Trends in Korean Reshoring

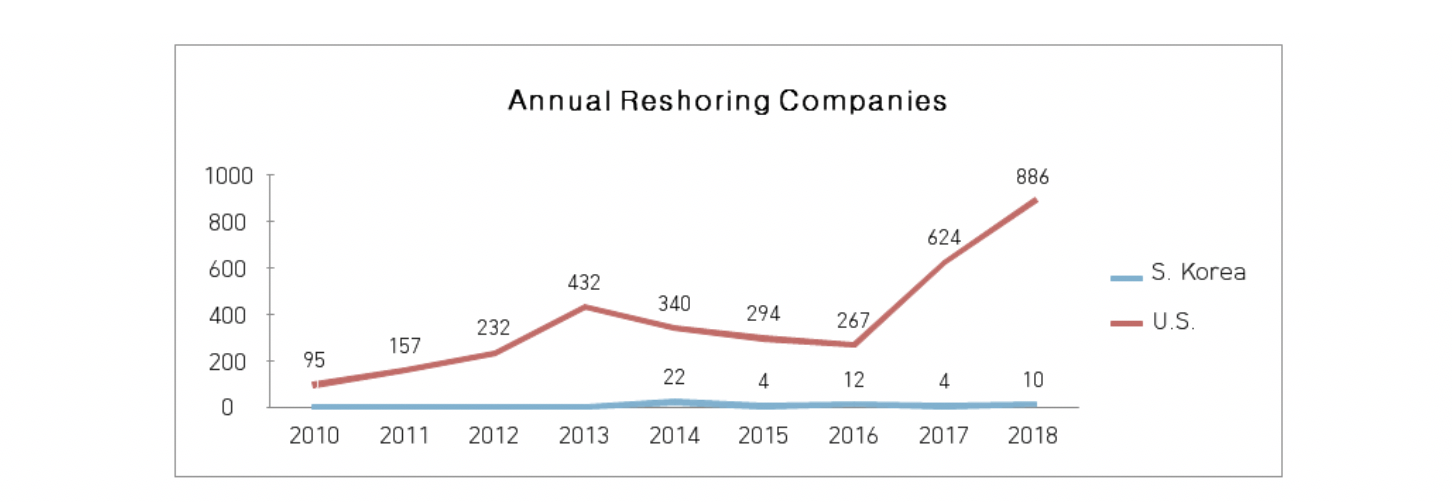

Annual Average Reshoring Companies: 10.4 in Korea vs 482 in U.S.A.,

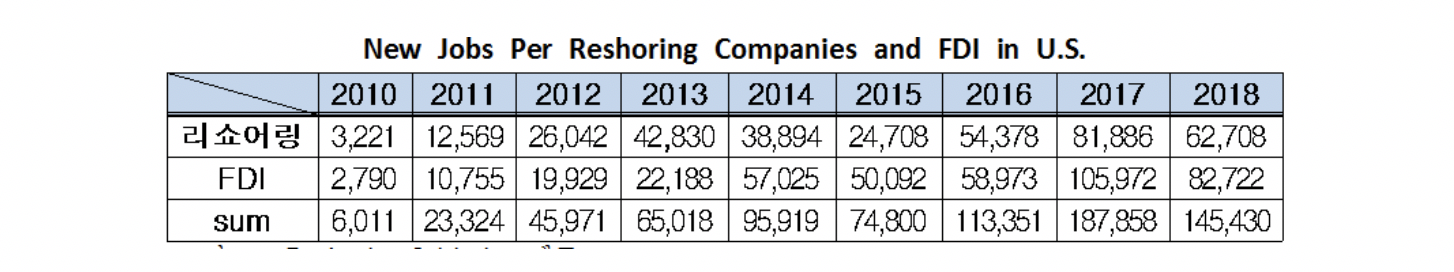

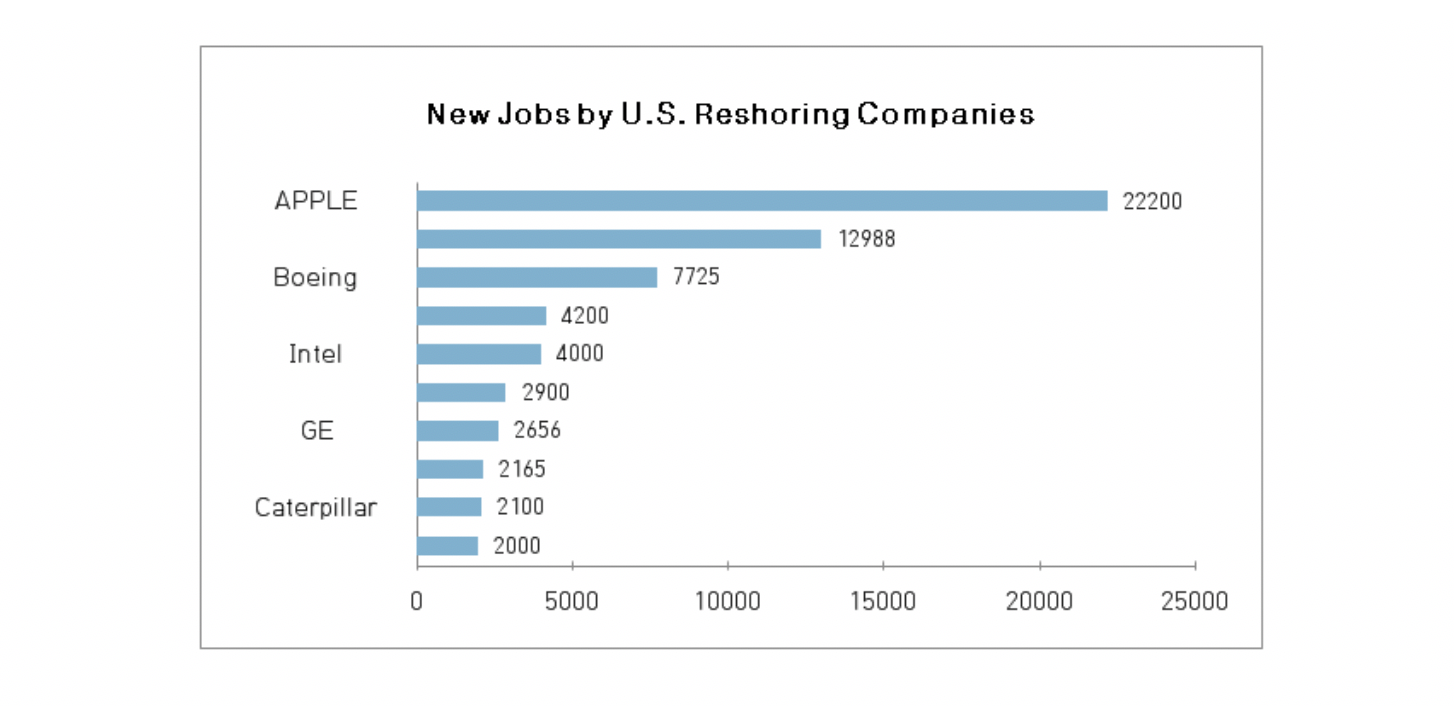

New Jobs Per Reshoring Companies: 19 in Korea vs 109 in U.S.A.- In 2017, approximately 55% (81,866) of all new manufacturing jobs in the U.S. were created by reshoring businesses.

- The secret behind the success of US reshoring policy: 1) exceptional corporate tax cuts; 2) other tax reduction programs; 3) deregulation - While organizations have been created to assist and manage reshoring in the U.S., none exist in Korea.Owing to the strong reshoring policies promoted by the US government, an annual average of 482 businesses have made a U-turn, returning a significant number of jobs back to the U.S. In 2017, reshoring US businesses were responsible for 81,886 new jobs, or approximately 55% of all new manufacturing jobs created in the U.S.

Reshoring Business: Annual Average: 10.4 in Korea vs 482 in U.S.A.

However, Korea’s track record on attracting businesses to return to Korean shores remains insignificant. In December 2013, ‘laws governing the reshoring of offshored Korean businesses (hereafter, U-Turn Law)’ was passed. For 5 years between 2014 to 2018, after the law went into effect, the annual average of reshoring Korean businesses recorded 10.4. During the same period, the U.S. annual average was 482. According to Reshoring Initiative 1), a nonprofit U.S. organization dedicated to assisting companies to bring manufacturing jobs back to the U.S., what was a mere 95 in 2010 increased to 886 reshoring U.S. companies in 2018, recording a near 9-fold increase. Since 2017, the same year that the Trump administration took office, there was a particularly high growth in reshoring companies. Exceptional corporate tax cuts, overall corporate tax reduction in the U.S.2), various other tax-cutting measures3), removal of regulations, business-friendly policies and protectionist programs that put ‘America First,’ are cited as factors that influenced this significant rise in reshoring businesses.

1) Reshoring Initiative: Founded in 2010, a nonprofit organization dedicated to reshoring U.S. businesses. A partner organization to the U.S. State Department (DOS). 2) US corporate tax cut rate: maximum 35% → overall 21% 3) Overseas profit repatriation tax rate reduced from 35% to 10%; transfer tax exemption cap increased from $5.6 million to $11.2 million. (Tax cuts and Jobs Act 2017) 4) Upon taking office, President Trump immediately implemented Two for One deregulation goal, which aims to remove two rules for every one proposed. During 2017 alone, this policy reduced $570 million in regulation cost.

Source: (Korea) MOTIE, (US) Reshoring Initiative

Source: (Korea) MOTIE, (US) Reshoring Initiative

Reshoring Jobs

Jobs Created by Reshoring Businesses: 19 (Korea) vs 109 (USA) Based on statistics collected on jobs created by US reshoring companies, in 2013, the impact of job creation through reshoring was approximately twice that achieved through foreign direct investment (FDI). In 2017, which recorded the greatest job creation owing to reshoring, it was responsible for approximately 55% of all new manufacturing jobs (149,269, DOL) in the U.S.

Source: Reshoring Initiative

Source: Reshoring Initiative

Source: USA Today, 2010~2018 1st Half

Source: USA Today, 2010~2018 1st Half New jobs created by returning Korean manufacturers in the past 5 years (2014~Nov. 2018) were 975 cumulatively, averaging approximately 195 per year. During the same period, while the average number of jobs created by each reshoring business in Korea was 19, it was 109 in the U.S., illustrating a job creation effect that is nearly 6 times greater than in Korea.

A U.S. reshoring expert suggests, “Korea needs to manage reshoring businesses in a systematic and comprehensive manner”

President Harry Moser of Reshoring Initiative, a nonprofit dedicated to assisting U.S. businesses to bring manufacturing jobs back to the U.S., responded to written questions prepared by the Federation of Korean Industries (FKI).

“Given that the size of the U.S. GDP is 14 times greater than that of Korea, and because the two countries have very different import and export structures and ratios, the two cannot be compared in simple terms. The U.S. is fundamentally different from Korea in that the former has a trade structure that imports a lot more than exports; hence, the U.S. has a greater probability of reshoring opportunities.”Moser provided the following reasons that contributed to more active reshoring by U.S. companies in the past 10 years. “Wage hikes and intellectual property issues in China and consumer preference for ‘Made in USA’ played major roles. Plus, the substantial impact was created by corporate tax cuts offered by the U.S. government.” In addition, companies began to understand the hidden costs involved in importing. Moser commented, “U.S. companies seem to have realized that offshoring does not offer significant cost savings.”

Moser offered the following suggestions to promote more reshoring in Korea: document all reshoring cases so the trend is apparent and credible, document cases of problems offshore, be sure there is sufficient skilled manufacturing workforce and train companies to use Total Cost instead of price for sourcing and plant siting.

Eom Chi-sung, head of the International Cooperation Department at FKI, offered his comment. “Although the Korean government announced the ‘General U-turn(reshoring) Support Measure’ in 2018, because the laws that puts the plan into effect, the amended U-Turn Law, hangs in legislation, it needs to be passed quickly and we must build a comprehensive managing system dedicated to reshoring businesses.”

Additionally, Eom stressed the need to improve the overall business environment. “The single common challenge that underlies poor performance of reshoring businesses, rapid rise of overseas investment cost and falling FDI, is the unfavorable domestic business environment that bears no signs of improvement. By accomplishing fundamental changes in creating a flexible labor market and deregulation, we can look forward to not only more reshoring, but also greater and more active investment in the Korean market.”

* [General U-turn(reshoring) Support Measure (Nov. 29, 2018)] Policies designed to encourage reshoring by expanding the definition of reshoring business, extending hiring subsidy assistance and unifying support structure.

* [U-Turn Law Amendment] Amendment of the U-Turn Law by applying major items introduced in the General Reshoring Support Measures released in November, 2018. (motioned by Assembly Member Kim, Kyung-Jin, 5 motions) - - -