High dollar drags on reshoring

An Op-Ed from the Washington Post last week caught our eye: “The Strong Dollar is Hurting U.S. Manufacturing. There's a Lesson in There for the TPP” by Jared Bernstein and Dean Baker. The article observes: “In a recent reversal of a positive trend, the nation’s factories have added almost no jobs on net over the past three months.”

We've been publicizing, especially with our recent data report, that reshoring is still happening and manufacturing is still recovering in the U.S. We stand by this, but 2015 Q1's jobs numbers are so far down, especially when compared to the powerhouse year reshoring had in 2013. U.S. natural gas prices are still low. The U.S. skilled workforce is not a strength vs. other developed countries such as Germany, but is improving, and we are still more than capable of producing high quality goods with more efficiency than low-labor-cost countries. Every reason we and other institutions and companies give for why reshoring is a good, total-cost-based decision still holds. So why the lull in job numbers? “There is a good explanation for the change,” say Bernstein and Backer, which is “the sharp increase in value of the U.S. dollar in foreign markets…our exports cost more in foreign currencies and imports from abroad are cheaper here.” As the chart below shows, the dollar has been steadily increasing against the euro for the last year:(http://www.xe.com/currencycharts/?from=USD&to=EUR&view=1Y)

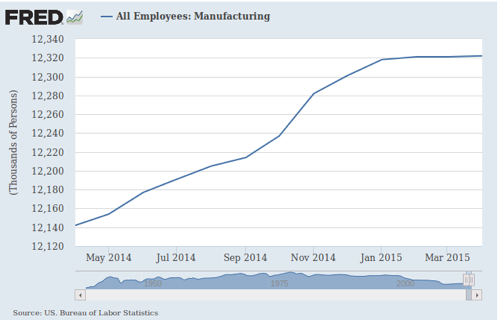

The following chart of manufacturing employment over the past year from FRED (https://research.stlouisfed.org/fred2/series/MANEMP) shows a similar shape, suggesting correlation:

The following chart of manufacturing employment over the past year from FRED (https://research.stlouisfed.org/fred2/series/MANEMP) shows a similar shape, suggesting correlation:  It makes sense that manufacturing employment is flattening out in part because the USD is so high.. It is inevitable that sooner or later we will see the USD decrease again in comparative strength, a correlating increase in foreign and domestic demand for U.S. goods, and in turn, an increase in U.S. manufacturing activity and employment. Now imagine a foreign government wants to create an advantageous environment for their country's goods. What might they do in order to make their goods relatively inexpensive in the global market compared to, say, American goods? And what if they have unfettered access to such global markets, thanks to trade agreements? As the U.S. has seen foreign powers do, they might artificially manipulate their currency so it stays low relative to the dollar, making their products cheaper and American products more expensive abroad, thus artificially perpetuating the strong dollar. If that happens, that flat-lined manufacturing employment doesn't have much incentive to turn back upwards, and indeed, could very well turn back down. Bernstein and Baker warn of just this, and the potential repercussions of currency manipulation if the proposed Trans-Pacific Partnership (TPP) is approved, which contains no provisions for such an eventuality According to the pair, “currency interventions by Japan, Malaysia and Singapore have cost us 250,000 to 320,000 jobs annually over the past few years,” but “a full accounting of the jobs lost to the set of countries that have suppressed the value of their currency relative to the dollar over the past five years comes to 2.5 million to 3 million jobs…” Job growth stagnation due to natural fluctuations and cycles in currency valuations is unavoidable. But entering into a trade agreement with governments known to artificially cause this effect for their own benefit, via an agreement that contains no “enforceable currency rules” and so no recourse against currency manipulations, is reckless at best. At worst, it could be disastrous for an American economy, which is only starting to rebuild itself.

It makes sense that manufacturing employment is flattening out in part because the USD is so high.. It is inevitable that sooner or later we will see the USD decrease again in comparative strength, a correlating increase in foreign and domestic demand for U.S. goods, and in turn, an increase in U.S. manufacturing activity and employment. Now imagine a foreign government wants to create an advantageous environment for their country's goods. What might they do in order to make their goods relatively inexpensive in the global market compared to, say, American goods? And what if they have unfettered access to such global markets, thanks to trade agreements? As the U.S. has seen foreign powers do, they might artificially manipulate their currency so it stays low relative to the dollar, making their products cheaper and American products more expensive abroad, thus artificially perpetuating the strong dollar. If that happens, that flat-lined manufacturing employment doesn't have much incentive to turn back upwards, and indeed, could very well turn back down. Bernstein and Baker warn of just this, and the potential repercussions of currency manipulation if the proposed Trans-Pacific Partnership (TPP) is approved, which contains no provisions for such an eventuality According to the pair, “currency interventions by Japan, Malaysia and Singapore have cost us 250,000 to 320,000 jobs annually over the past few years,” but “a full accounting of the jobs lost to the set of countries that have suppressed the value of their currency relative to the dollar over the past five years comes to 2.5 million to 3 million jobs…” Job growth stagnation due to natural fluctuations and cycles in currency valuations is unavoidable. But entering into a trade agreement with governments known to artificially cause this effect for their own benefit, via an agreement that contains no “enforceable currency rules” and so no recourse against currency manipulations, is reckless at best. At worst, it could be disastrous for an American economy, which is only starting to rebuild itself.