Reshoring of Polyolefins in North America

In the past 3-4 years, one of the commonly observed trends in North America manufacturing has been ‘reshoring’ or ‘repatriation’ of the manufacturing industry. Nexant defines repatriation or reshoring as bringing back of manufacturing from overseas to North America, resulting in the displacement of process imports into the region.

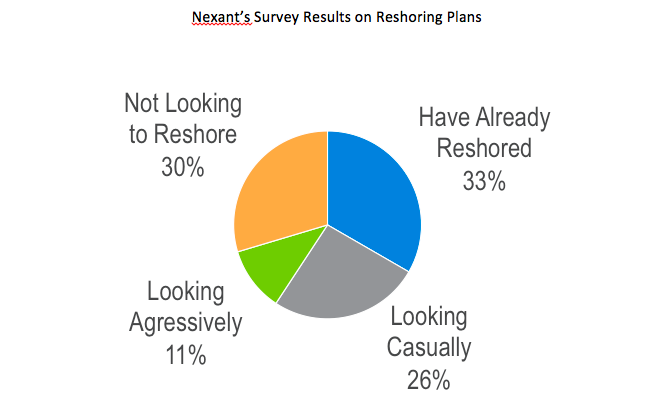

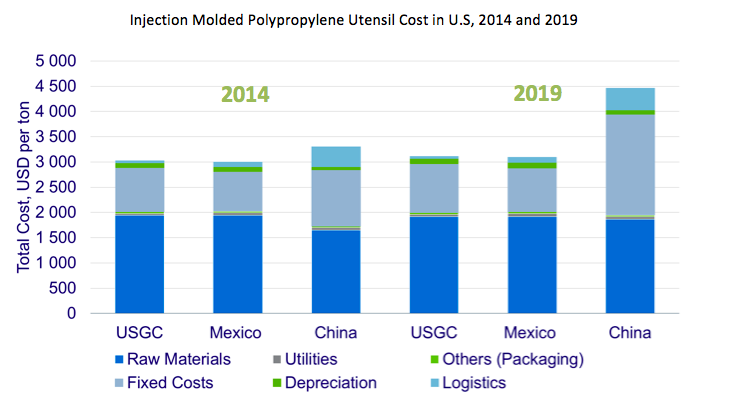

What are the drivers and challenges to reshoring in North America? Nexant conducted a survey of the plastics industry, in collaboration with Plastics News, to understand reshoring trends and the effect on the North American market. Nexant received about 200 survey responses from compounders, fabricators, equipment suppliers and toolers. About 70 percent of the survey responses analyzed, mentioned that they had either reshored or were planning to reshore in the near future. One of the major reasons quoted for reshoring is the rising labor costs overseas, particularly in China. Wages in China have almost doubled in the past decade, while U.S. wages have stayed relatively flat. Low cost natural gas and the diminishing price gap between the U.S. and South East Asian polyethylene prices is making North America more cost competitive for manufacturing. However, about one third of the fabricators mentioned that they would not consider reshoring to North America as they supply Asian markets and the logistic costs would not make sense if manufacturing was moved back to North America. Also, it is not critical to reshore in cases where the product quality is not crucial, which has been identified as another driver to reshoring.

How much of the domestic demand growth in North America will be driven by reshoring? The impact of reshoring on domestic polyolefin demand in North America will not be significant; with about ten percent of the total 4 million tons demand growth from 2014 to 2020 driven by reshoring activities. Polyethylene accounts for the lion’s share of polyolefin reshoring. The majority of the growth will be in the injection molding segment as it is an automated process, and requires less labor; providing manufacturing advantage to the United States. Repatriation is occurring in the automotive, packaging, and appliances sectors of injection molding. NexantThinking’s recently published report “Impact of Reshoring on North American Polyolefin Demand” provides an in-depth analysis into Nexant’s reshoring survey results, reshoring drivers and challenges, reshoring measurement indices, North America’s manufacturing cost competitiveness and impact on polyolefin applications growth. Article courtesy of Nexant Priyanka Khemka, Senior Analyst Email : pkhemka@nexant.com Contact Number: 914-609-0320 Company website: http://thinking.nexant.com/

How much of the domestic demand growth in North America will be driven by reshoring? The impact of reshoring on domestic polyolefin demand in North America will not be significant; with about ten percent of the total 4 million tons demand growth from 2014 to 2020 driven by reshoring activities. Polyethylene accounts for the lion’s share of polyolefin reshoring. The majority of the growth will be in the injection molding segment as it is an automated process, and requires less labor; providing manufacturing advantage to the United States. Repatriation is occurring in the automotive, packaging, and appliances sectors of injection molding. NexantThinking’s recently published report “Impact of Reshoring on North American Polyolefin Demand” provides an in-depth analysis into Nexant’s reshoring survey results, reshoring drivers and challenges, reshoring measurement indices, North America’s manufacturing cost competitiveness and impact on polyolefin applications growth. Article courtesy of Nexant Priyanka Khemka, Senior Analyst Email : pkhemka@nexant.com Contact Number: 914-609-0320 Company website: http://thinking.nexant.com/