RESHORING INITIATIVE® 2021 DATA REPORT:

Essential Product Industries Drive Job Announcements to Record High

Read below or download the full report here. When the Reshoring Initiative was founded in 2010 the U.S. was finally beginning to recognize the negative impacts of offshoring, like the destruction of the blue-collar middle class, the loss of intellectual property, the reduction of innovation, financial miscalculations from using price instead of total cost, and the peril of accruing a massive national trade deficit. While these issues remain highly relevant, the recent developments of the pandemic, the Russian war on Ukraine (and the free world), risk of China decoupling, and the climate crises present a world that has dramatically changed. A strong U.S. manufacturing base used to signify economic prosperity and competitiveness, but today with the heightened need for national security, sustainability and self-reliance, reshoring of U.S. manufacturing, has become, quite literally, a matter of survival.

When the Reshoring Initiative was founded in 2010 the U.S. was finally beginning to recognize the negative impacts of offshoring, like the destruction of the blue-collar middle class, the loss of intellectual property, the reduction of innovation, financial miscalculations from using price instead of total cost, and the peril of accruing a massive national trade deficit. While these issues remain highly relevant, the recent developments of the pandemic, the Russian war on Ukraine (and the free world), risk of China decoupling, and the climate crises present a world that has dramatically changed. A strong U.S. manufacturing base used to signify economic prosperity and competitiveness, but today with the heightened need for national security, sustainability and self-reliance, reshoring of U.S. manufacturing, has become, quite literally, a matter of survival.

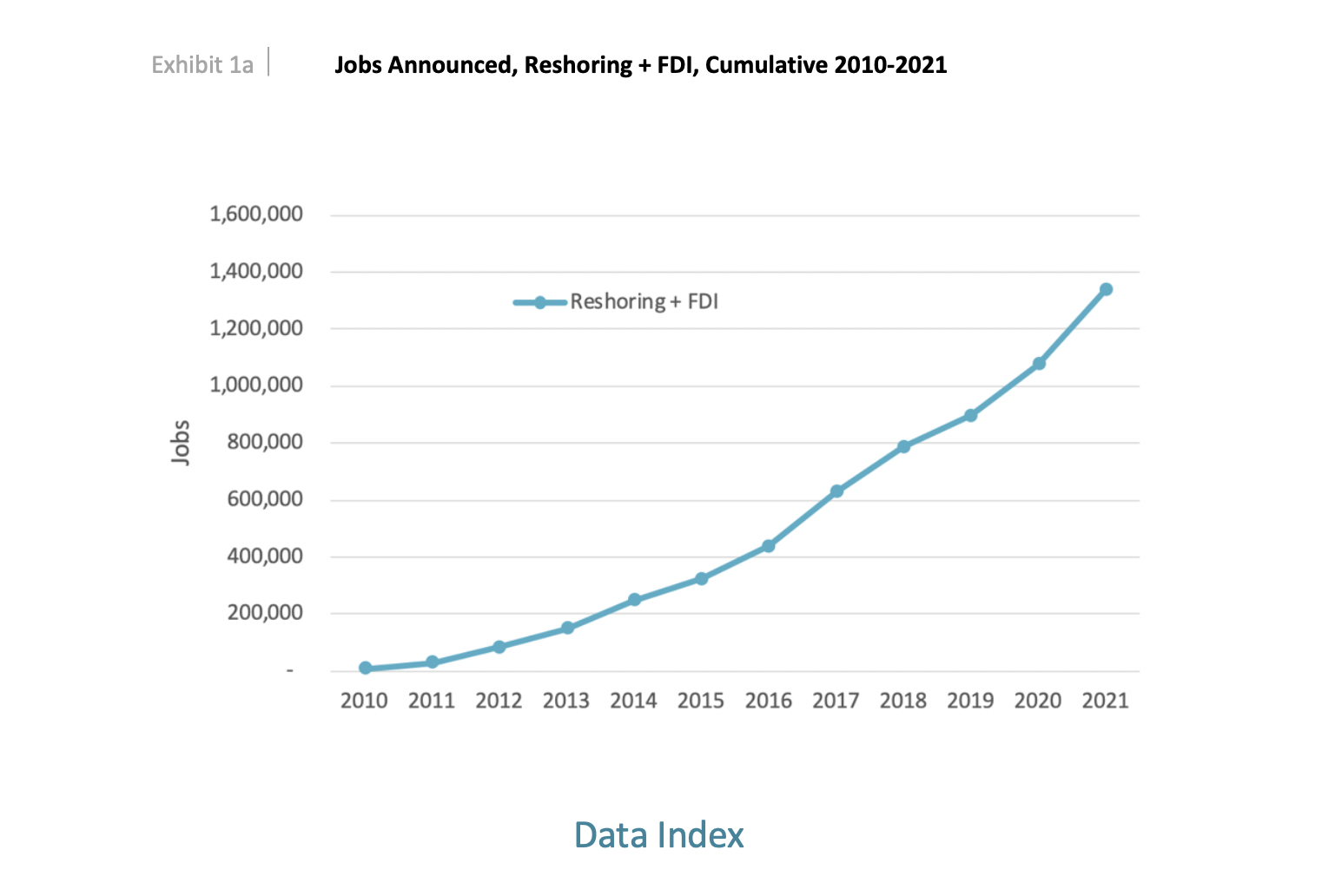

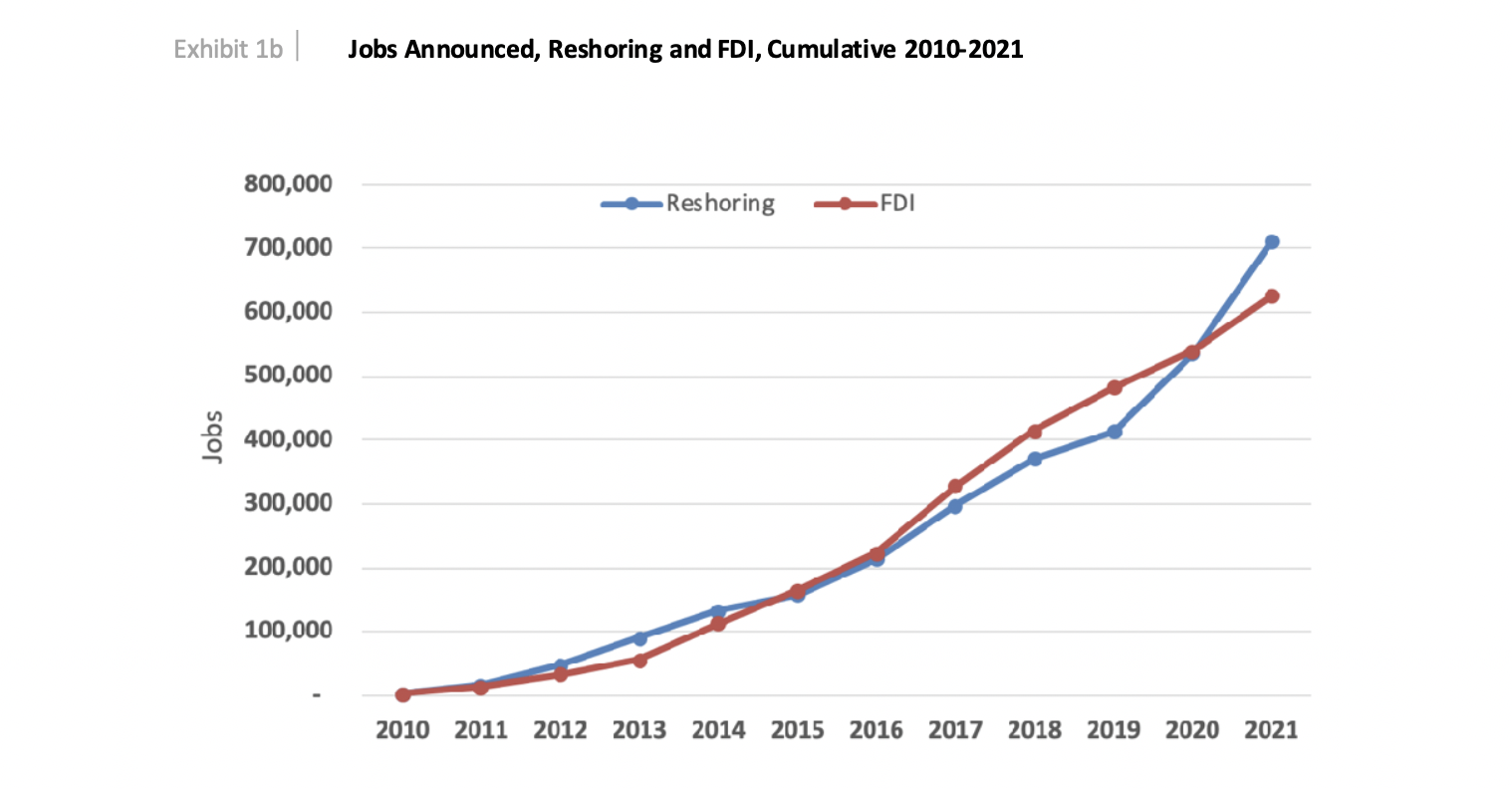

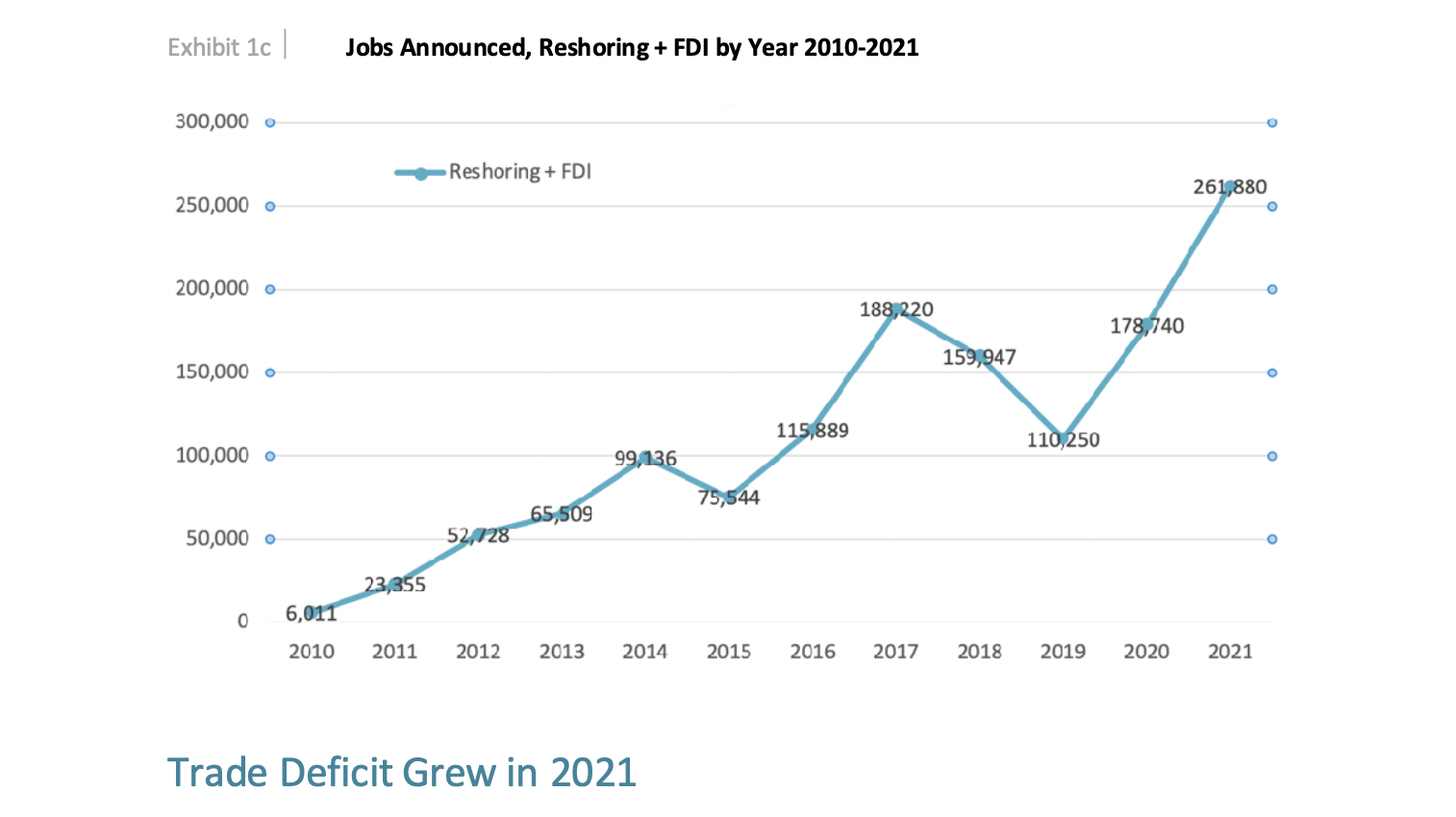

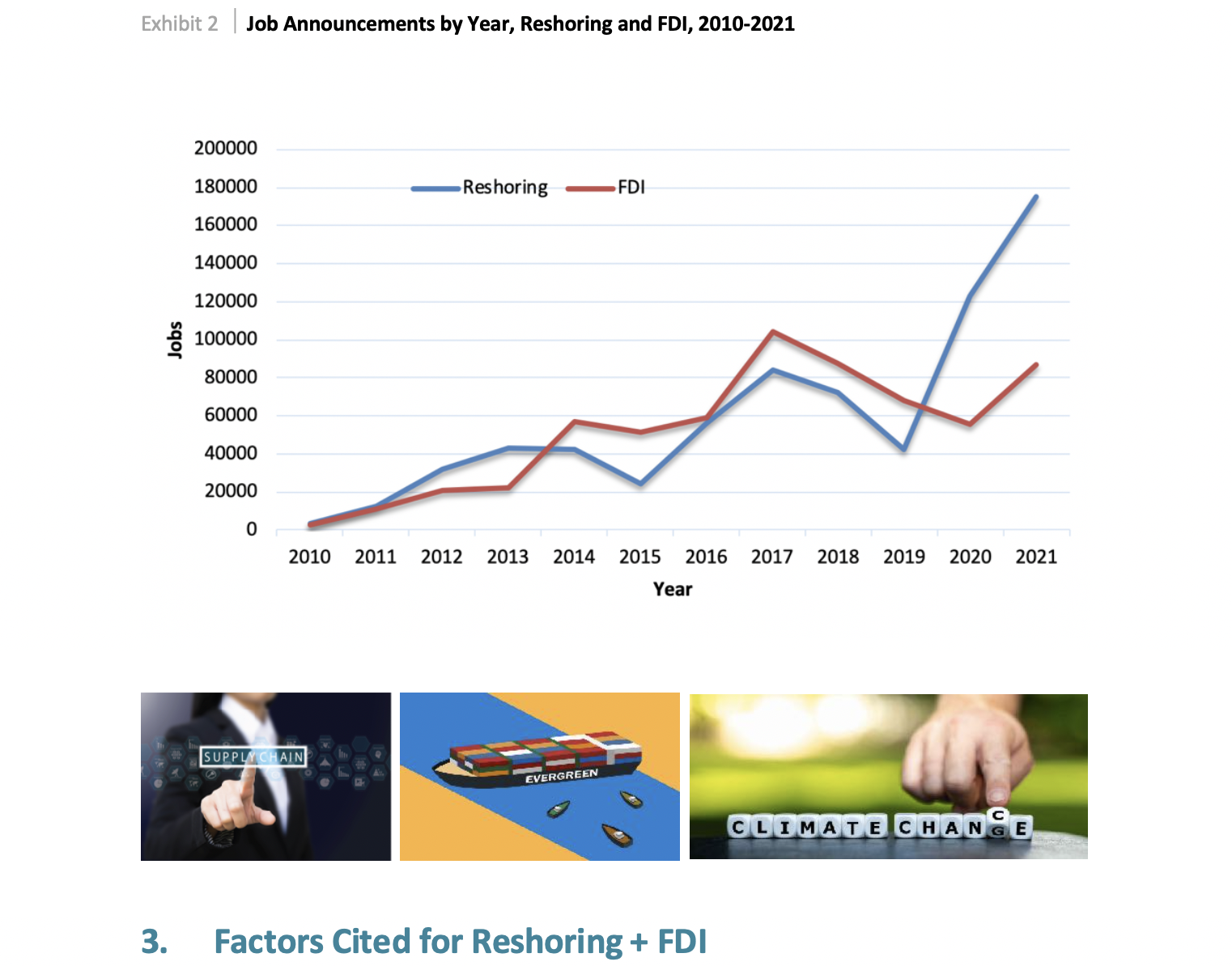

In 2021 the private and federal push for domestic supply of essential goods propelled reshoring and foreign direct investment (FDI) job announcements to a record 261,000, bringing the total jobs announced since 2010 to over 1.3 million. For the second year in a row, reshoring exceeded FDI by 100%, continuing a recent trend not seen since 2013. Additionally, the number of companies reporting new reshoring and FDI set a new record of over 1,800 companies. This report discusses the trend and how reshoring will continue to be key to U.S. manufacturing and economic recovery.

In 2021 the private and federal push for domestic supply of essential goods propelled reshoring and foreign direct investment (FDI) job announcements to a record 261,000, bringing the total jobs announced since 2010 to over 1.3 million. For the second year in a row, reshoring exceeded FDI by 100%, continuing a recent trend not seen since 2013. Additionally, the number of companies reporting new reshoring and FDI set a new record of over 1,800 companies. This report discusses the trend and how reshoring will continue to be key to U.S. manufacturing and economic recovery.

This report contains data on trends in U.S. reshoring announcements by U.S. headquartered companies and FDI by foreign companies that have shifted production or sourcing from offshore to the U.S. The cumulative data includes 2010 - 2021. All data(1) is for reshoring plus FDI, 2010 to 2021, unless otherwise noted.

This report contains data on trends in U.S. reshoring announcements by U.S. headquartered companies and FDI by foreign companies that have shifted production or sourcing from offshore to the U.S. The cumulative data includes 2010 - 2021. All data(1) is for reshoring plus FDI, 2010 to 2021, unless otherwise noted.

1. Cumulative Manufacturing Jobs 2. Manufacturing Job Announcements by Year 3. Factors Cited 4. Industry 5. Tech Level 6. Countries From 7. International Regions From 8. State 9. U.S. Region 10. Nearshoring 11. Wall Street 12. 2022 Trends and Projections

1. Cumulative Manufacturing Jobs 2. Manufacturing Job Announcements by Year 3. Factors Cited 4. Industry 5. Tech Level 6. Countries From 7. International Regions From 8. State 9. U.S. Region 10. Nearshoring 11. Wall Street 12. 2022 Trends and Projections

Allowing for a conservative two-year lag until hiring, we estimate that 860,000 have been hired, equaling 78% of the 1,100,000 increase in U.S. manufacturing jobs since the manufacturing employment low of 11.45 million in February 2010 and 7% of total 12/31/21 manufacturing employment of 12.55 million.

In 2021 non-petroleum goods imports increased about 18% and exports increased about 20 per-cent. Sounds good, except that imports are about 70% more than exports so the result was an 18% increase in the goods trade deficit to $1.070 trillion. The large increase in imports was largely due to increased imports of PPE and of “stay at home” products, also driven by the COVID pandemic(2).

In 2021 non-petroleum goods imports increased about 18% and exports increased about 20 per-cent. Sounds good, except that imports are about 70% more than exports so the result was an 18% increase in the goods trade deficit to $1.070 trillion. The large increase in imports was largely due to increased imports of PPE and of “stay at home” products, also driven by the COVID pandemic(2). There is no measure of offshoring announcements or implementation. We did not observe a high rate of announcements of offshoring. When measured by our overall trade deficit of about $859 billion/year, there are still five million U.S. manufacturing jobs offshore at current levels of U.S. productivity, representing a huge potential for U.S. economic growth. Measured by our $1.1 trillion non-petroleum goods trade deficit there are about six million still offshore.

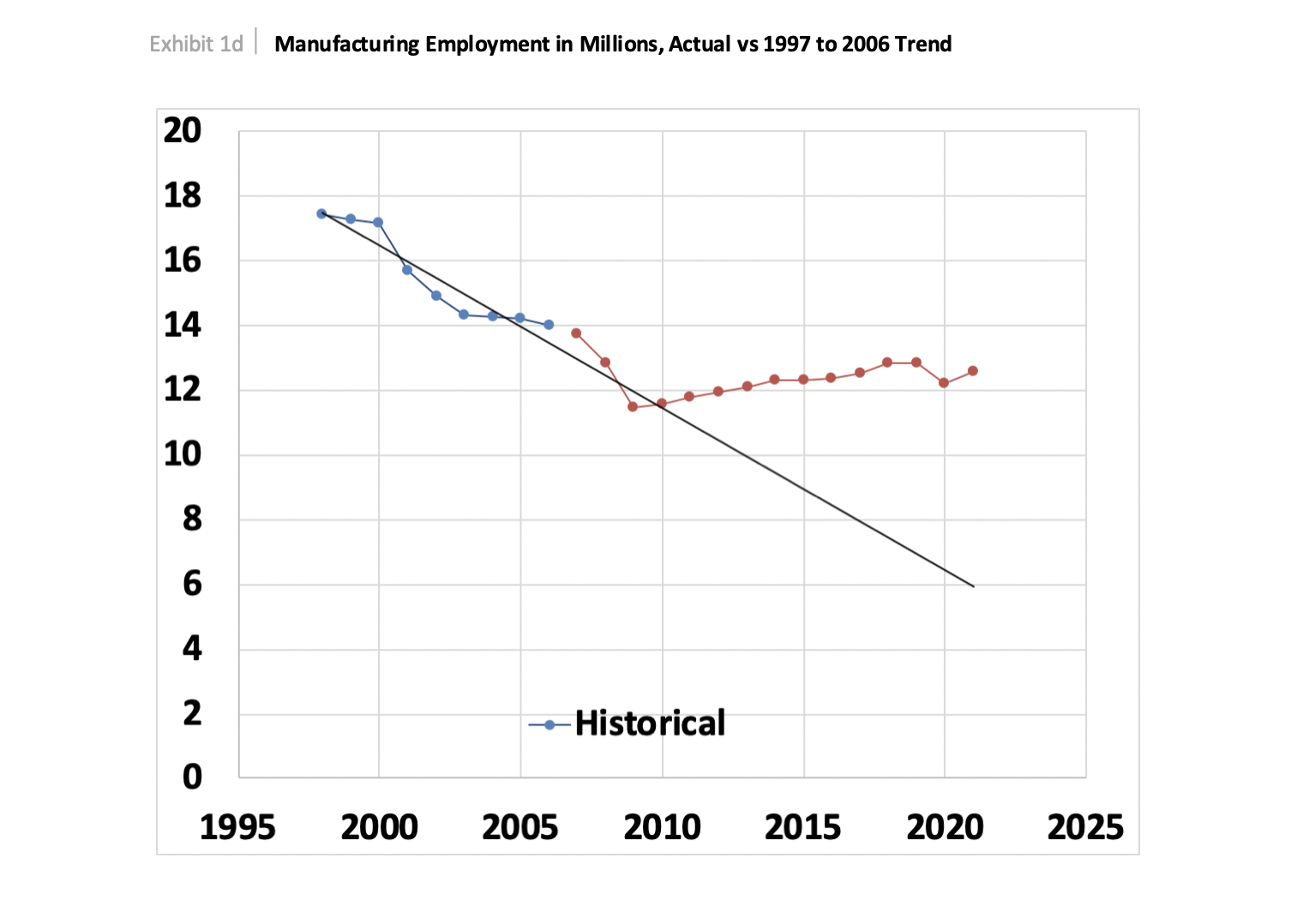

The trend in U.S. manufacturing employment, as per Exhibit 1d, is the best evidence that a combination of less offshoring and more reshoring and FDI is working. The chart shows a regression line based on 1997, before China joined the WTO, to 2006, before the great recession. If the trend had continued, U.S. manufacturing employment would be more than five million jobs lower than the actual level today. Most notably, in past recessions manufacturing employment dropped below the trend line. In the 2020 recession, the surplus above the trend line held approximately constant and is clearly increasing in 2022.

In 2021 reshoring surged to a record high of 261,000 jobs announced. The strength of the trends in recent years is based on a combination of factors. Large announcements in 2021 were driven by government support for U.S. production of essential products driven by import shortages observed during the pandemic and by the dramatic increases in freight cost and delivery time. Other important forces included greater U.S. competitiveness due to residual effects of the 2017 corporate tax and regulatory cuts, increased recognition of the total cost of offshoring and rising concern over U.S. dependency on China.

In 2021 reshoring surged to a record high of 261,000 jobs announced. The strength of the trends in recent years is based on a combination of factors. Large announcements in 2021 were driven by government support for U.S. production of essential products driven by import shortages observed during the pandemic and by the dramatic increases in freight cost and delivery time. Other important forces included greater U.S. competitiveness due to residual effects of the 2017 corporate tax and regulatory cuts, increased recognition of the total cost of offshoring and rising concern over U.S. dependency on China.

The high rate of 2020 and 2021 reshoring vs. FDI also indicates that U.S. headquartered companies are starting to understand the same benefit to localized production that many foreign companies have understood over the last decade.

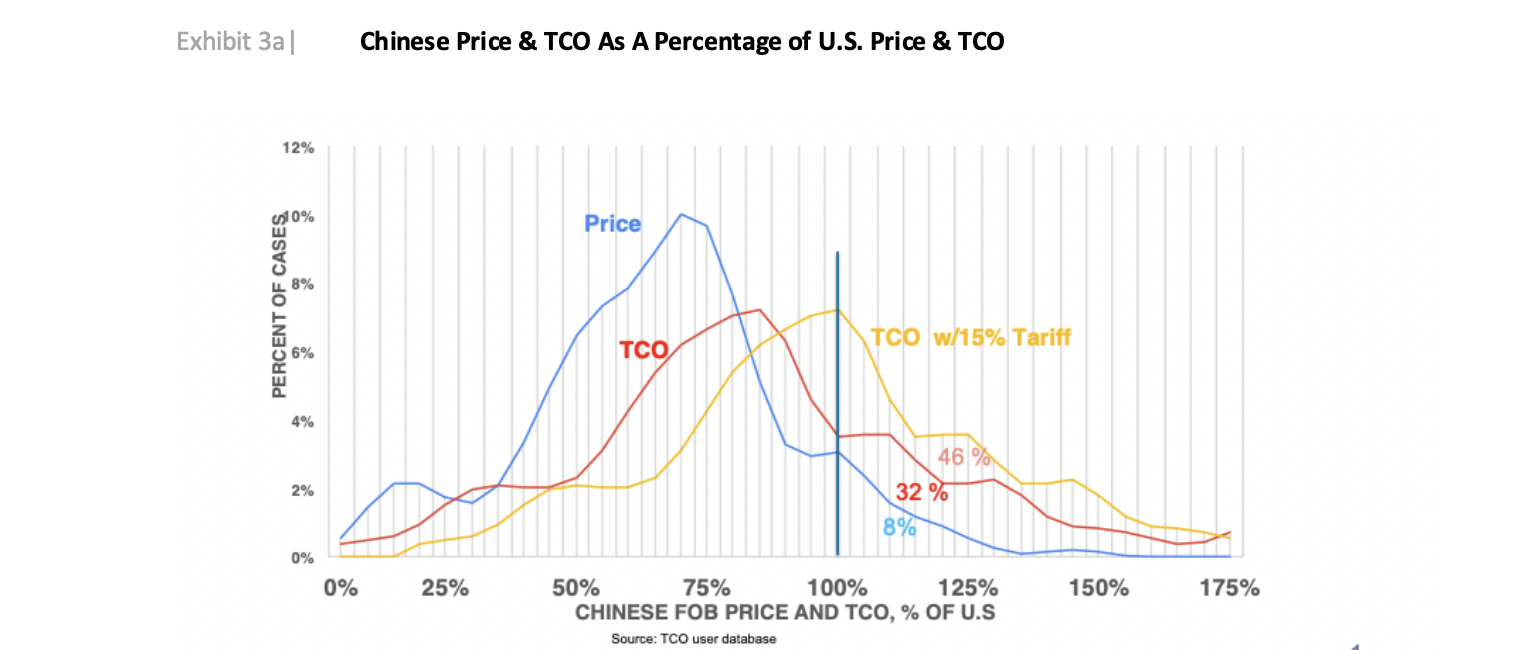

About 60% of companies decide to offshore based on comparing wage rates, FOB prices or landed costs. Much of the strength of the reshoring trend has been due to more companies becoming familiar with a broad range of factors (costs and risks) they had previously ignored. This change in behavior is partially due to the recent dramatic increase in those costs and risks. Understanding the reasons other companies have given for reshoring helps companies to determine whether those reasons apply to them also. A broad range of costs and risks can be quantified using the free online Total Cost of Ownership Estimator®. The Impact of Using TCO shows that shifting decisions from a price basis to TCO can be expected to drive reshoring of 20 to 30% of what is now imported. In Exhibit 3a the percentage of work that is more profitably sourced domestically rather than imported from China rises from 8% to 32% when the sourcing metric shifts from FOB price to TCO.

About 60% of companies decide to offshore based on comparing wage rates, FOB prices or landed costs. Much of the strength of the reshoring trend has been due to more companies becoming familiar with a broad range of factors (costs and risks) they had previously ignored. This change in behavior is partially due to the recent dramatic increase in those costs and risks. Understanding the reasons other companies have given for reshoring helps companies to determine whether those reasons apply to them also. A broad range of costs and risks can be quantified using the free online Total Cost of Ownership Estimator®. The Impact of Using TCO shows that shifting decisions from a price basis to TCO can be expected to drive reshoring of 20 to 30% of what is now imported. In Exhibit 3a the percentage of work that is more profitably sourced domestically rather than imported from China rises from 8% to 32% when the sourcing metric shifts from FOB price to TCO.

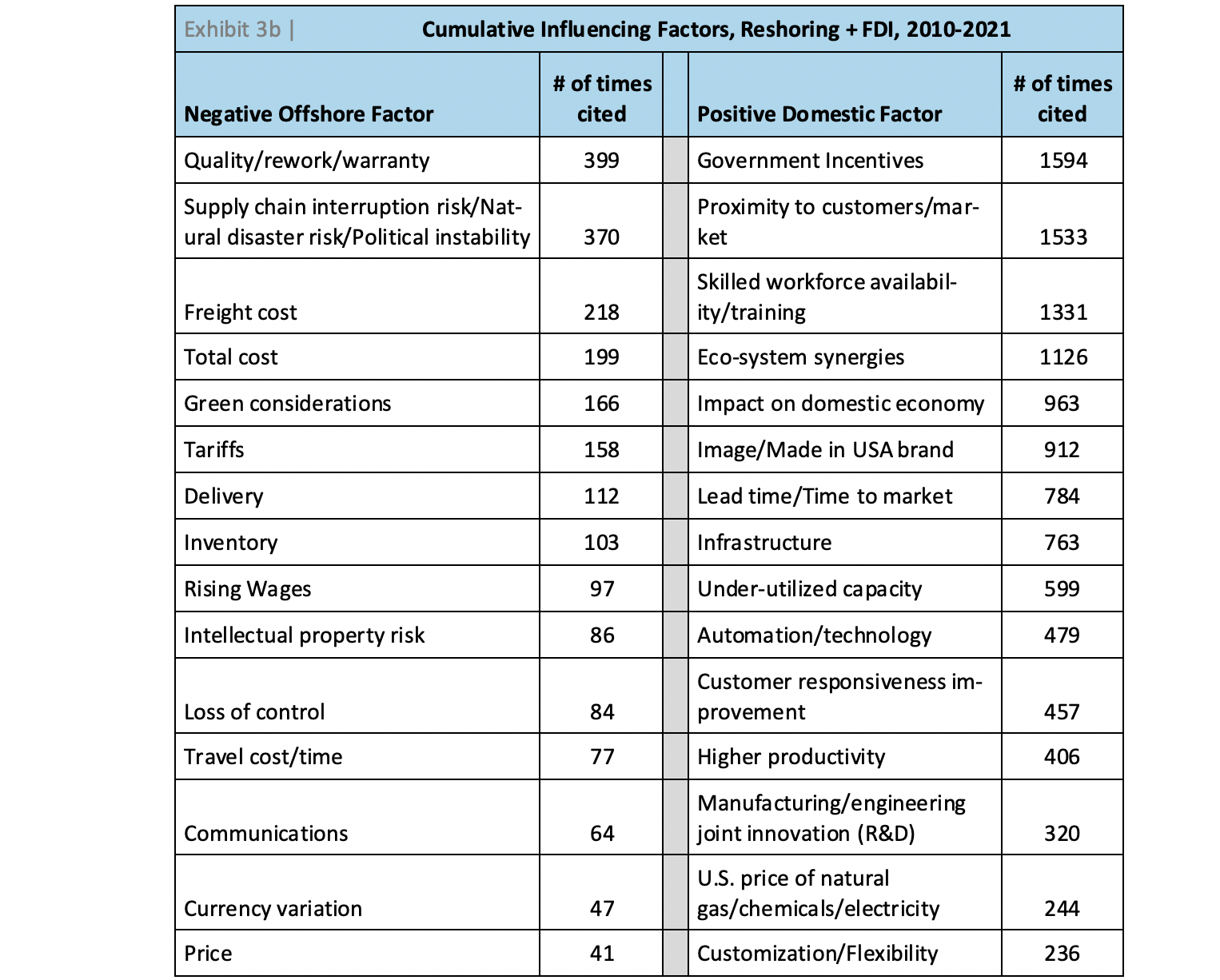

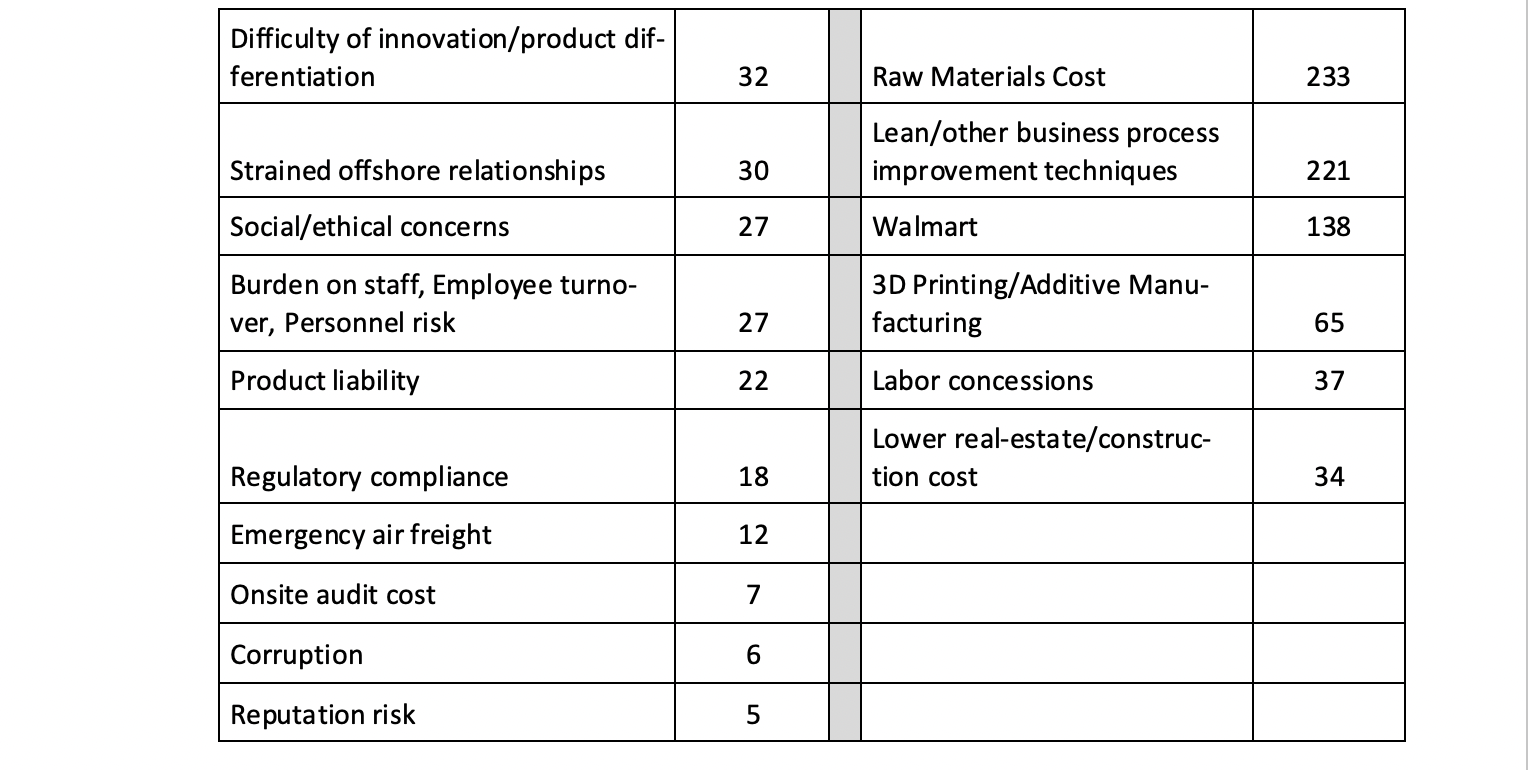

The Reshoring Initiative records Positive and Negative Factors cited for reshoring. Positive Factors are the values that attracted the company to their U.S. site and that they achieved here. These fac-tors are similar for reshoring and FDI with the following exceptions.

- Reshoring places higher emphasis on Made-in-USA image, Redesign of the product, Impact on domestic economy, Lead time/Time to market and Walmart’s US supplier initiative. (If other large retailers would make similar efforts as Walmart, they could have equal or greater impact, and if there were many, a compounded impact.)

- Since most FDI is primarily from other developed countries, Made-in-USA branding is a less powerful sales argument. Shifting from Made-in-Germany to Made-in-USA has less brand value than shifting from Made-in-China.

- FDI places more emphasis on Government incentives, Skilled workforce, Proximity to customers, Infrastructure, Ecosystem synergies.

- Foreign companies can be recruited by all 50 states and often have larger projects; thus, they receive more government incentives. This may be shifting to include reshoring, with the essential products push by the U.S. government.

- Since reshoring is almost all from low-wage countries, reshoring companies have increased automation to make up for higher domestic hourly labor cost. This trend more recently also applies to FDI.

Negative Factors are the negative issues experienced offshore. Most of the issues are related to distance: freight, delivery, inventory, etc. Others are country specific: rising wages, IP risk, geo-political risk, etc. Reshoring reports more negative factors because they are more frequently coming from less developed countries. Reshoring accounts for 75% of all negative factor citings. The top negative factors for reshoring in 2021 were Supply chain interruption, Green considerations and Quality/rework/warranty.

Companies have consistently reported Positive Factors more often than Negative, probably because the companies place more value on demonstrating the wisdom of their current reshoring decision than on what went wrong with their earlier offshoring decision. Companies also do not want to offend the country they are leaving.

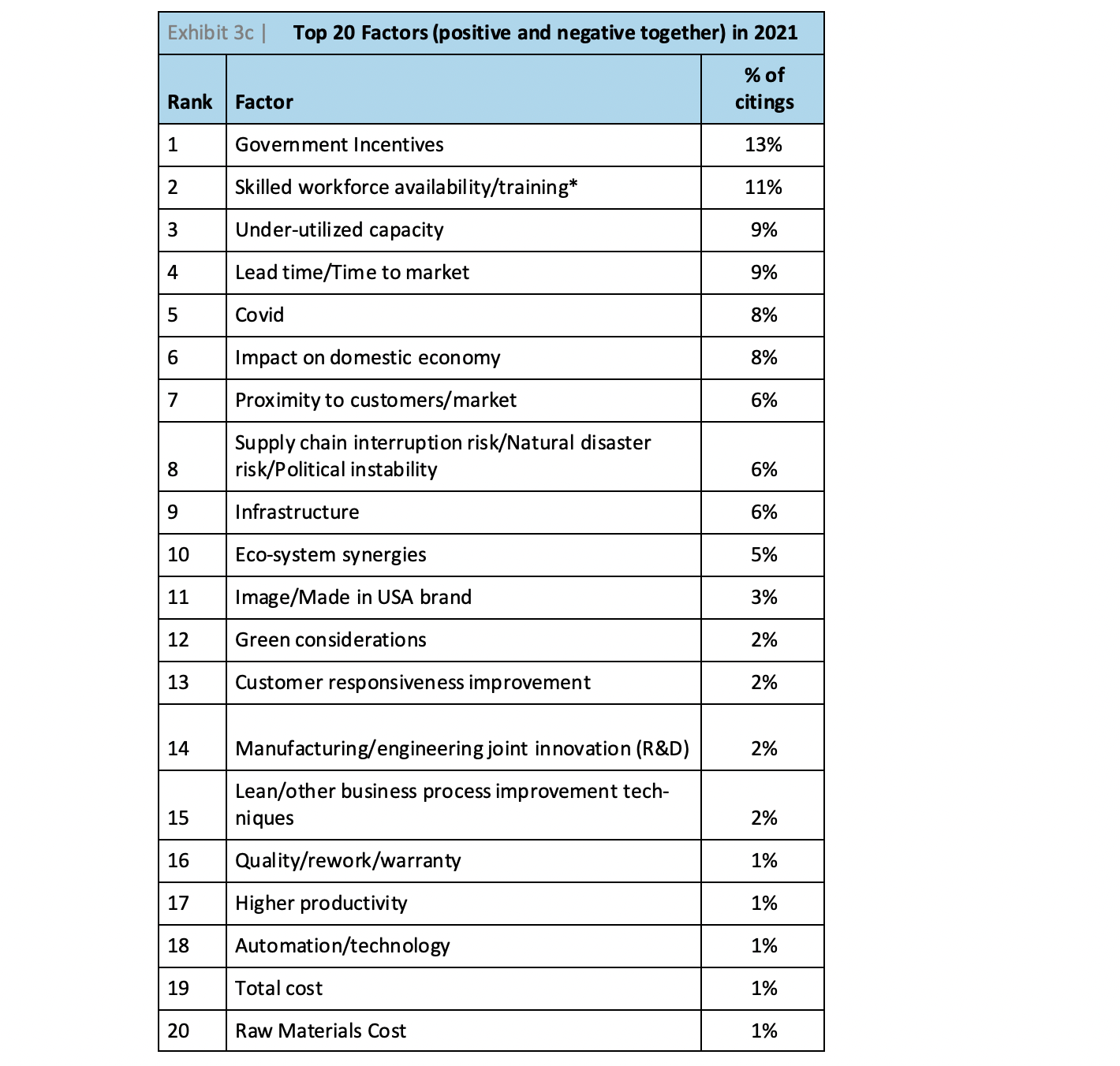

The largest shifts in factor reporting in 2021 were pandemic related. Covid-19 itself remained in the top 5 factors in 2021. Negative Offshore Factors with substantial changes included: Supply chain disruption (1500% increase in annual rate since 2019), Green considerations, and Total cost. Citings of Tariffs as a factor dropped off sharply in 2021. It is unclear if companies have adjusted to the tariffs, are waiting for them to be removed or view the topic as too politically charged.

We predicted Green considerations to become more relevant due to the new emission reduction initiative by the International Maritime Organization, along with other imminent mandates related to climate change. With heightened public awareness of climate change issues, consumers are increasingly demanding environmental, social and governance (ESG) responsibility. Local sourcing is intrinsically conducive to clean, sustainable sourcing.

Quality/rework/warranty remained the highest reported negative factor, cumulatively and has seen consistent levels of reporting over the years.

There were a number of large increases in reporting of positive factors including the following: Lead Time to market, Underutilized capacity, Eco-system synergies, Infrastructure, Manufacturing/engineering joint innovation (R&D), Skilled workforce, and the largest increase: Government Incentives. Reduced lead time is prioritized due to the current drastically extended delivery time and cost for container freight.

Other factors mentioned, but not recorded in these Exhibits, include: national security, price gouging, Chinese ban on imports of recyclables, investing to improve competitiveness, sustainability, Biden initiatives and essential products supply.

Only products that have been offshored/imported can be reshored. Thus, the products least suitable for offshoring never left, such as heavy, high volume minerals, high mix/low volume items or customized automation systems.

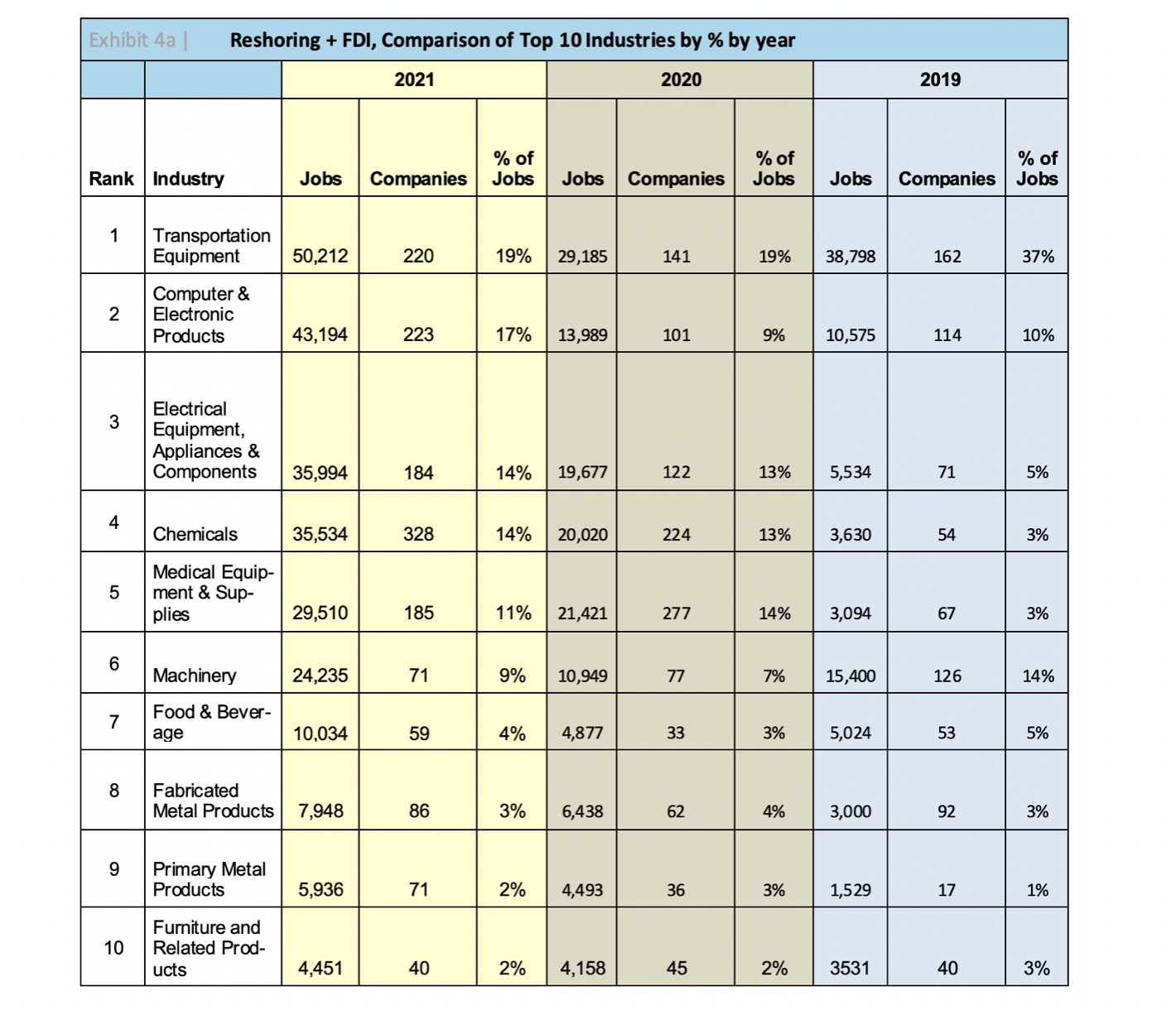

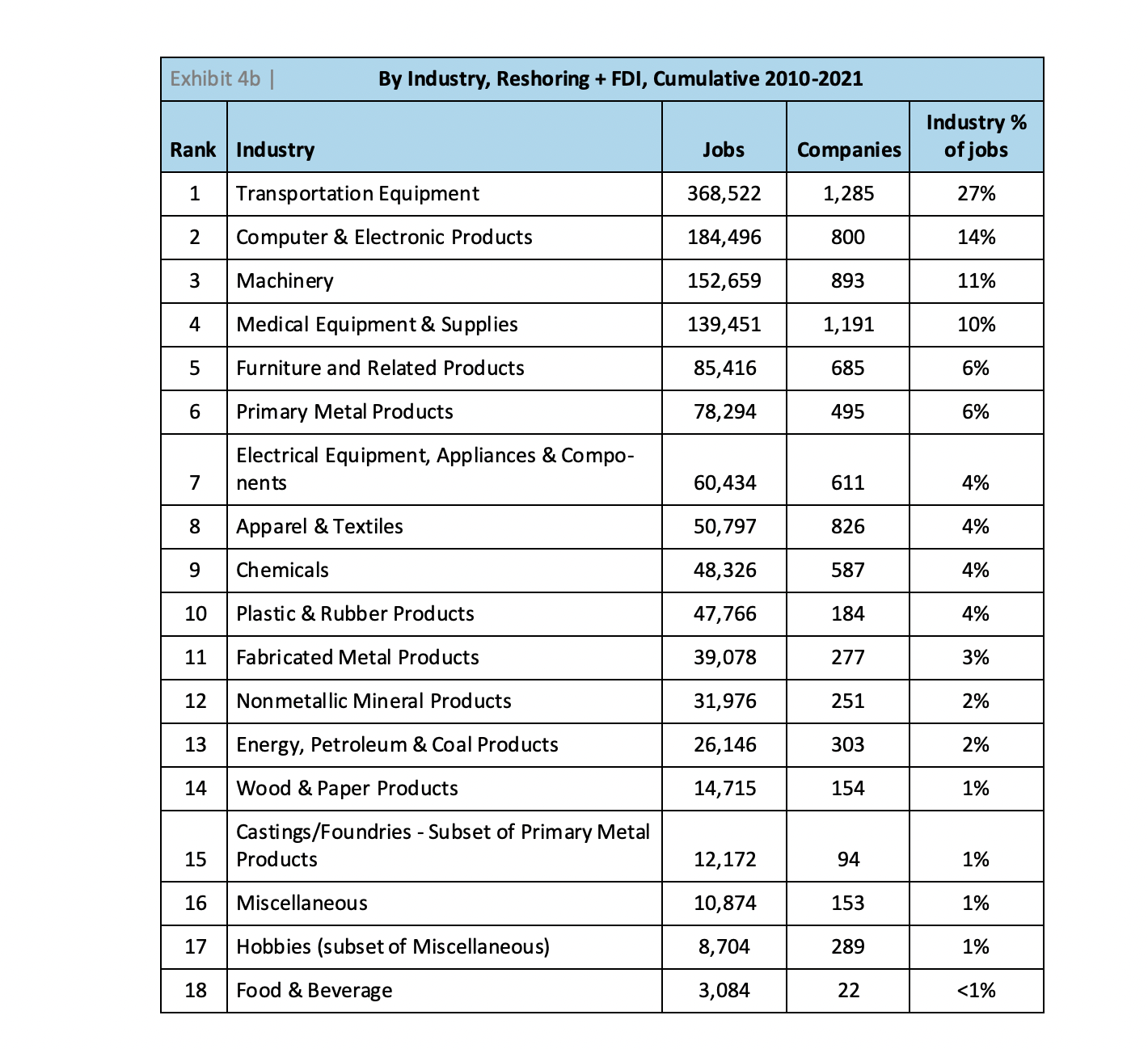

Only products that have been offshored/imported can be reshored. Thus, the products least suitable for offshoring never left, such as heavy, high volume minerals, high mix/low volume items or customized automation systems. Historically, the most active reshoring is by those that left and probably should not have done so, including machinery, transportation equipment and appliances. More recently, we added to that list essential products of which the U.S. relies too heavily on imports, such as electric batteries, semiconductors, PPE, pharmaceuticals and rare earths. In 2021 President Biden ordered a review of four classes of essential products where America relies excessively on imports. Both 2020 and 2021 have seen a jump in cases in these industries and we expect that trend to accelerate in the coming years, as we discuss more broadly in Chapter 12. 2022 Trends and Projections.

In 2022, congress is pursuing the COMPETES Act and USICA to make the U.S. more competitive. This legislation has value but misses the root cause of the problem, U.S. lack of price/cost competitiveness. Our Competitiveness Toolkit is available to help quantify the impact of policy alternatives, including a stronger skilled workforce, competitive corporate tax rates and a lower U.S. dollar.

As the data indicates, reshoring is focused on products whose size and weight, e.g. transportation equipment, or frequency of design change/volatility of demand, e.g. some apparel or electronics, suggest that offshoring never offered great total cost savings.

FDI has traditionally brought about 2/3 of the Transportation Equipment jobs. With FDI off 20% from 2017 and auto plants distracted by COVID, the Transportation Equipment industry saw a 25% reduction of reshoring + FDI job announcements in 2020, and stayed at that level through 2021.

The second and third largest industries, Computer and Electronic Products and Electrical Equipment, Appliances & Components continue to grow, pushed in recent years by solar panels, lithium ion batteries, robotics, drones and most recently, semiconductors.

Chemicals also continued to grow, driven by the pandemic-revealed U.S. dependencies on pharmaceuticals in general, and the specific need for vaccines and COVID-19 treatments.

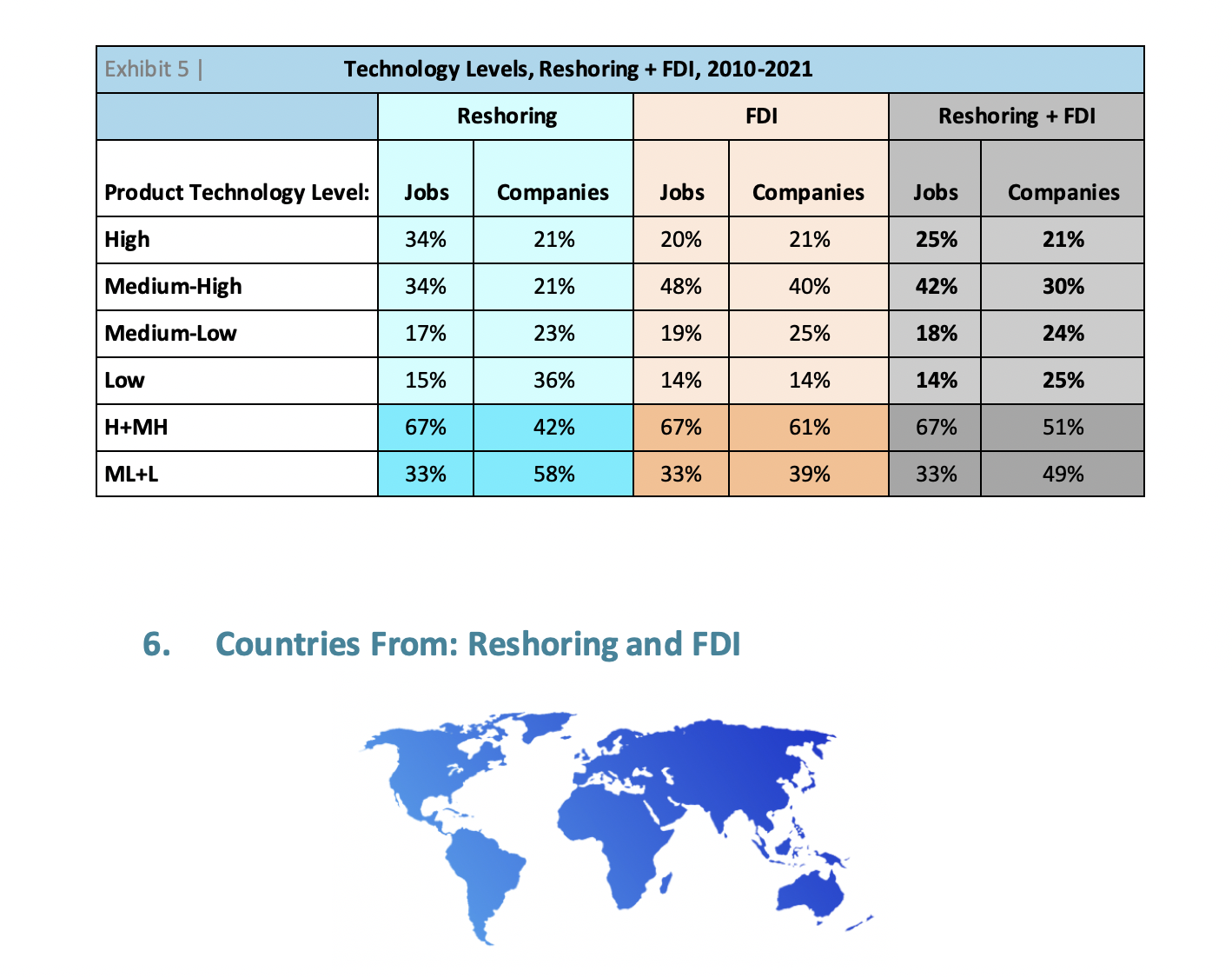

Currently, reshoring and FDI are continuing to add more High-Tech jobs than Low-Tech, again driven by the essential products push. This trend is important since the U.S. has a trade deficit in High-Tech products. Reshoring is stronger in High-Tech than FDI which is stronger in Medium-High due to the high % of transportation equipment in FDI. The higher tech companies average more employees/company than do the lower tech companies.

Currently, reshoring and FDI are continuing to add more High-Tech jobs than Low-Tech, again driven by the essential products push. This trend is important since the U.S. has a trade deficit in High-Tech products. Reshoring is stronger in High-Tech than FDI which is stronger in Medium-High due to the high % of transportation equipment in FDI. The higher tech companies average more employees/company than do the lower tech companies.

We encourage the U.S. to become competitive on all tech levels to balance the trade deficit and employ a broader range of workers. High-Tech products represent too small a percentage of our consumption to allow the U.S. or any country to focus only on High-Tech. One challenge is to upskill our workforce so that more of them can work on more highly automated production of lower tech products.

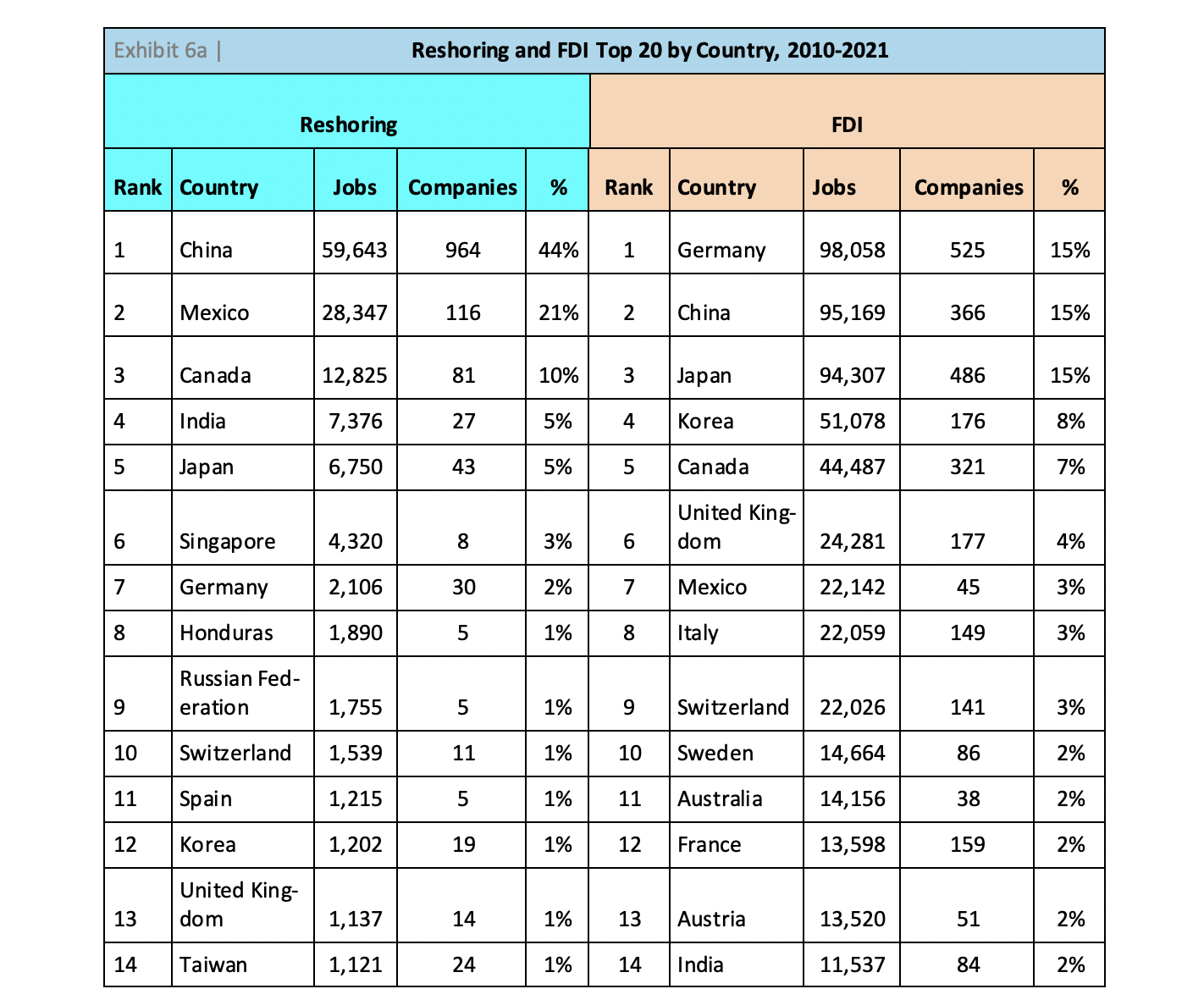

China is the source of 44% of reshoring, cumulative 2010 to 2021. The rate of reshoring from China has been dropping over recent years. There are a number of possible reasons for this trend. One explanation is that the many jobs which have already reshored can’t be reshored again. While it is true that the rate and percentage of jobs from China is going down, we suspect the overall actual number returning from China is actually much greater that what is reported. Cumulatively, only about 30% of reshoring cases report Country From. We see two main factors driving this reporting trend: 1.) historically, companies haven’t wanted to report/advertise leaving China for fear of retaliation. 2.) rather than stating the country from, many cases simply refer to “Asia” or “returned from offshore.”

China reshoring cases are broadly distributed across industry categories.

FDI is heavily from Germany (15%) and Japan (15%), both driven by transportation equipment, and more recently China (15%), driven by a broad range of industries. We know country of origin in 100% of FDI cases because we know the home country of the parent company.

As a result of the Coronavirus pandemic, FDI slowed relative to reshoring in 2020. See more in Chapter 12. 2022 Trends and Projections.

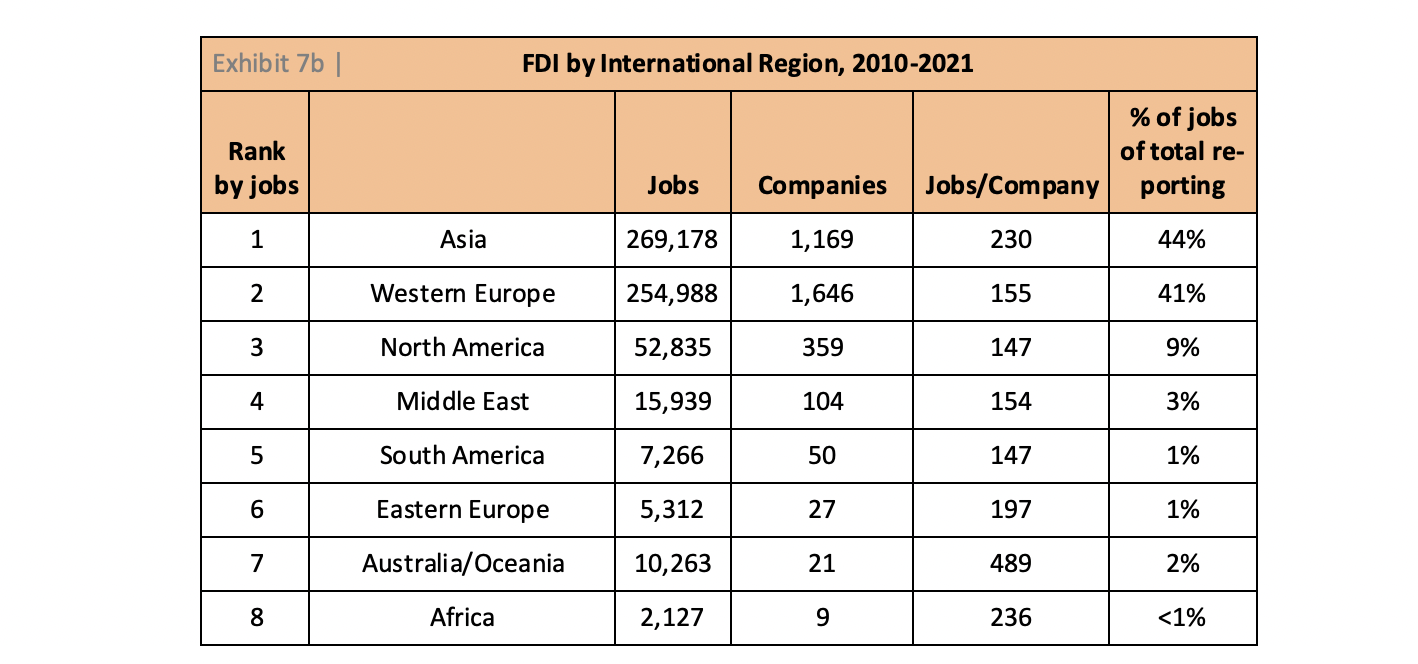

FDI used to come primarily from Western Europe and Japan. With the increase in Chinese investment in the mid 2010’s, Western Europe and Asia are cumulatively about equal for FDI.

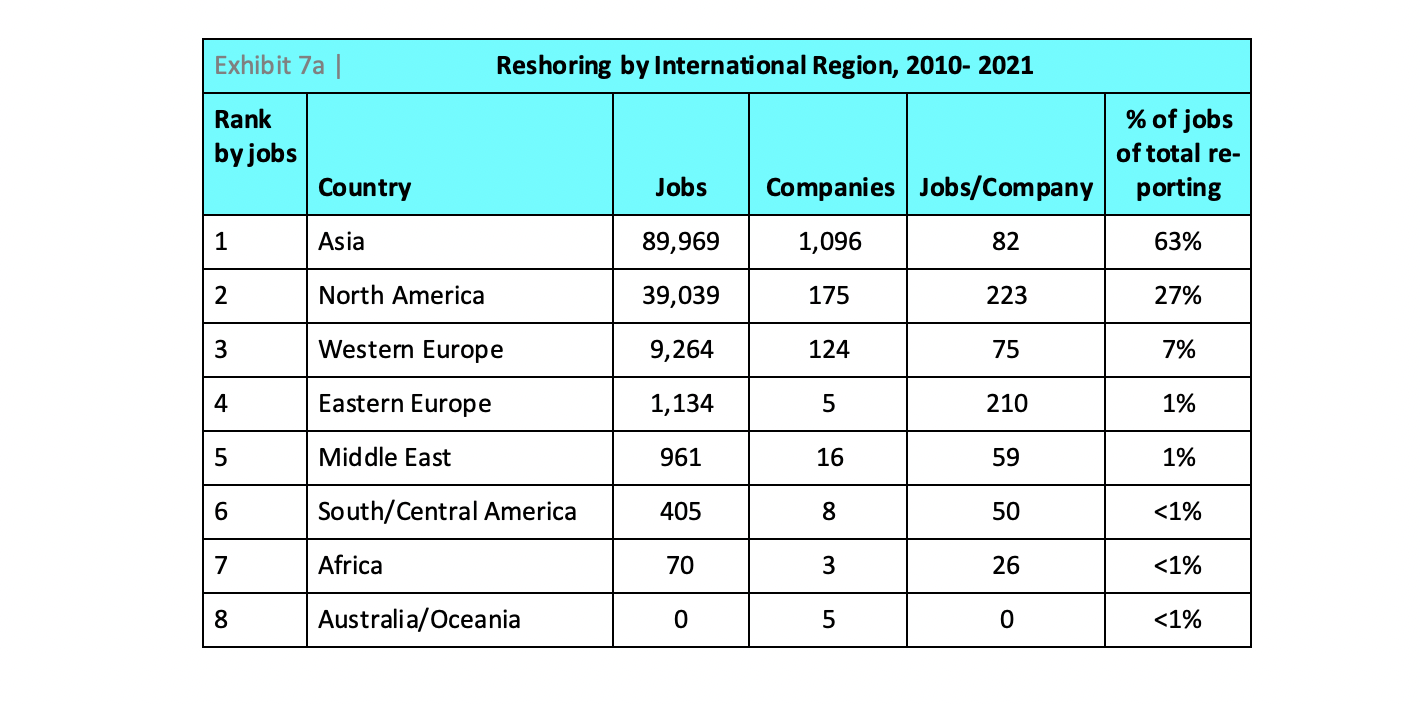

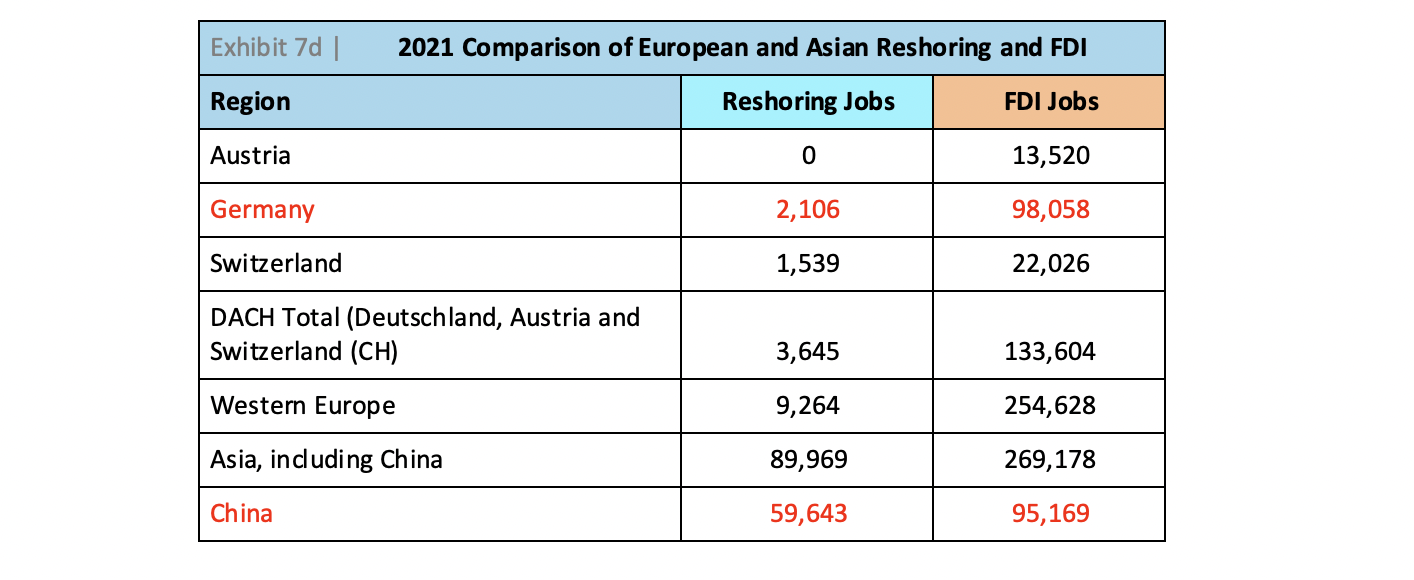

Comparing reshoring and FDI across regions and countries provides an insight into the trends and what is feasible. China is the source of as much FDI as Germany, but about 30X as much reshoring. Asia and Western Europe have a similar contrast.

Comparing reshoring and FDI across regions and countries provides an insight into the trends and what is feasible. China is the source of as much FDI as Germany, but about 30X as much reshoring. Asia and Western Europe have a similar contrast.

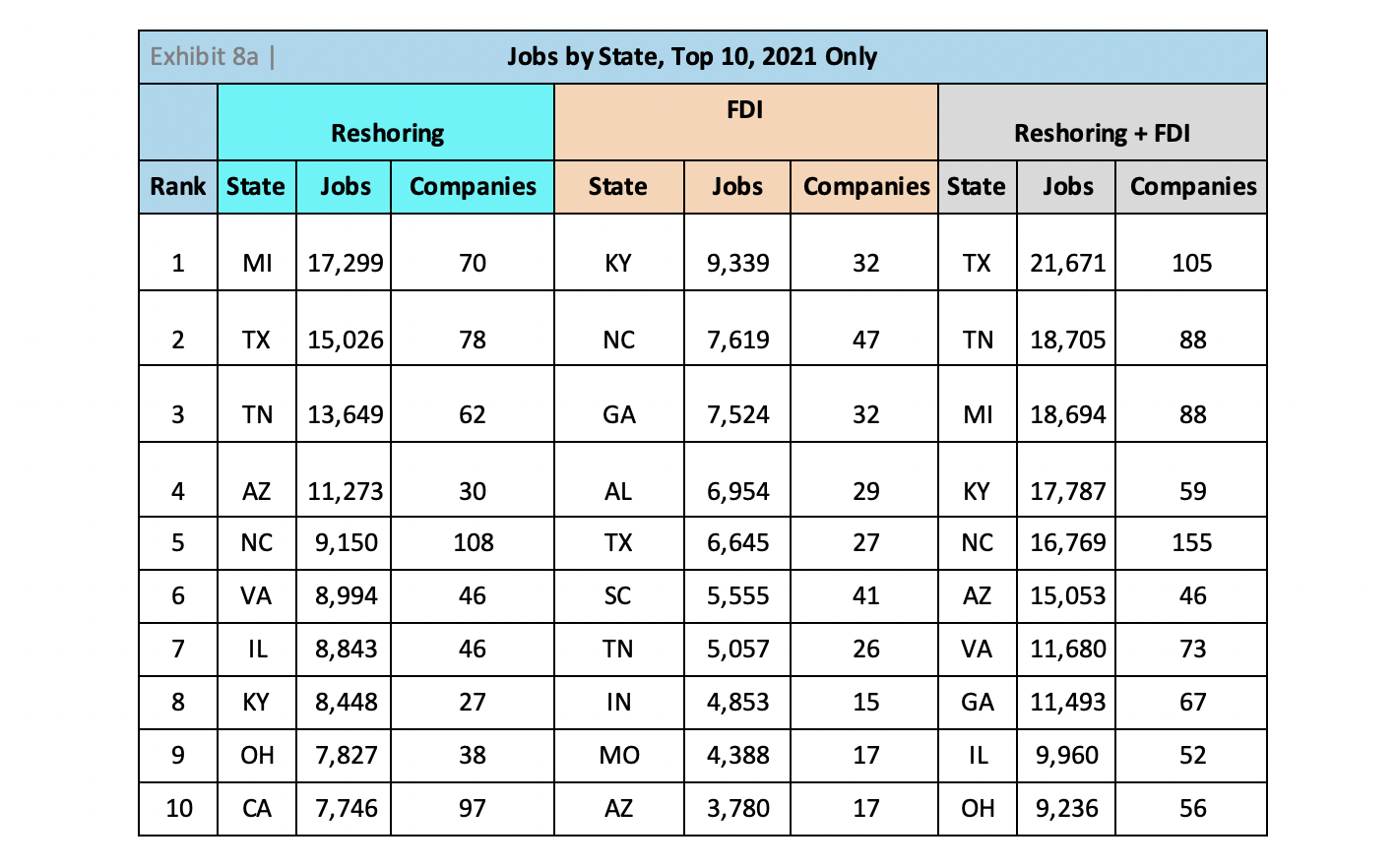

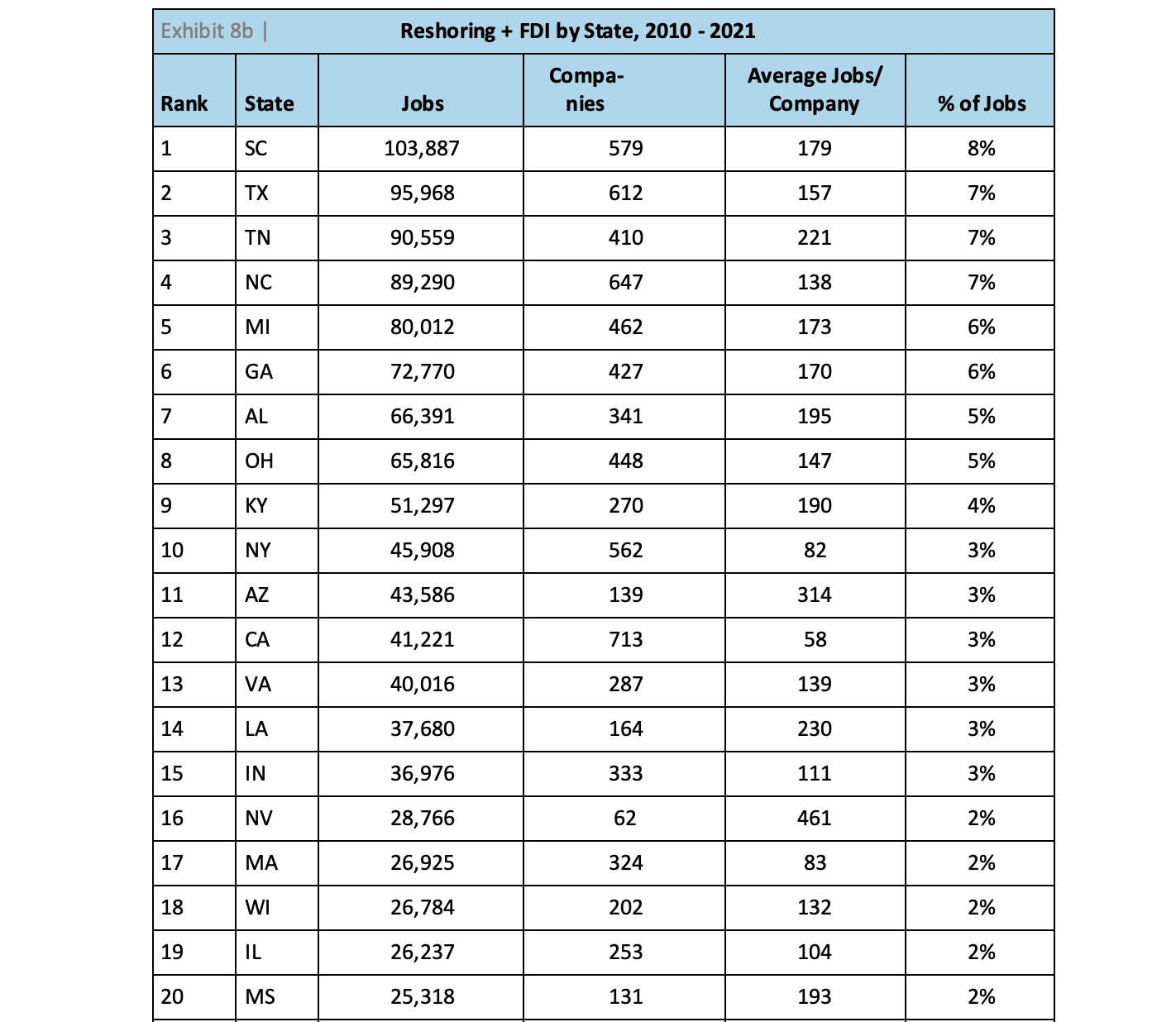

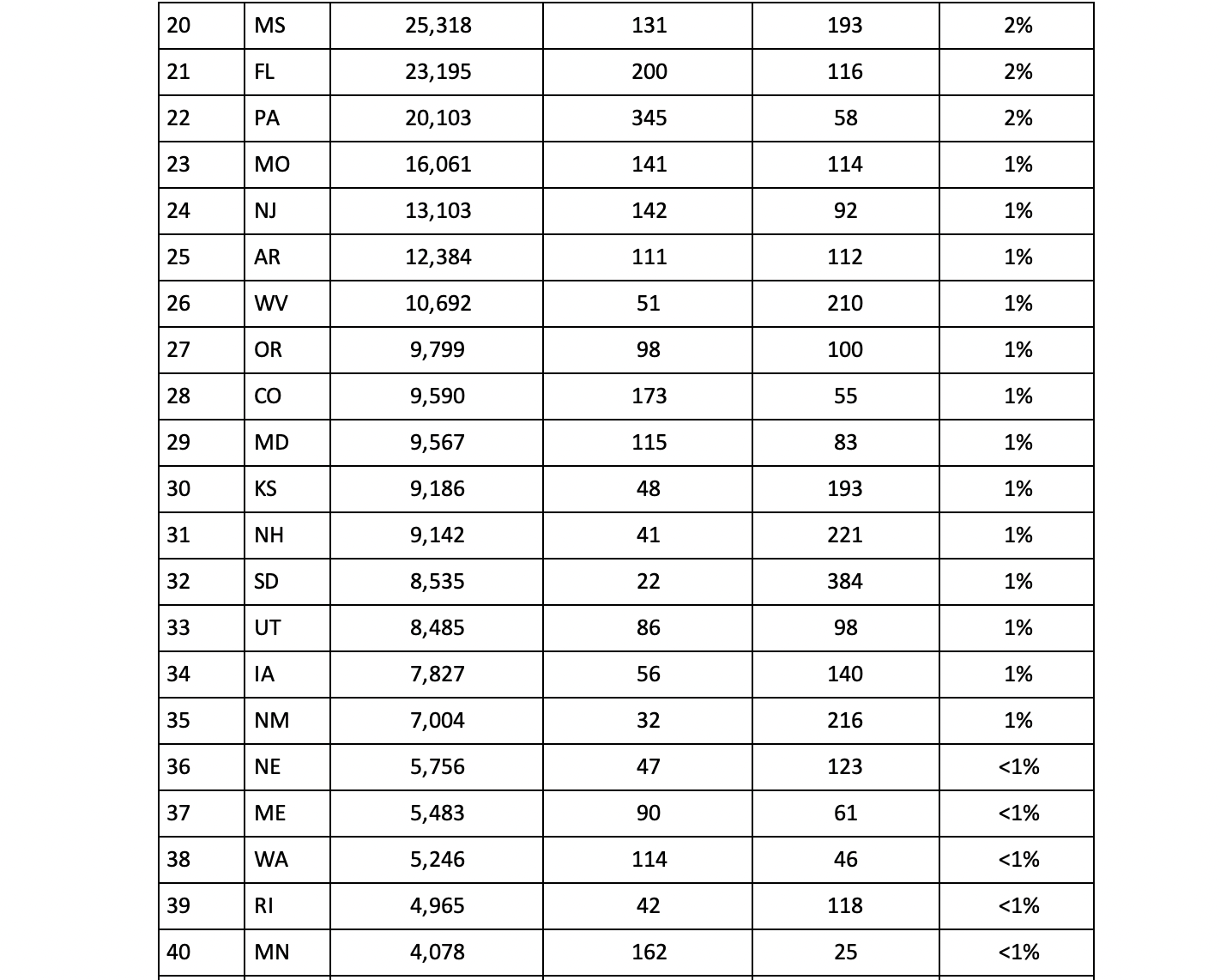

In 2021 Texas had the most job announcements of all the states. Tennessee moved up to 2nd. Arizona jumped from 15th for 2010 thru 2020 to 6th for 2021, driven strongly by chip foundry announcements.

In 2021 Texas had the most job announcements of all the states. Tennessee moved up to 2nd. Arizona jumped from 15th for 2010 thru 2020 to 6th for 2021, driven strongly by chip foundry announcements.

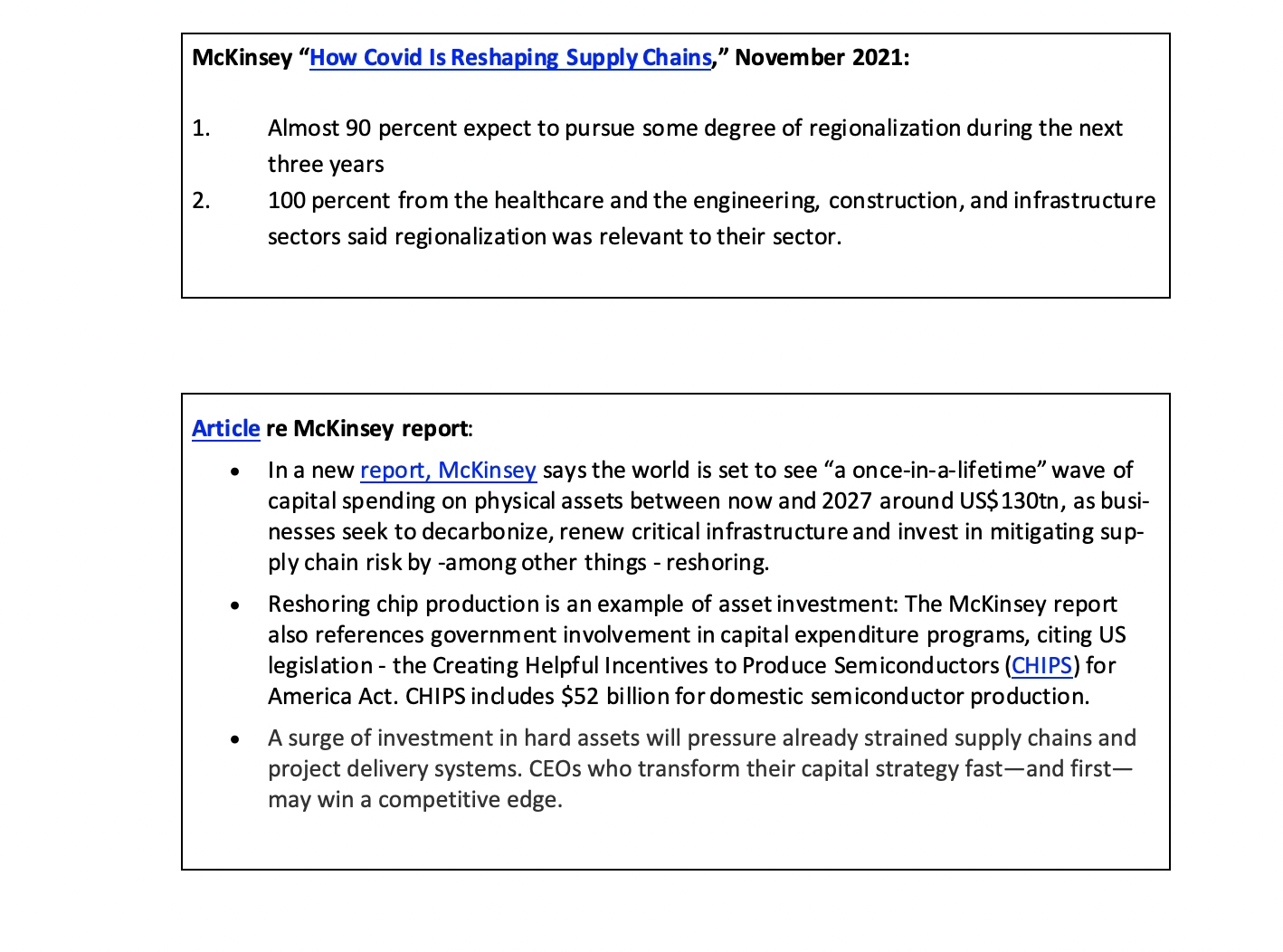

Wall Street’s focus on short-term profits was a major force driving offshoring for the last 40 years. Major banks, financial institutions and private equity companies are now sensing the rewards of reshoring. The Initiative is working with several to help them identify firms with opportunities for outsize gains by selling or buying smarter.

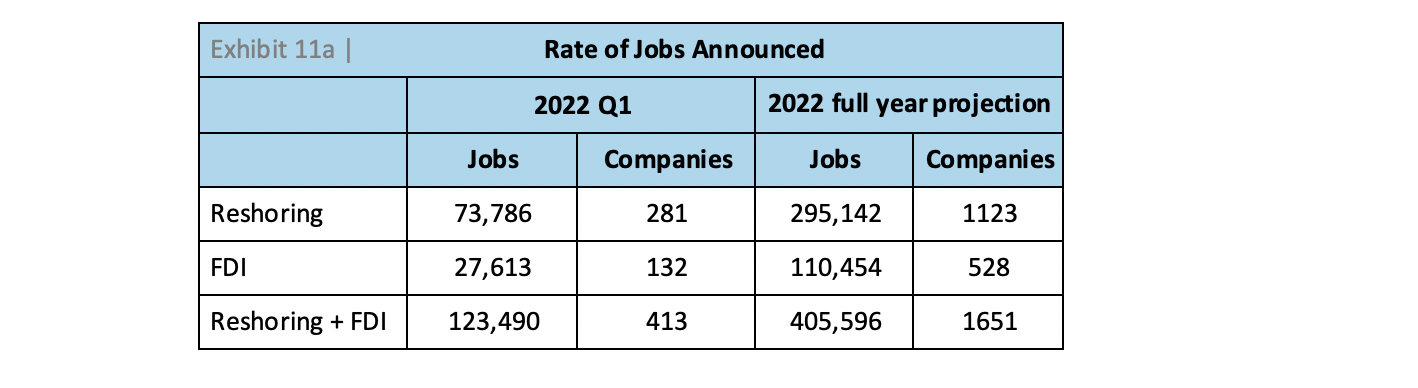

Wall Street’s focus on short-term profits was a major force driving offshoring for the last 40 years. Major banks, financial institutions and private equity companies are now sensing the rewards of reshoring. The Initiative is working with several to help them identify firms with opportunities for outsize gains by selling or buying smarter.  Based on the first quarter of 2022 we project that 2022 reshoring + FDI jobs announced will be up-wards of 400,000. However, at some point, companies will become more focused on fulfilling the giant commitments already made before announcing more.

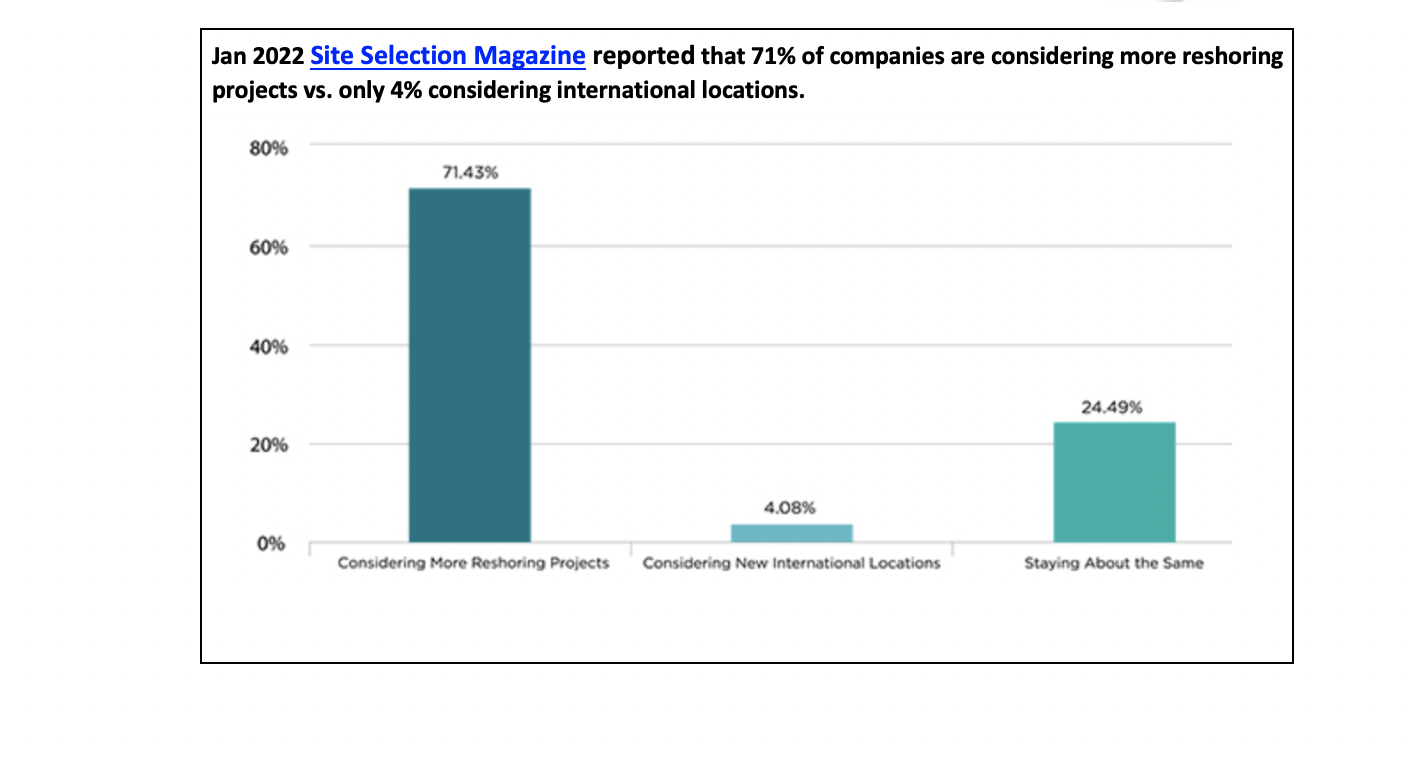

Based on the first quarter of 2022 we project that 2022 reshoring + FDI jobs announced will be up-wards of 400,000. However, at some point, companies will become more focused on fulfilling the giant commitments already made before announcing more.  We anticipate the strength of reshoring vs. FDI to continue, consistent with a multi-year slowing in global FDI. COVID and geo-political induced business uncertainty is causing companies to emphasize operations in their home countries. Training a skilled workforce to fill the new positions will be a challenge and barrier to further growth. To meet this challenge, companies, trade associations and states have been ramping up training programs.

We anticipate the strength of reshoring vs. FDI to continue, consistent with a multi-year slowing in global FDI. COVID and geo-political induced business uncertainty is causing companies to emphasize operations in their home countries. Training a skilled workforce to fill the new positions will be a challenge and barrier to further growth. To meet this challenge, companies, trade associations and states have been ramping up training programs. Survey results showed a surge in reshoring plans in 2021, subject to the emotion of the pandemic, and have continued in 2022. Perceptions of manufacturing jobs are also improving.

There is a substantial pipeline of huge projects that have been announced but are not firm enough to be included in our database. These projects include: Foxconn in Wisconsin, Apple, SoftBank and numerous shale gas refinery projects. Foxconn is now considering producing EV’s instead of display panels in the Wisconsin facility. It remains to be seen whether the political and economic climates that motivated the earlier announcements are still strong enough to enable follow through.

Results in 2022 will depend largely on economic recovery from the COVID crisis and inflationary problems that are building for the Russian Ukraine war. Re the pandemic, there are two forces that will conflict. On the negative side, the virus’ continued impact on the economy and business uncertainty. On the positive front, the virus’ lesson about the country’s lack of self-sufficiency will spur growth in local sourcing.

The Biden administration offers both head and tailwinds for progress. Corporate tax rates, regulations, tariffs, skilled workforce, etc. could play an important role. The 2017 upswing in activity was in response to lower tax rates and regulations. Below are some factors that may impact 2022 relative to 2021.

Forces likely to slow reshoring and FDI:

1. Disrupted supply chains causing lack of availability of components 2. Continued workforce shortages 3. Continued increase in industrial capabilities in SE Asia and Mexico, attracting work that would otherwise come back to the U.S. 4. U.S. inflation rate higher than in other countries, further reducing competitiveness. 5. Higher USD

Forces likely to help reshoring and FDI:

1. Government actions to reduce national dependence on imports of key products - This effort is starting aggressively with medical products, chips, rare earth minerals, EV batteries, etc. to fill in current supply chain gaps. President Biden is prioritizing reshoring highly, applying different methods than President Trump. 2. Continued growth in efforts by MEPs (Manufacturing Extension Partnerships), EDOs (economic development organizations) and states to enable reshoring - The Reshoring Initiative is deeply involved in these efforts. 3. Environmental, Social and Governance (ESG) trend: b. Corporate responsibility expands The Business Roundtable’s August 2019 Statement on the Purpose of a Corporation expanded the definition of stakeholders from just shareholders to now include employees, suppliers and community. We anticipate companies will recognize that reshoring is the most effective and least expensive way to fulfill their commitments. Companies can strengthen the three new stakeholder constituencies while increasing the return to shareholders if they do the math correctly. c. Climate crisis and Increasing environmental consciousness - Domestic supply chains are more transparent than offshore and less polluting, cutting the world’s environmental impact by up to 25%, depending on the product. Sustainability practices will continue to increase as a corporate strategy and will help drive reshoring and FDI. 4. Risk of aggressive “decoupling” by China. As tensions grow over Taiwan and any Chinese support of Russia in Ukraine, the likely of an abrupt termination of shipments of a broad range of products increases. 5. Continued increases in usage of TCO (Total Cost of Ownership) instead of price in making sourcing decisions. Universal TCO usage, alone, would reshore about 1.5 million jobs. 6. Continued improvement in skilled workforce programs 7. Automation, IoT, Industry 4.0, AI shrinking the unit labor cost gap 8. Russian/Ukrainian war. Nickel, argon and neon are a few of the materials whose supply is severely disrupted by the war. Equally important, companies can now better appreciate the possible impact of geopolitics.

Ambiguous:

1. Higher interest rates - Has raised the value of the USD (headwind) but will surely increase the carrying cost of inventory (tailwind), which is increased by offshoring. 2. Possible actions on tariffs, trade with China, etc. - Likely to be long-term favorable but temporarily disruptive. 3. Oil prices and environmental regulations - Higher prices increase freight costs and tend to make U.S. shale gas more of an advantage for making plastics and for having competitive electricity rates. 4. Biden administration policy - Has placed a high priority on reshoring. Tends to apply tourniquets and Band-Aids to high profile problems, rather than systematically attacking the underlying problem: lack of cost/price competitiveness, which could be more directly dealt with by massive skilled workforce investment, 20% lower USD and adding a VAT.There is probably an average 12-month lag time between the announcement or implementation of policy changes and a significant response in the trends. Best guess forecast: 2022 reshoring will reach a new record and FDI will recover moderately. The biggest challenge will be bolstering our skilled workforce, which is not adequate to support a much higher rate of reshoring.

The rate of reshoring plus FDI job announcements in 2021 was up 46% from 2020 and over 4000% from the 2010 rate. The resulting cumulative 860,000 incremental hires represent about 7% of U.S. manufacturing employment. The acceleration of jobs coming back combined with the decline in the rate of offshoring has resulted in a 12-year steady uptrend in U.S. manufacturing jobs. The COVID crisis has revealed the U.S.’s over-dependence on imports. The Ukraine/Russian war and geopolitical tension with China will drive ongoing supply chain shifts, further accelerating reshoring and nearshoring. This Data Report should motivate companies to further reevaluate their sourcing and siting decisions by considering all of the cost, risk and strategic impacts flowing from those decisions. Reshoring’s success has occurred despite uncompetitive U.S. manufacturing costs. The Reshoring Initiative can help government policy makers project the impact of applying industrial policy to bring millions more jobs back.

Continuation of the trend depends on companies reevaluating their offshoring. Acceleration of the trend depends on the government leveling the playing field, making the United States more price competitive. The Reshoring Initiative offers many tools and resources, which are listed below. Please contact us for help driving reshoring for your company, your region and our country.

Data refinement is ongoing.

1. Companies, industry associations, states, EDOs and others are encouraged to send us information on reshoring and FDI cases. Send us links to articles and announcements.

2. To see a full list of companies in the database click here. 3. If your company is listed, email us to request your company’s data to review, edit and return. Please include your company name and detailed contact info.