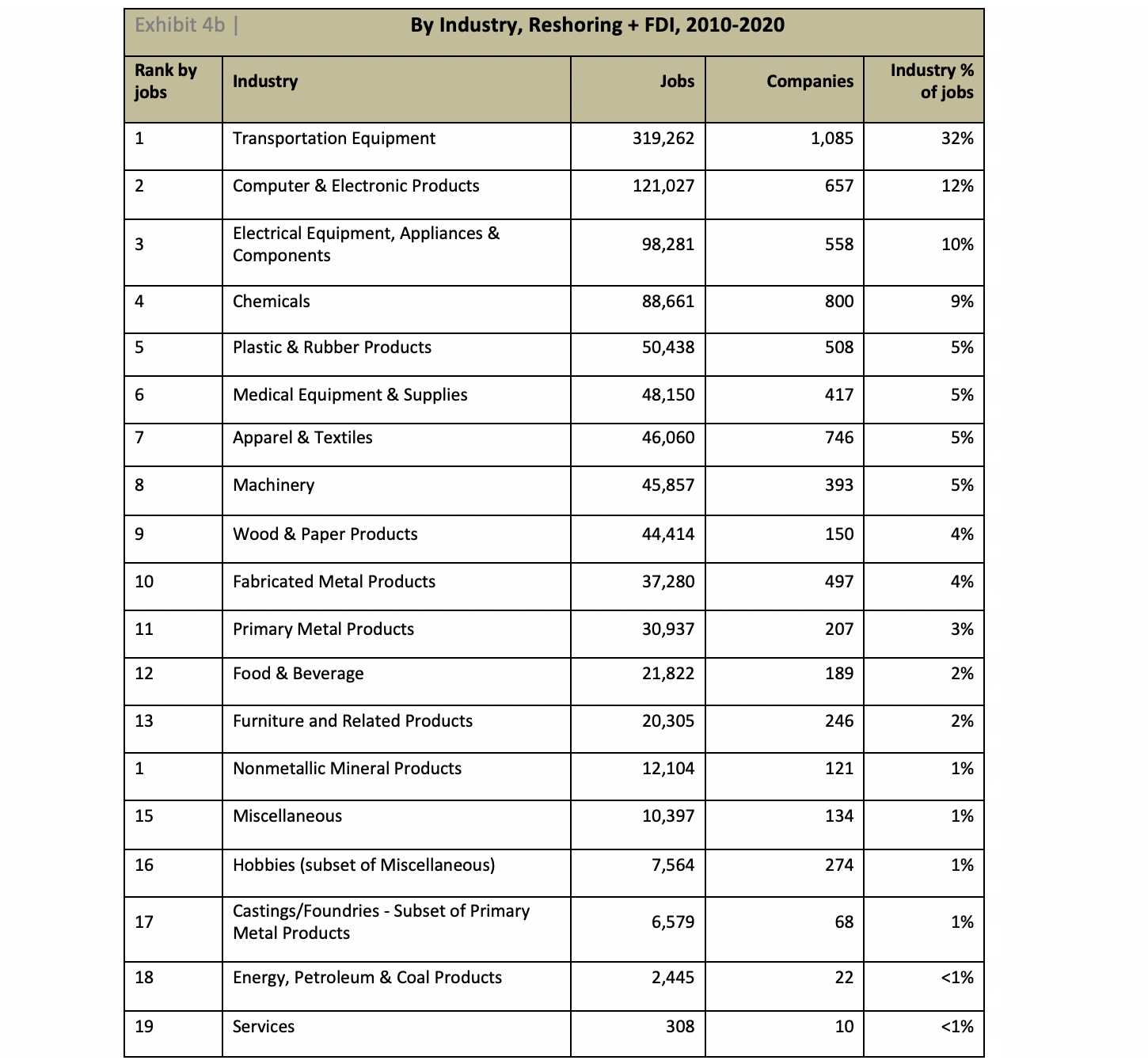

Only products that have been offshored/imported can be reshored. Thus, the products least suitable for offshoring never left, such as heavy, high volume minerals, high mix/low volume items or customized automation systems.

Historically, the most active reshoring is by those that left and probably should not have done so, including machinery, transportation equipment and appliances. More recently, we added to that list essential products of which the U.S. relies too heavily on imports, such as PPE, pharmaceuticals, rare earths, semiconductors and electric batteries. President Biden has ordered a review of four classes of essential products where American manufacturers rely on imports. Both 2020 and 2021 have seen a jump in cases in these industries and we expect that trend to accelerate in the coming years, as we discuss more broadly in Chapter 11. 2021 Trends and Projections.

As the data indicates, reshoring is focused on products whose size and weight, e.g. transportation equipment, or frequency of design change/volatility of demand, e.g. some apparel, suggest that offshoring never offered great total cost savings.

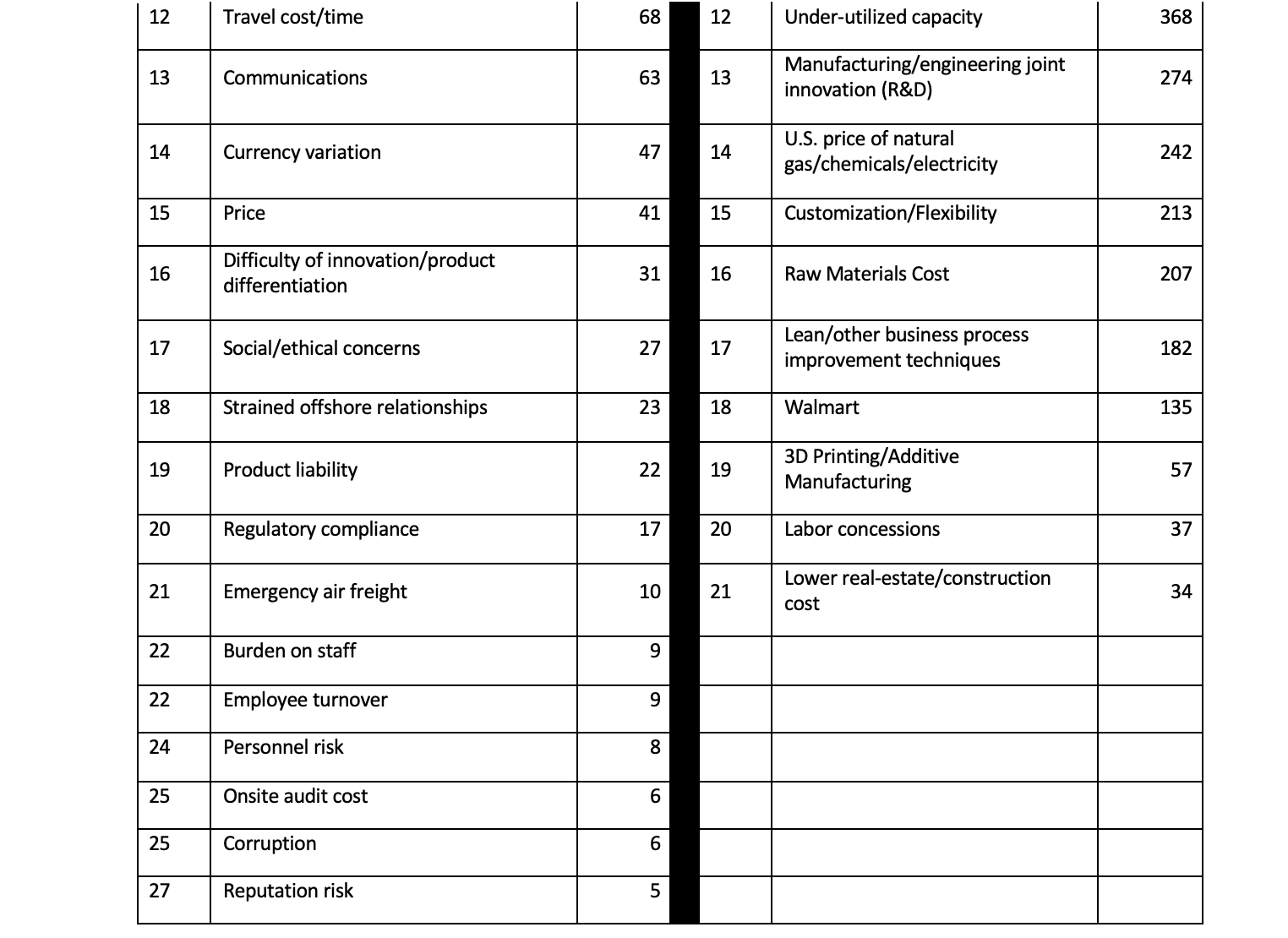

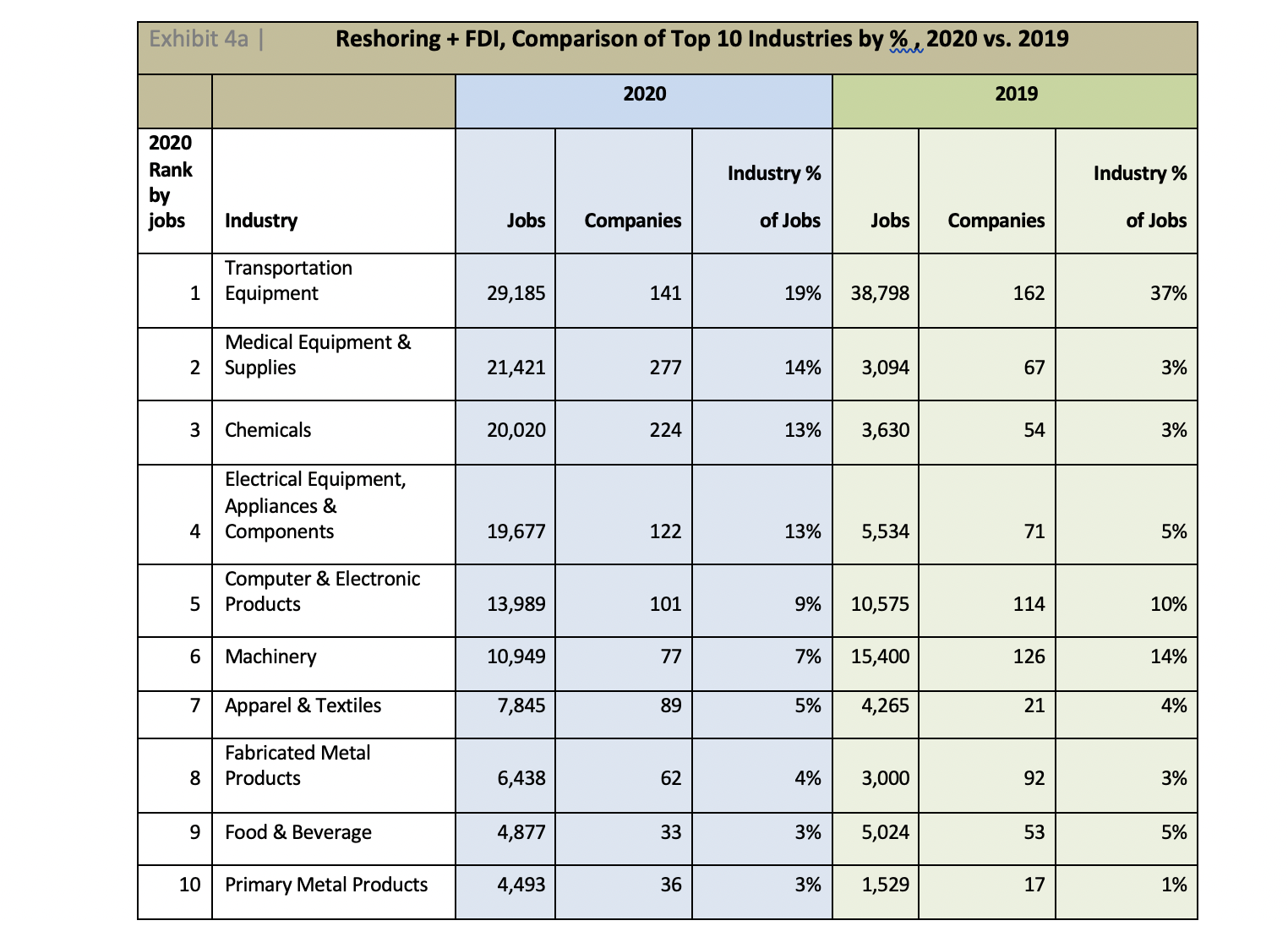

FDI has traditionally brought about 2/3 of the Transportation Equipment jobs. With FDI off 50% from 2017 and auto plants distracted by COVID, the Transportation Equipment industry saw a 25% reduction of reshoring + FDI job announcements in 2020.The second and third largest industries, Computer and Electronic Products and Electrical Equipment, Appliances & Components continue to grow and have been dominated in recent years by solar panels and lithium ion batteries, robotics, drones and the beginning of a trend to semiconductors. Semiconductors will soar starting in 2021.

Medical Equipment and Chemicals (this year, primarily pharmaceuticals) saw the largest increases, driven by the pandemic-revealed U.S. dependencies and the need for PPE, vaccines and COVID-19 treatments.

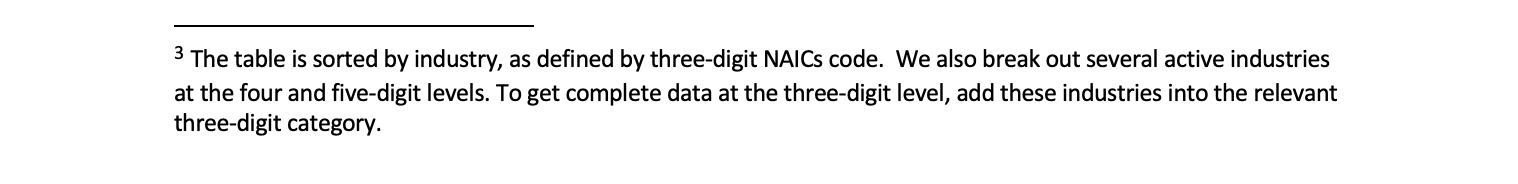

Currently, reshoring and FDI are adding more High-Tech jobs than Low-Tech. This trend is important since the U.S. has a trade deficit in High-Tech products. While High and Medium-High tech are creating the lion’s share of jobs, there has also been a recent uptick in Low-Tech, with increases in apparel, wood, and plastic and rubber industries, and now also PPE. Reshoring is stronger in High-Tech than FDI which is stronger in Medium-High due to the high % of transportation equipment in FDI. The mix of reshoring and FDI products is higher tech than the average of current U.S. manufacturing. The higher tech companies average more employees/company than do the lower tech companies. We encourage the U.S. to become competitive on all tech levels to balance the trade deficit and employ a broader range of workers. High-Tech products represent too small a percentage of our consumption to allow the U.S. or any country to focus only on High-Tech. One challenge is to upskill our workforce so that more of them can work on more highly automated production of lower-tech products.

Currently, reshoring and FDI are adding more High-Tech jobs than Low-Tech. This trend is important since the U.S. has a trade deficit in High-Tech products. While High and Medium-High tech are creating the lion’s share of jobs, there has also been a recent uptick in Low-Tech, with increases in apparel, wood, and plastic and rubber industries, and now also PPE. Reshoring is stronger in High-Tech than FDI which is stronger in Medium-High due to the high % of transportation equipment in FDI. The mix of reshoring and FDI products is higher tech than the average of current U.S. manufacturing. The higher tech companies average more employees/company than do the lower tech companies. We encourage the U.S. to become competitive on all tech levels to balance the trade deficit and employ a broader range of workers. High-Tech products represent too small a percentage of our consumption to allow the U.S. or any country to focus only on High-Tech. One challenge is to upskill our workforce so that more of them can work on more highly automated production of lower-tech products.

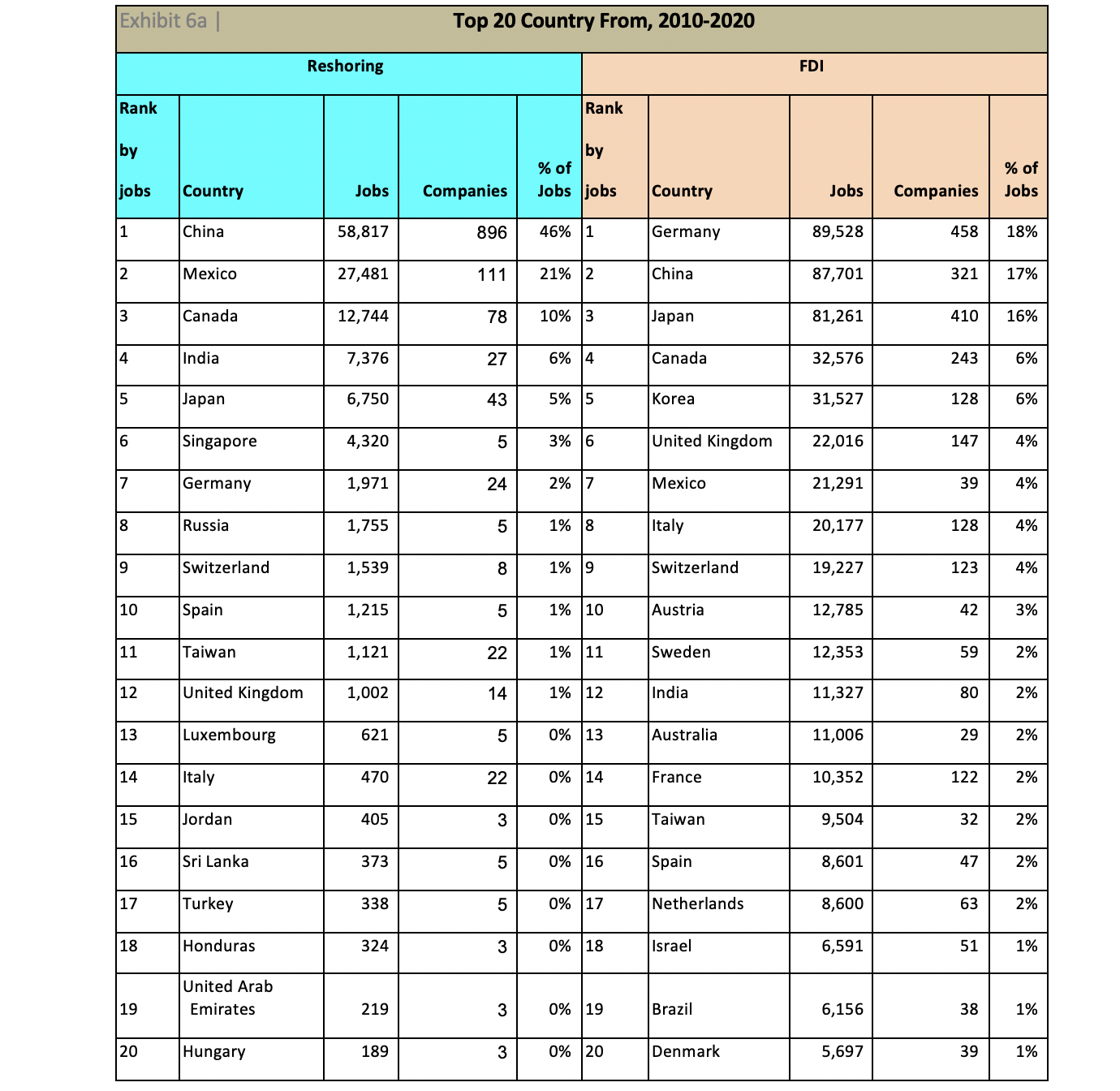

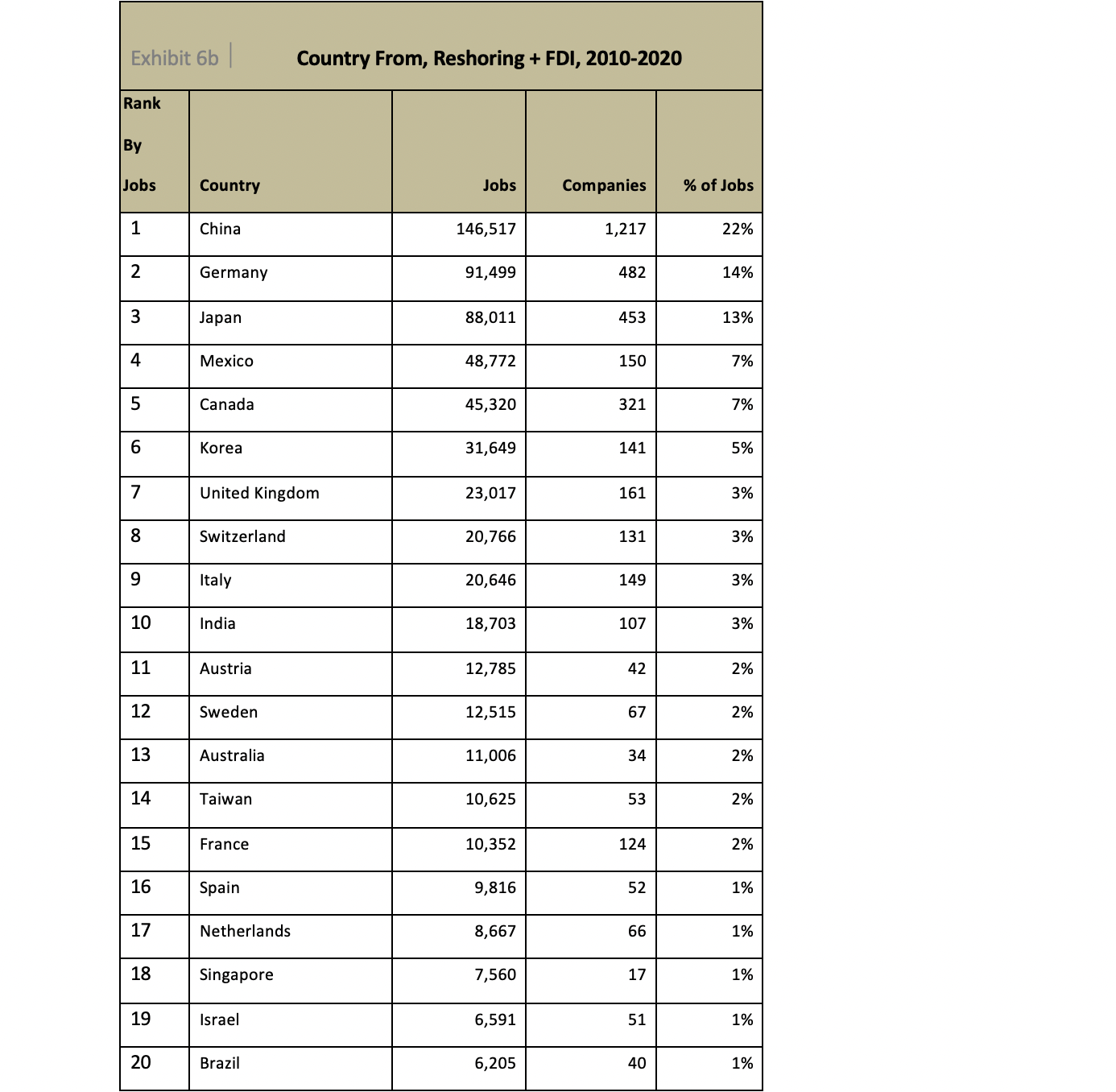

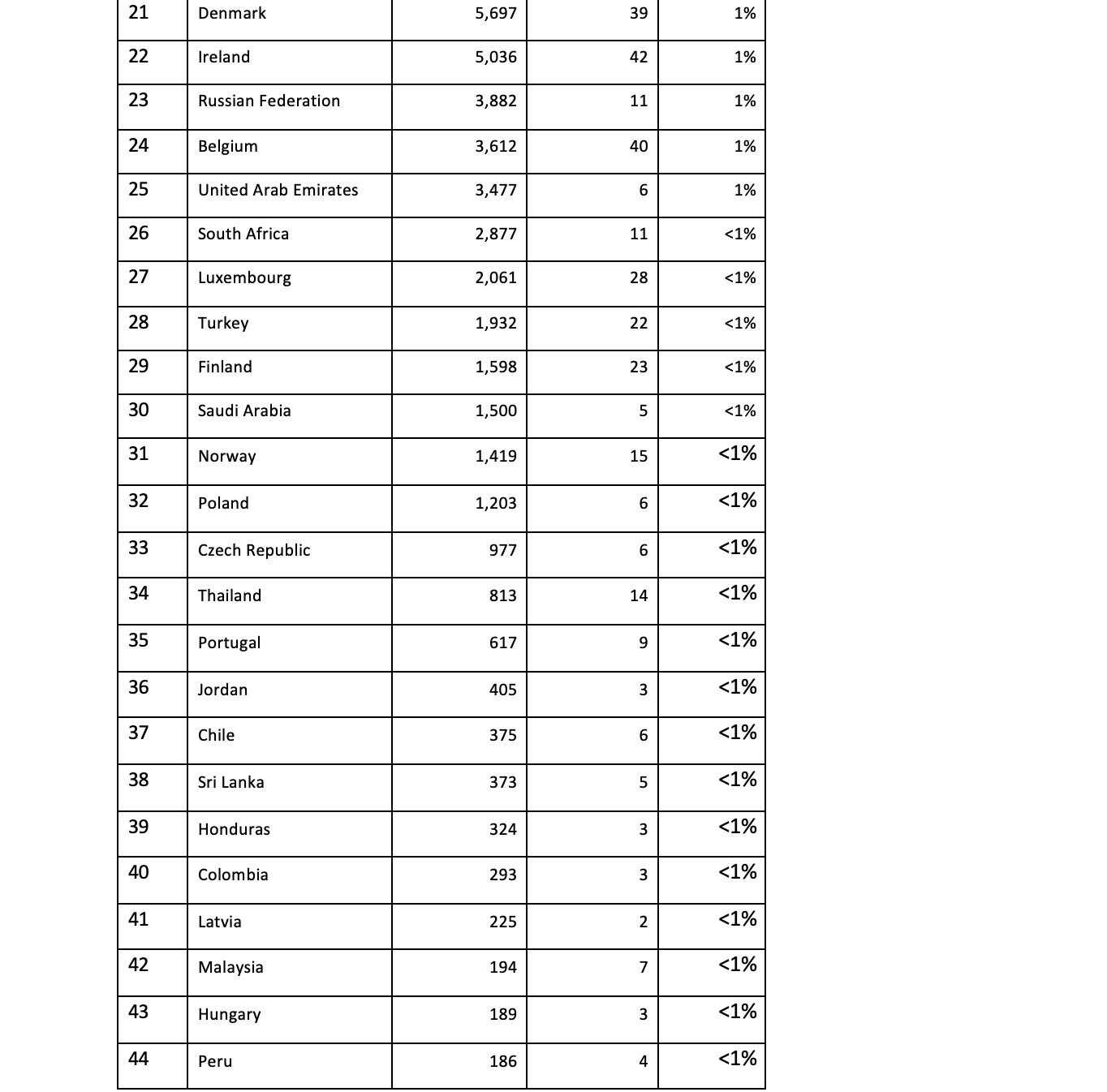

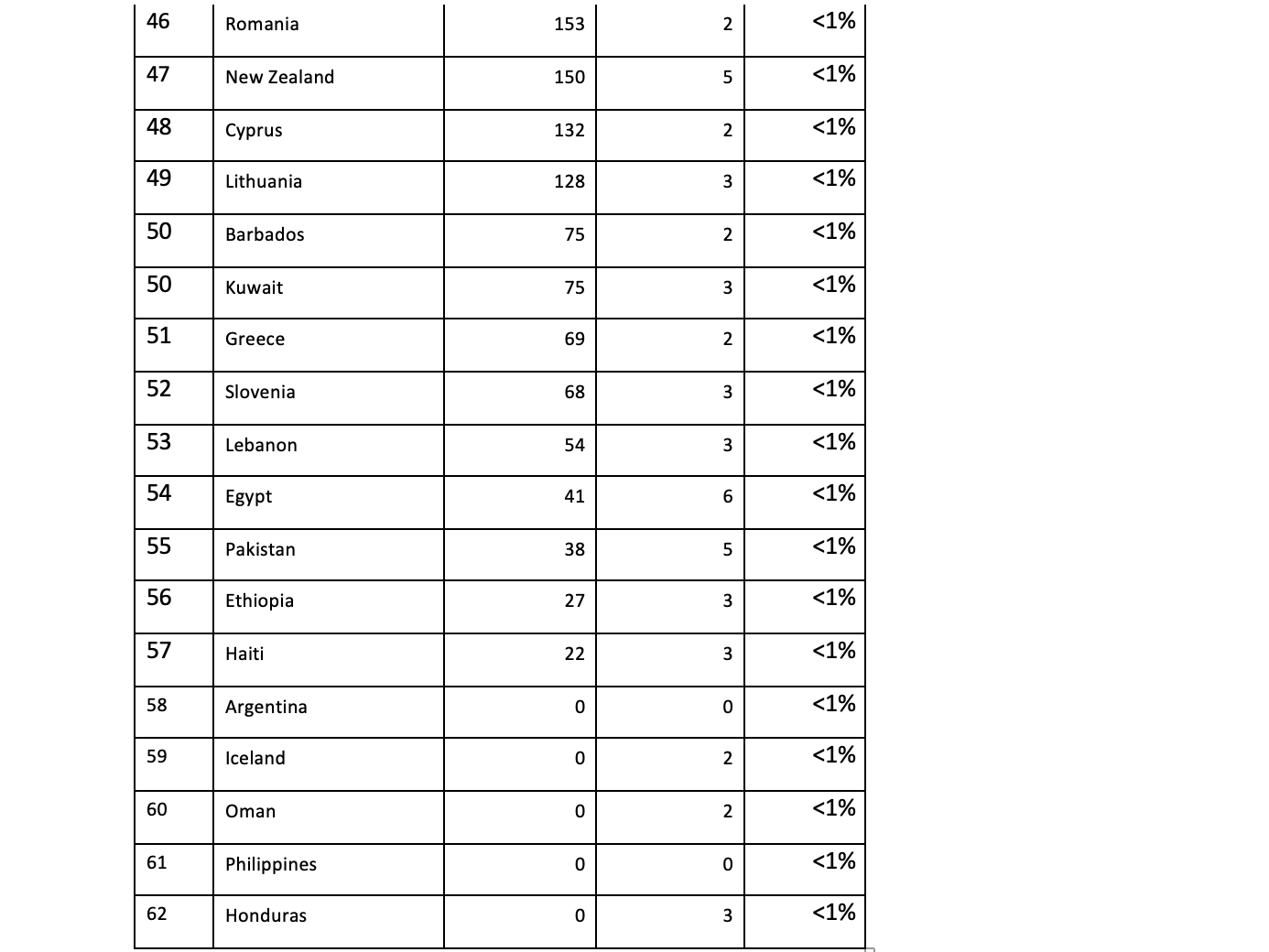

China as the source of 46% of reshoring, cumulative 2010 to 2020. This figure is down from prior years. The rate of reshoring from China did drop in 2019 and 2020, but the number is also lower by a few percentage points due to data refinement. Only about 30% of reshoring cases report Country From. We suspect the actual number of jobs returning from China is even greater, because companies don’t want to report/advertise that fact for fear of retaliation. Many cases do not mention country or refer to “Asia” or “returned from offshore.” China reshoring cases are broadly distributed across industry categories.

China as the source of 46% of reshoring, cumulative 2010 to 2020. This figure is down from prior years. The rate of reshoring from China did drop in 2019 and 2020, but the number is also lower by a few percentage points due to data refinement. Only about 30% of reshoring cases report Country From. We suspect the actual number of jobs returning from China is even greater, because companies don’t want to report/advertise that fact for fear of retaliation. Many cases do not mention country or refer to “Asia” or “returned from offshore.” China reshoring cases are broadly distributed across industry categories. FDI is heavily from Germany (18%) and Japan (16%), both driven by transportation equipment, and more recently China (17%), driven by a broad range of industries. We know country of origin in 100% of FDI cases because we know the home country of the parent company.

As a result of the Coronavirus pandemic, FDI slowed relative to reshoring in 2020. See more in Section 11. 2020 Trends and Projections.

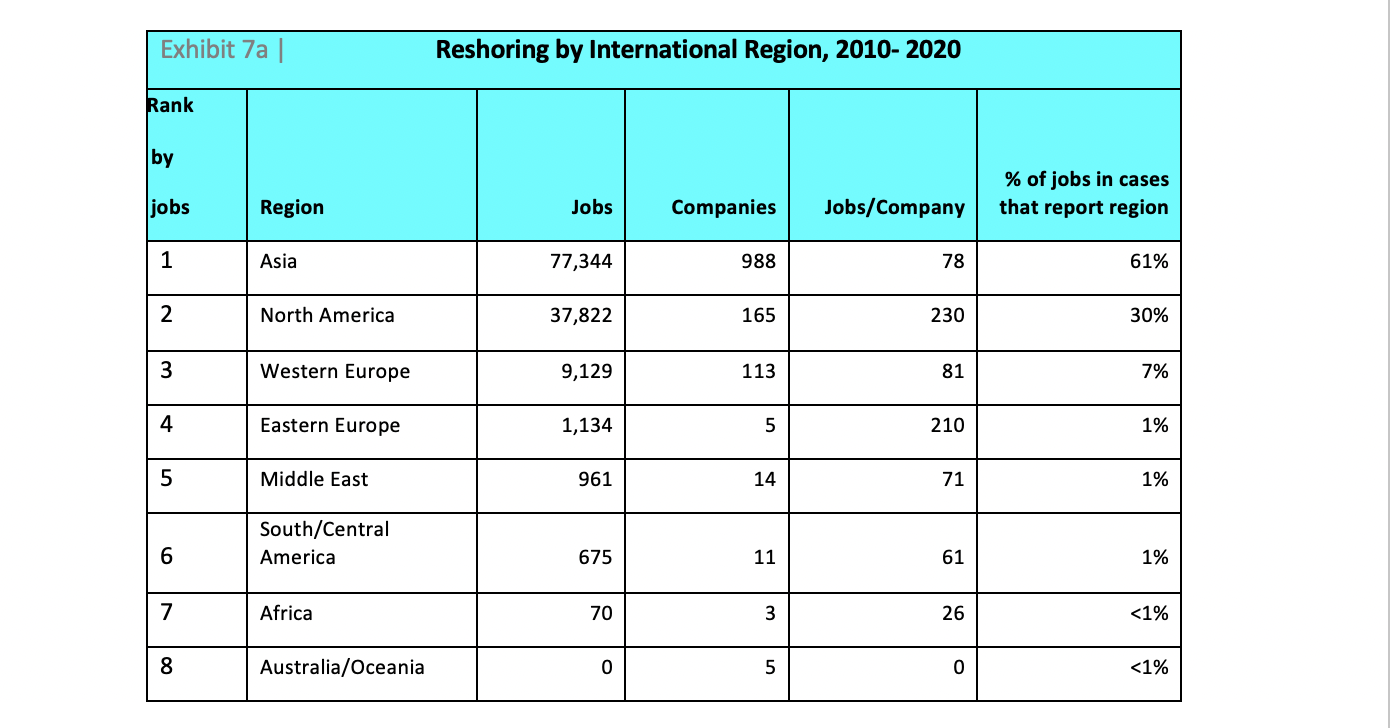

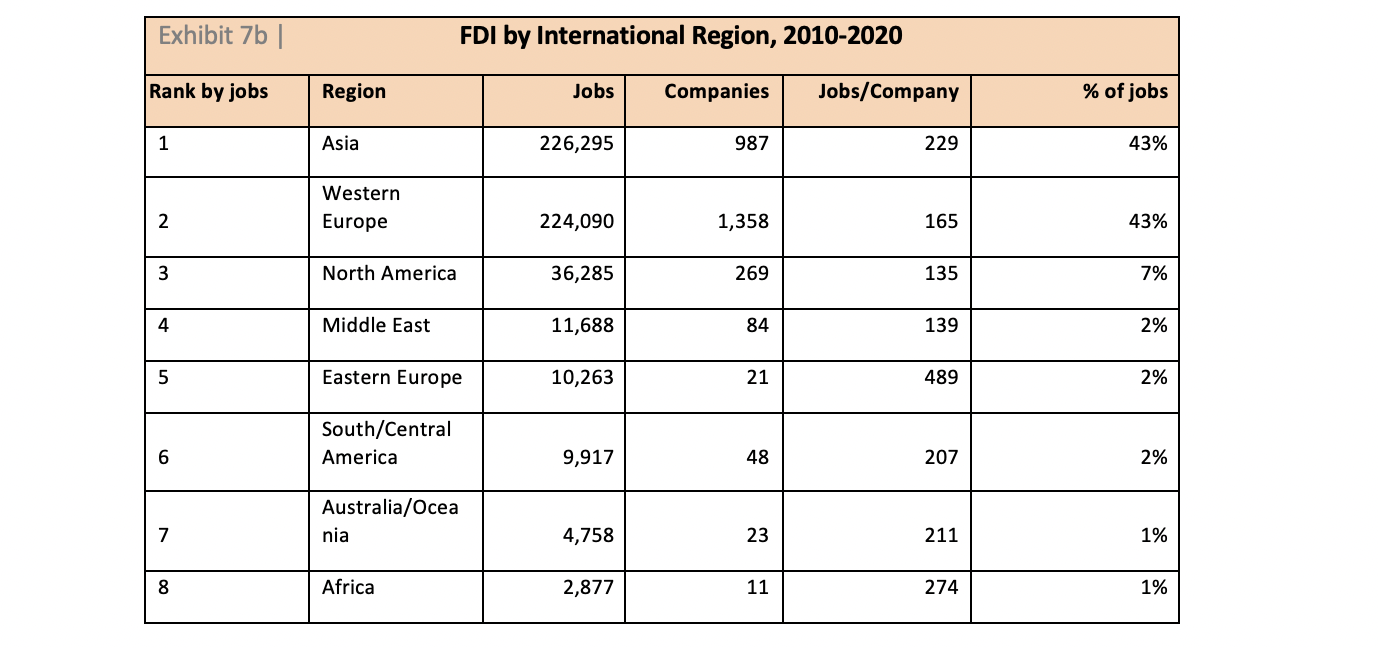

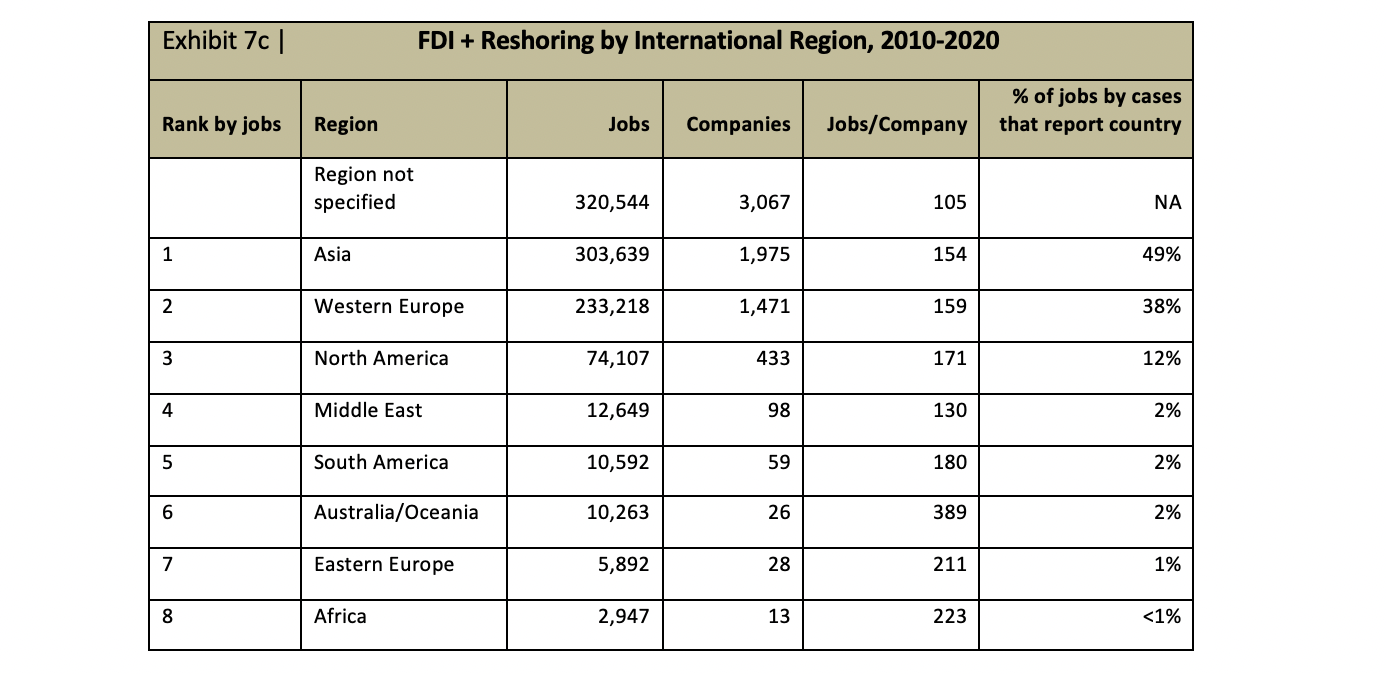

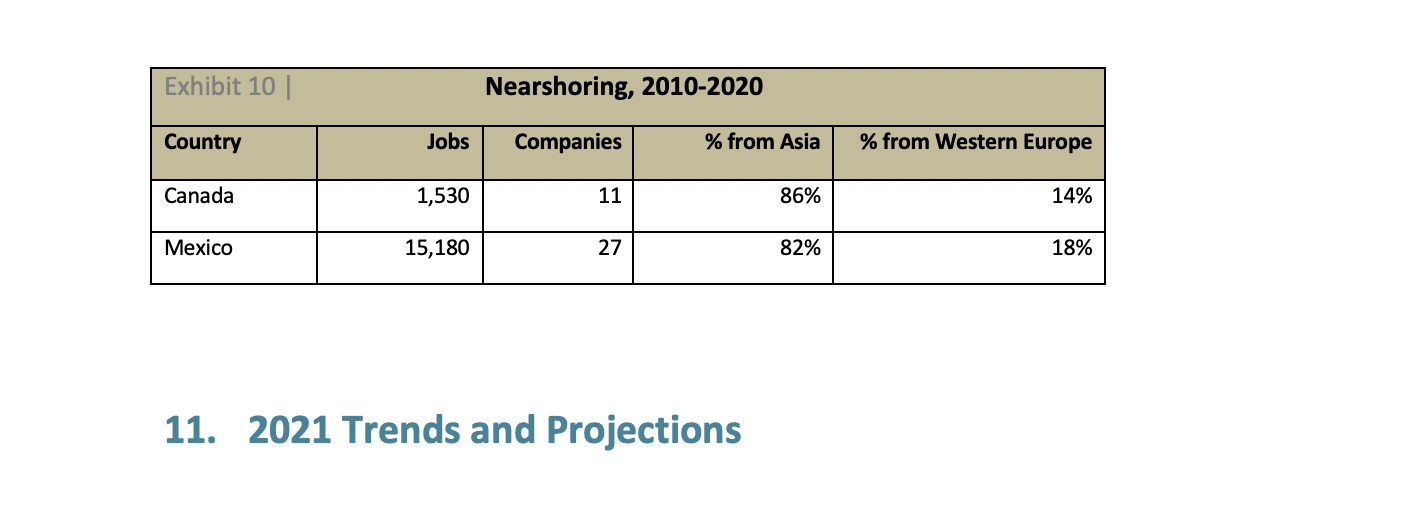

About 70% of Reshoring cases do not report Country or International Region From. We expect the true percentage from Asia is higher, due to the risks and subsequent silence about leaving China. FDI used to come primarily from Western Europe and Japan. With the increase in Chinese investment in the early 2010’s, Western Europe and Asia are cumulatively about equal.

About 70% of Reshoring cases do not report Country or International Region From. We expect the true percentage from Asia is higher, due to the risks and subsequent silence about leaving China. FDI used to come primarily from Western Europe and Japan. With the increase in Chinese investment in the early 2010’s, Western Europe and Asia are cumulatively about equal.

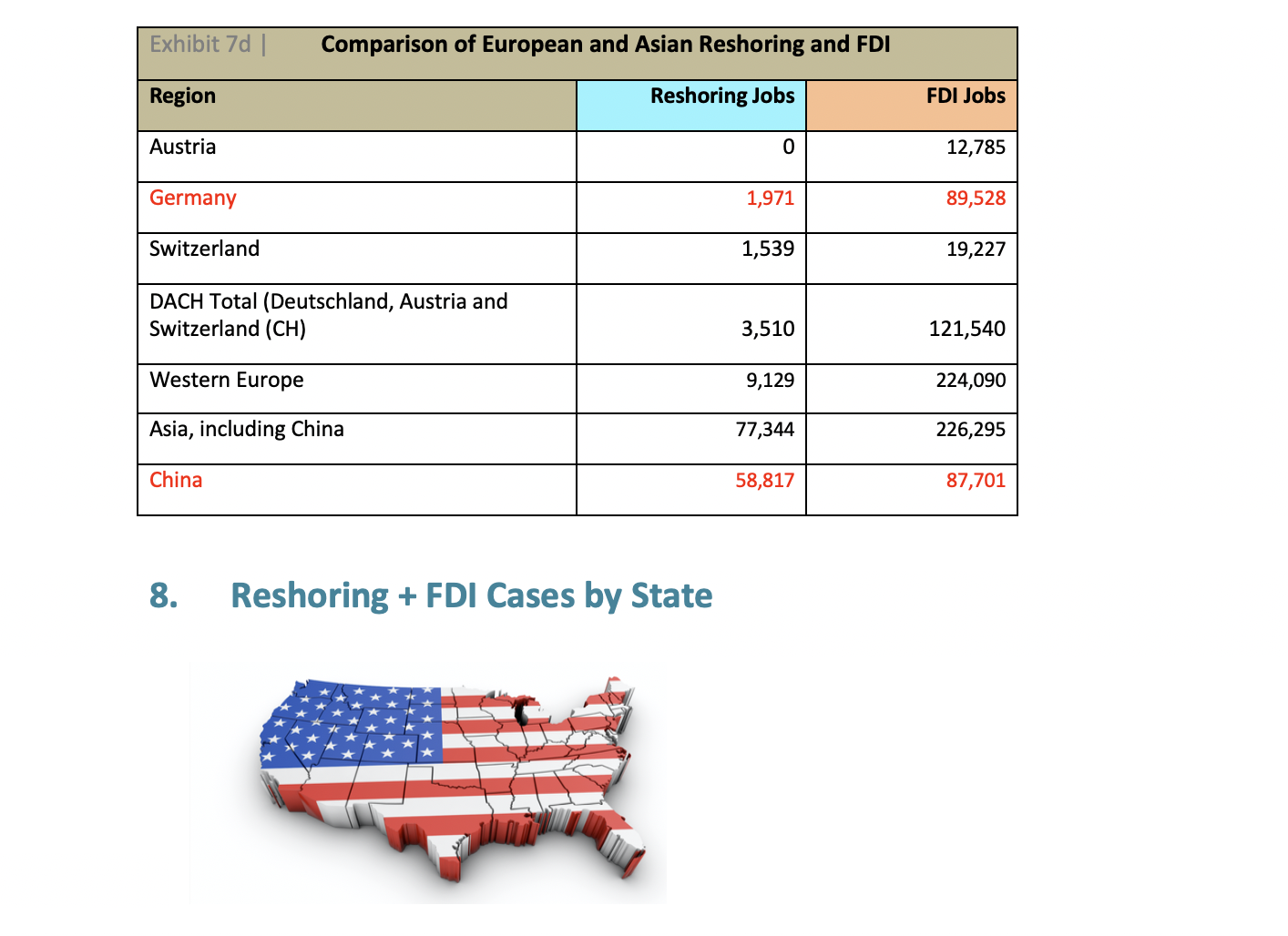

Comparing reshoring and FDI across regions and countries provides an insight into the trends and what is feasible. China is the source of as much FDI as Germany, but about 30X as much reshoring. Asia and Western Europe have a similar contrast.

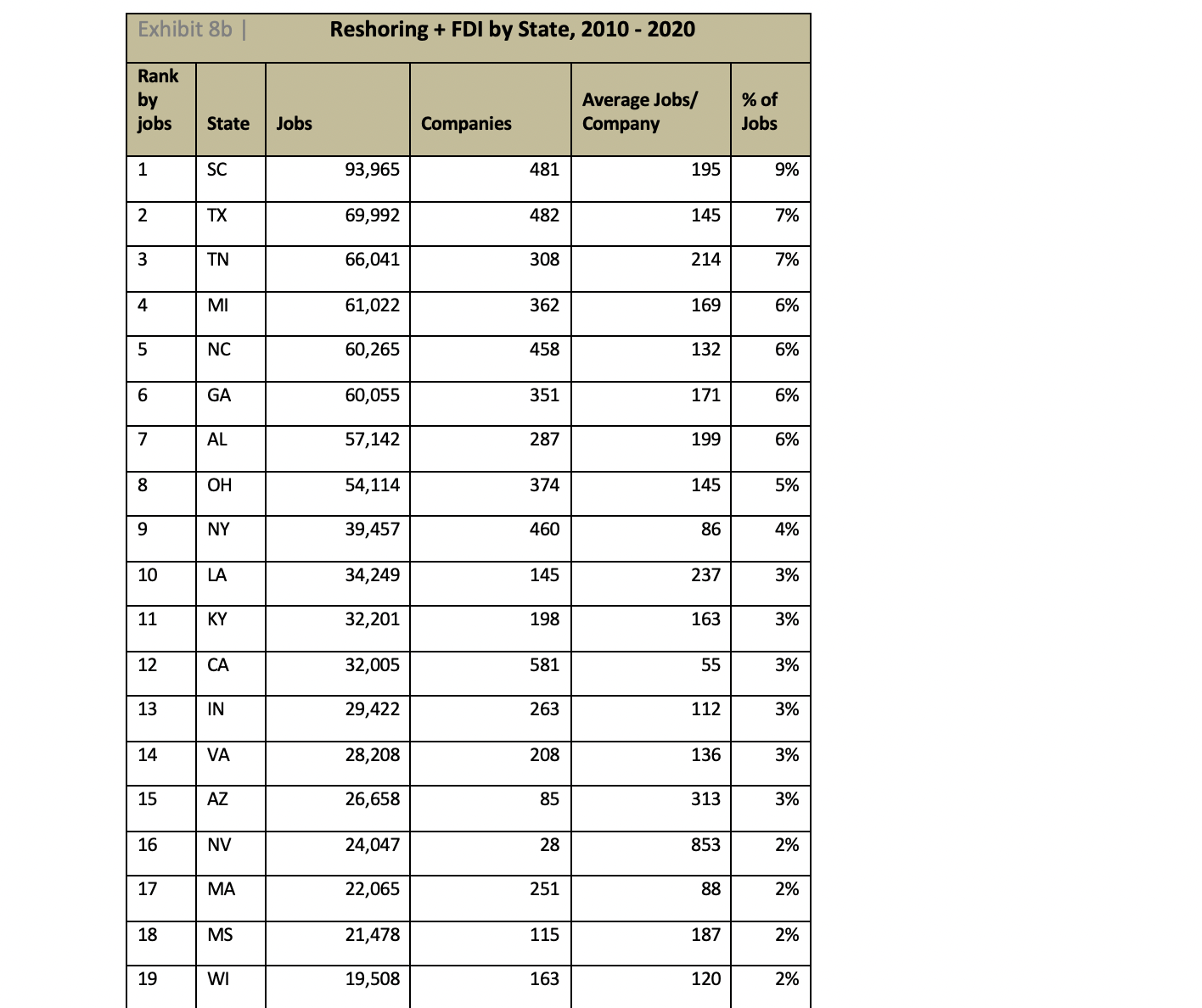

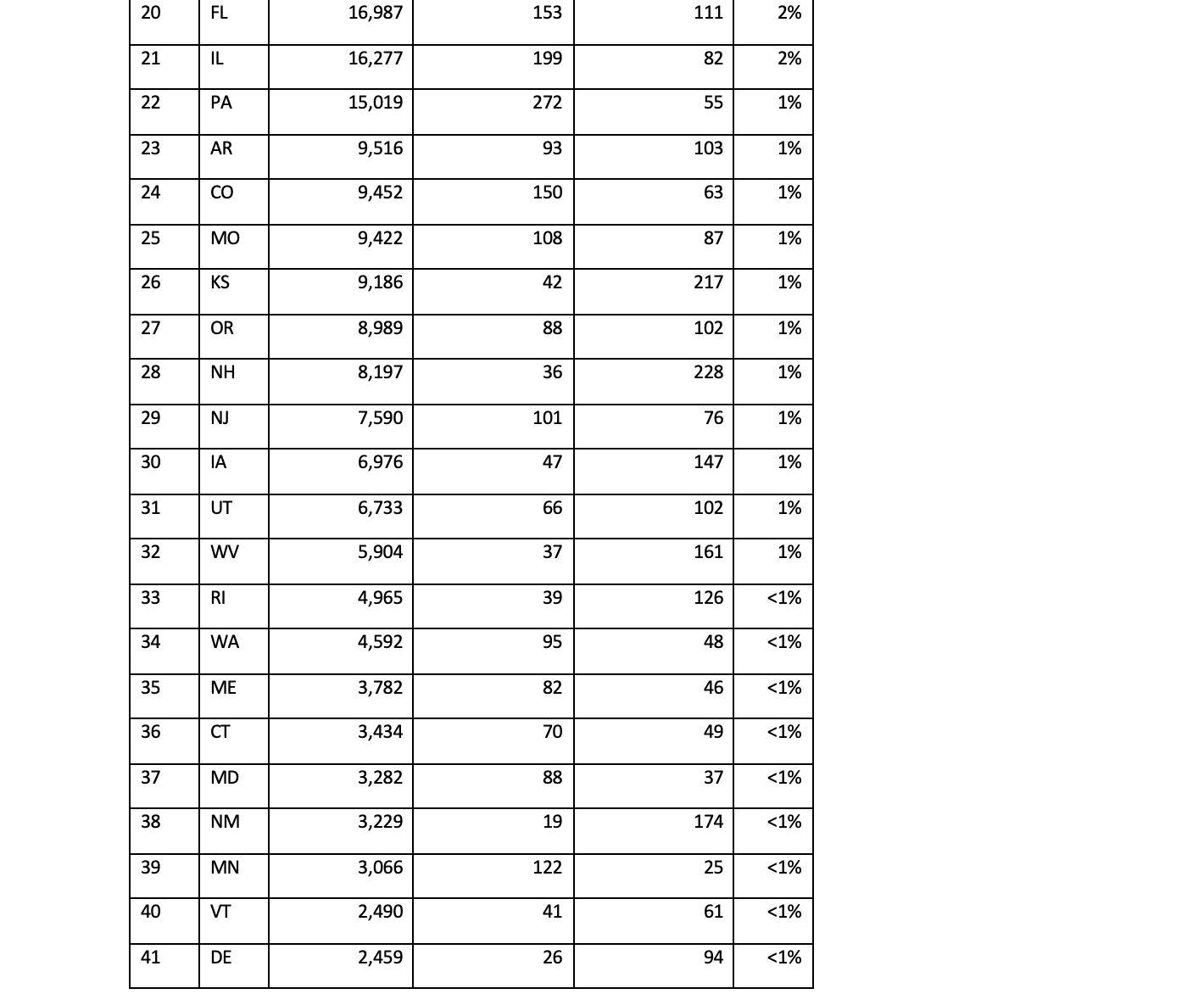

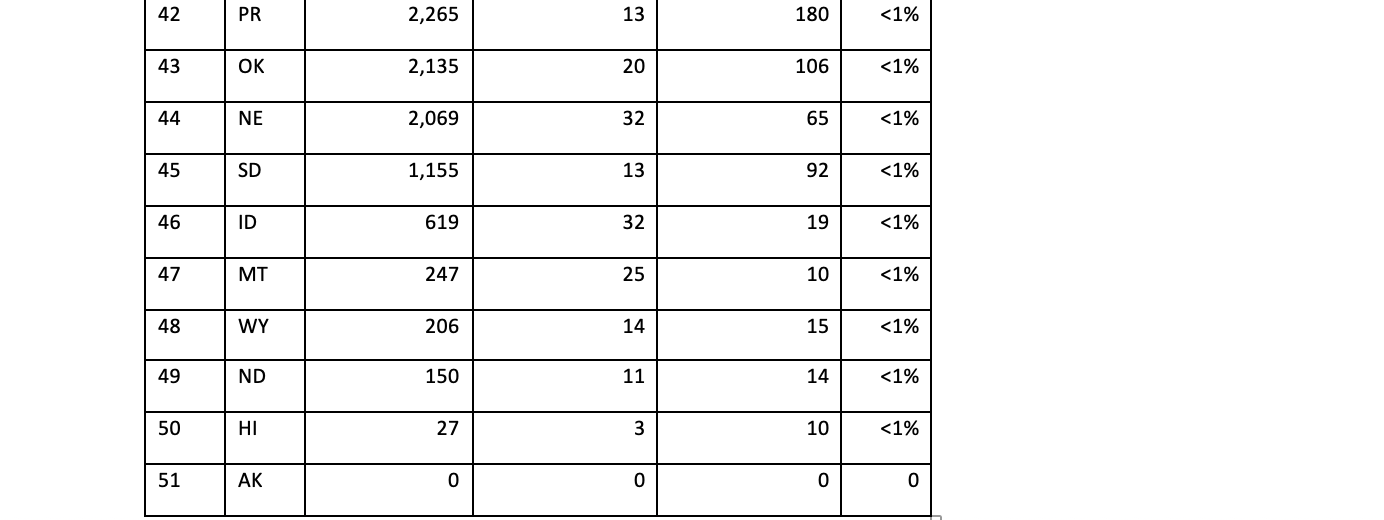

Comparing reshoring and FDI across regions and countries provides an insight into the trends and what is feasible. China is the source of as much FDI as Germany, but about 30X as much reshoring. Asia and Western Europe have a similar contrast.  In 2020 California, Texas, and North Carolina led in number of jobs announced. South Carolina maintained its strong long-term lead. California’s surge was driven mostly by a large Government contract given to Maddox Defense for PPE.

In 2020 California, Texas, and North Carolina led in number of jobs announced. South Carolina maintained its strong long-term lead. California’s surge was driven mostly by a large Government contract given to Maddox Defense for PPE.

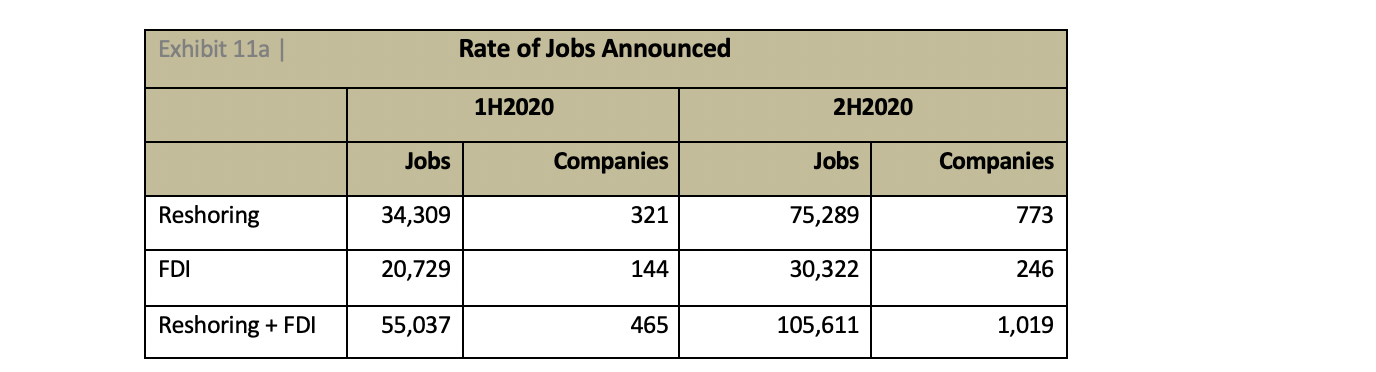

Based on the first half of 2020 we projected 2020 reshoring + FDI jobs announced at about 110,000. The actual number ended up over 160,000. We anticipate that the surge will continue in 2021 at the 2H2020 rate, reaching a record 200,000 for the year.

In addition to our own data, multiple surveys show that more companies, driven by the virus crisis, have decided to reshore. We expect the 2021 data to be consistent with the survey results. Also due to the pandemic, we are seeing U.S. reshoring outpacing FDI for the first time since 2013. This trend is consistent with a multi-year slowing in global FDI. COVID induced business uncertainty is causing companies to emphasize operations in their home countries. We anticipate 2021 reshoring + FDI job announcements to be near 200,000. up by at least 25% form 2020.

In addition to our own data, multiple surveys show that more companies, driven by the virus crisis, have decided to reshore. We expect the 2021 data to be consistent with the survey results. Also due to the pandemic, we are seeing U.S. reshoring outpacing FDI for the first time since 2013. This trend is consistent with a multi-year slowing in global FDI. COVID induced business uncertainty is causing companies to emphasize operations in their home countries. We anticipate 2021 reshoring + FDI job announcements to be near 200,000. up by at least 25% form 2020. Survey results showed a surge in reshoring plans in 2020, subject to the emotion of the pandemic, and have continued in 2021 despite the reopening.

Survey results showed a surge in reshoring plans in 2020, subject to the emotion of the pandemic, and have continued in 2021 despite the reopening. MHL News, Feb. 16, 2021, “Supply Chain Resiliency to See Major Investment Over Next Two Years”

Gartner Survey: 1300 Supply Chain Professionals: 1. 60% of supply chains designed for cost efficiency not resilience 2. 87% plan investments in resiliency within 2 years 3. 30% shifting from global to regionalized model 4. 56% think automation will enable reshoring

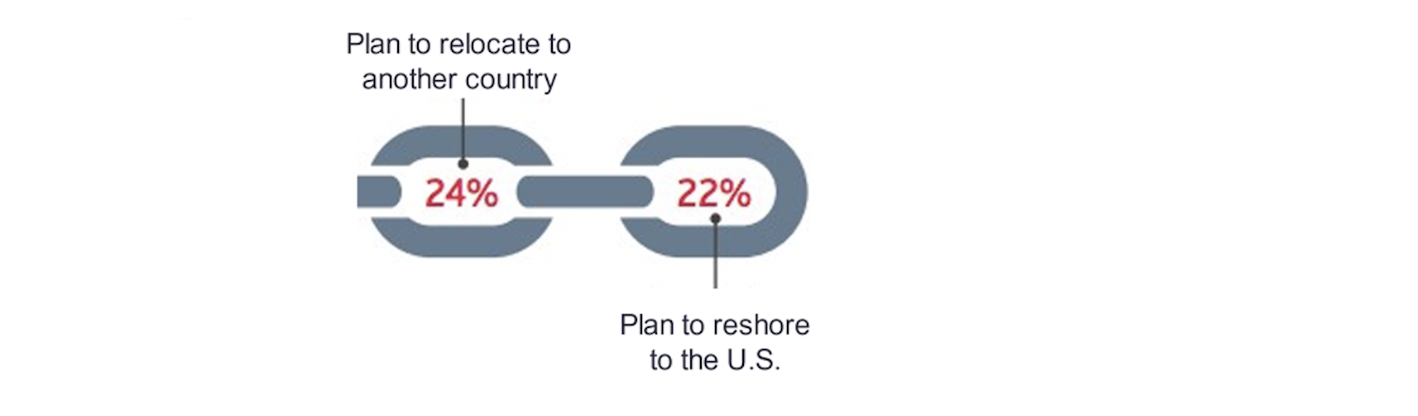

From Loley and Lardner LLP, September, 2020, 2020 Global Supply Chain Disruption and Future Strategies Survey Report:

From Loley and Lardner LLP, September, 2020, 2020 Global Supply Chain Disruption and Future Strategies Survey Report:

Forces likely to slow reshoring and FDI:

1. Concern about new tax rates, regulations, etc. 2. COVID related unemployment payments and remote schooling making work unattractive for some 3. Disrupted supply chains causing lack of availability of components

Forces likely to help reshoring and FDI:

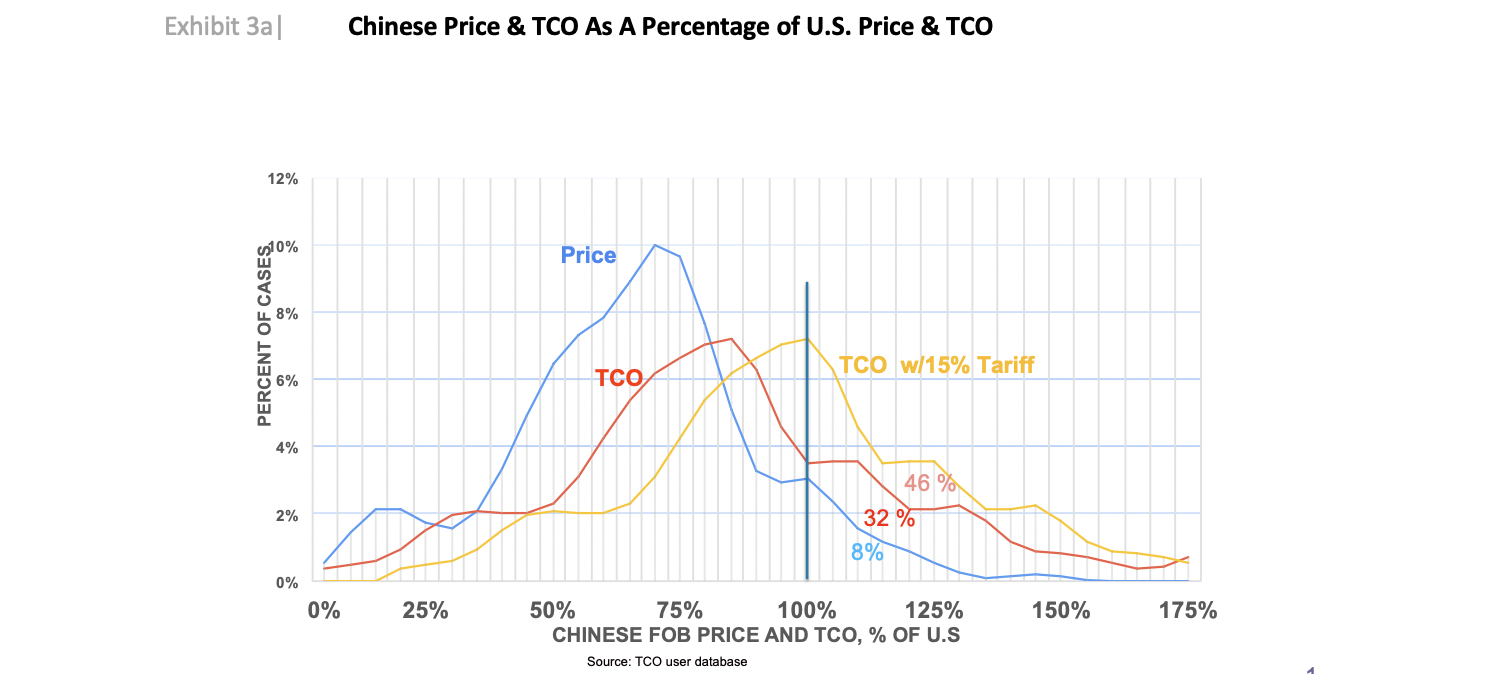

1. Government actions to reduce national dependence on imports of key products - This effort is starting aggressively with medical products, chips, rare earth minerals, EV batteries, etc. to fill in current supply chain gaps. President Biden is prioritizing reshoring highly but applying different methods than President Trump. 2. Continued growth in efforts by MEPs (Manufacturing Extension Partnerships), EDOs (economic development organizations) and states to enable reshoring - The Reshoring Initiative is deeply involved in these efforts. We are currently driving reshoring thru MEPs in Illinois, NYS, Ohio and Rhode Island and expect several more MEPs soon. 3. Continued decline in the USD - The dollar is down 10% from a brief March 2020 high and is approaching a 2018 low. A gradual further 20% decline in the USD would reshore over one million manufacturing jobs over several years by making U.S. manufacturing more competitive at home and abroad. 4. Corporate responsibility expands The Business Roundtable’s August 2019 Statement on the Purpose of a Corporation expanded the definition of stakeholders from just shareholders to now include employees, suppliers and community. We anticipate companies will recognize that reshoring is the most effective and least expensive way to fulfill their commitments. 5. Shifting markets - World growth recovery will make other markets more attractive for offshore suppliers leaving domestic suppliers with less competition to supply the U.S. 6. Continued increases in usage of TCO (Total Cost of Ownership) instead of price in making sourcing decisions. Universal TCO usage, alone, would reshore about 1.5 million jobs. 7. Continued improvement in skilled workforce programs 8. Automation, IoT, Industry 4.0, AI shrinking the unit labor cost gap 9. Improving environmental consciousness - Domestic supply chains are more transparent than offshore and less polluting, cutting the world’s environmental impact by up to 25%, depending on the product. Sustainability practices will continue to increase as a corporate strategy and will help drive reshoring and FDI. 10. Possible aggressive “decoupling” by China

Ambiguous:

1. Higher interest rates - Will eventually raise the value of the USD (headwind) but will surely increase the carrying cost of inventory (tailwind), which is increased by offshoring. 2. Possible actions on tariffs, trade with China, etc. - Likely to be long-term favorable but temporarily disruptive. 3. Oil prices and environmental regulations - Higher prices increase freight costs and tend to make U.S. shale gas more of an advantage for making plastics and for having competitive electricity rates.There is probably an average 12-month lag time between the announcement or implementation of policy changes and a significant response in the trends. Best guess forecast: 2021 reshoring will reach a new record and FDI will recover moderately. The biggest challenge will be bolstering our skilled workforce, which is not adequate to support a much higher rate of reshoring.

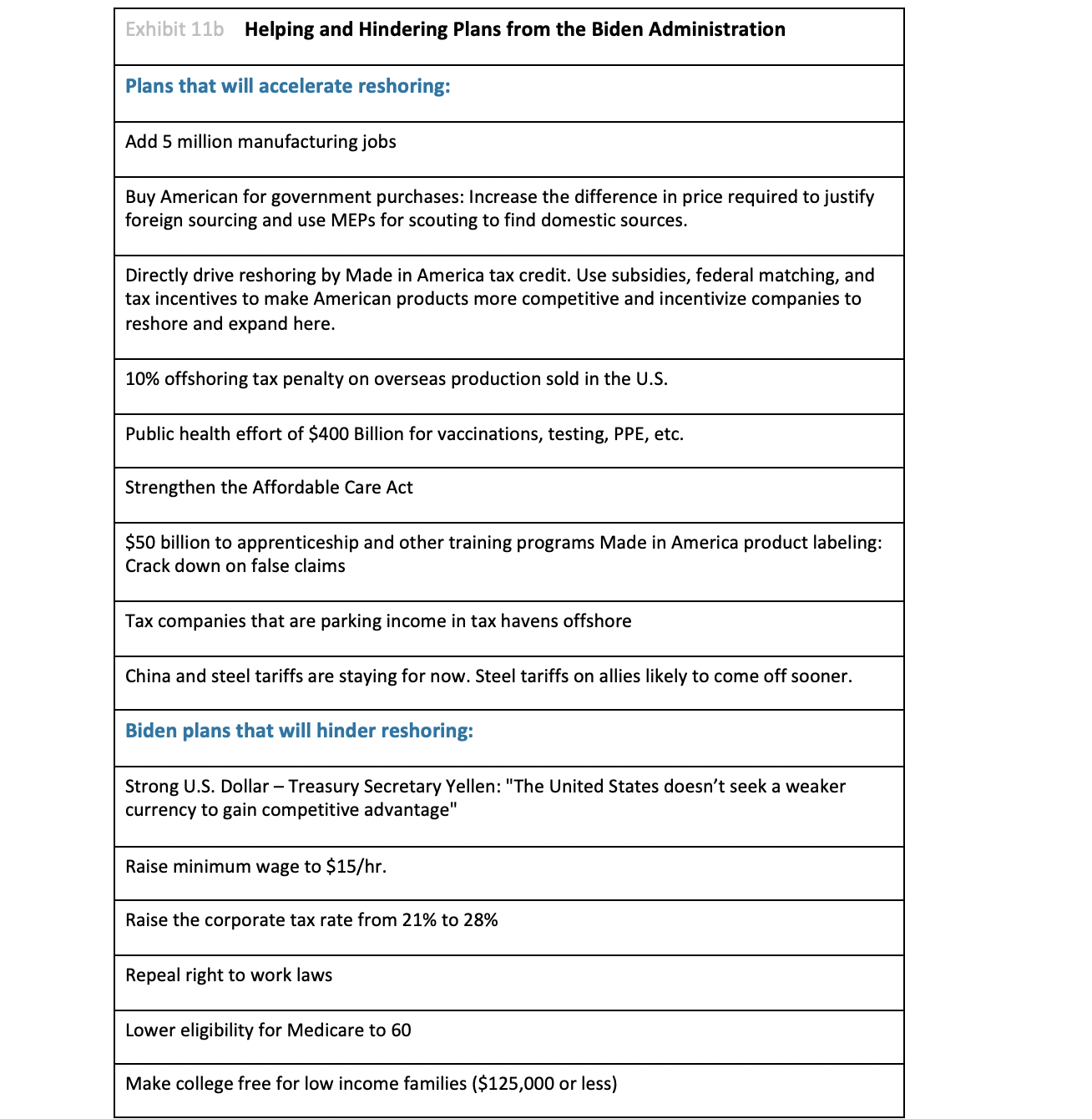

The table below summarizes the head and tailwinds specific to the Biden administration. See further details in the February 2021 eNewsletter.

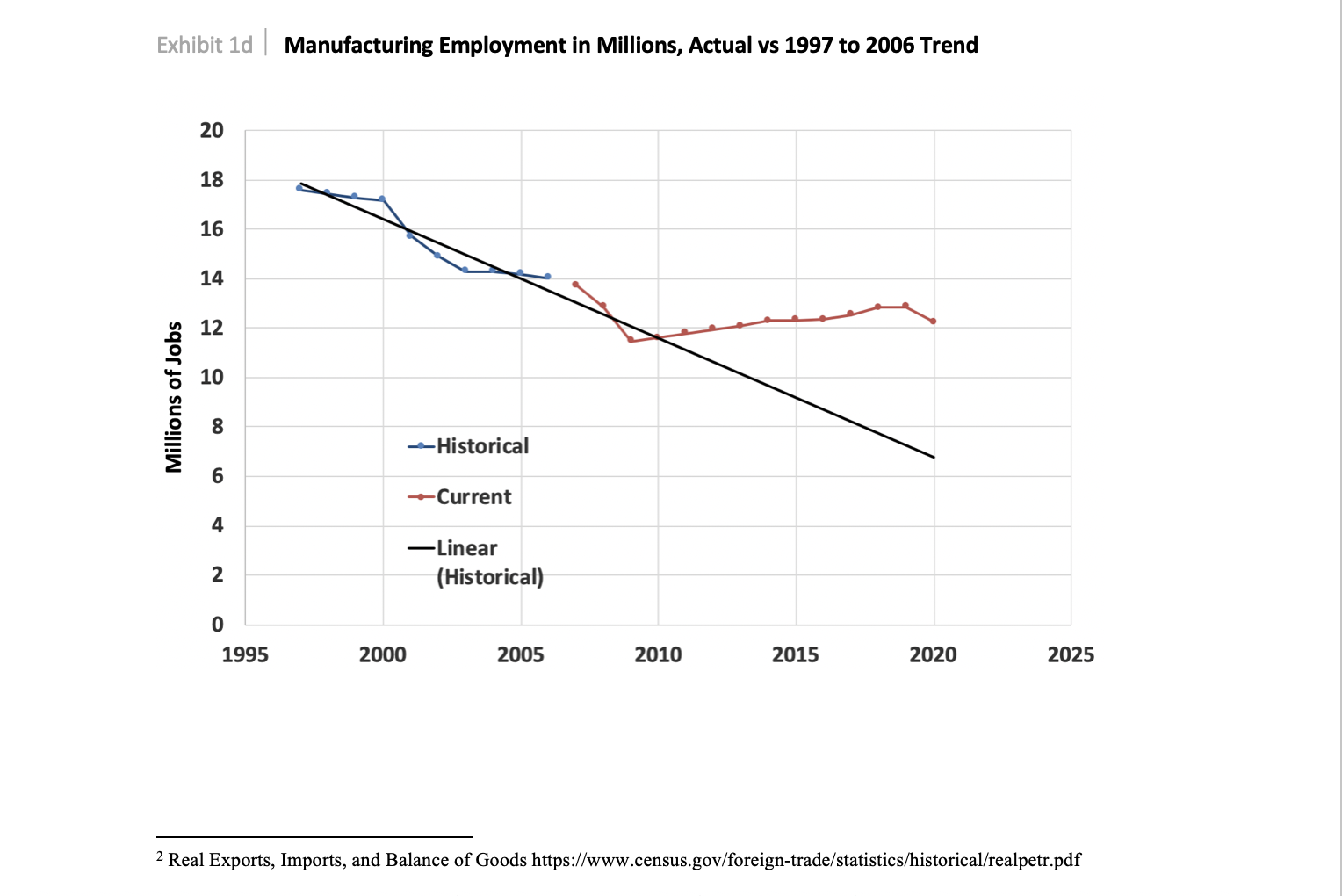

The revised rate of reshoring plus FDI job announcements in 2020 was up about 2500% from 2010. The cumulative 780,000+ jobs brought back represent about 7% of U.S. manufacturing employment. The acceleration of jobs coming back combined with the decline in the rate of offshoring has resulted in a plateauing of the non-petroleum goods trade deficit at about $900 billion/year. The COVID crisis has revealed the U.S.’s over-dependence on imports.

This Data Report should motivate companies to further reevaluate their sourcing and siting decisions by considering all of the cost, risk and strategic impacts flowing from those decisions. Policy makers can use the continued reshoring successes as proof that it is feasible to bring millions of jobs back. Continuation of the trend depends on companies reevaluating their offshoring. Acceleration of the trend depends on the government leveling the playing field, making the United States more price competitive. The Reshoring Initiative offers many tools and resources, which are listed below. Please contact us for help driving reshoring for your company, your region and our country.

Import Substitution Program (ISP) - Manufacturers select the products at which they excel. ISP identifies and qualifies the major relevant importers of those products. The manufacturers then use TCO to convince the importers to reshore. Offered directly to manufacturers and thru MEPs, EDOs (economic development organizations), trade associations and equipment sellers.

Supply Chain Gap Program - Identifies U.S. supply chain gaps. Helps U.S. manufacturers fill the gaps. Helps EDOs find foreign firms to fill the gaps. Competitiveness Toolkit - Designed to quantify and select the optimal national policy changes to bring back a desired number of jobs. Corporate Social Responsibility Estimator - Provides a model for estimating sourcing decisions’ impact on pollution and on the domestic economy. Reshoring Library – You can use Advanced Search to identify companies that have reshored or done FDI in relevant industries or regions. Search for potential customers.Reshoring Initiative Data Report – Annual reports track the drivers, impact and momentum of the trend.

Data refinement is ongoing.

1. Companies, industry associations, states, EDOs and others are encouraged to send us information on reshoring and FDI cases. Send us links to articles and announcements, or go to the Reshoring Initiative’s database entry form. 2. To see a full list of companies in the database click here. 3. If your company is listed, email us to request your company’s data to review, edit and return. Please include your company name and detailed contact info.