A.T. Kearney’s Report on Reshoring: Some Right, Some Wrong

A.T. Kearney's report Rehoring In Reverse Again got some things right, others clearly wrong:

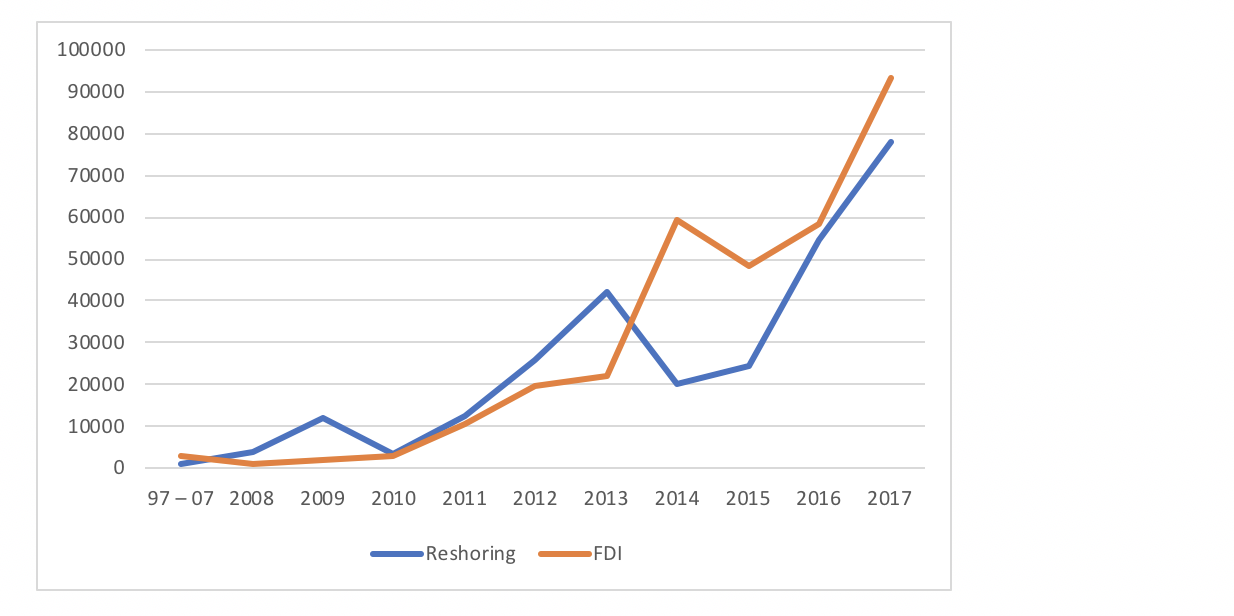

Right:Fig 1. Reshoring and FDI jobs announced/year

- A.T. Kearney’s “Database” shows only 20 cases of reshoring reported in 2017, down from over 200 in 2013 and 2014

- Reality: 223 cases in 2017, up from 158 in 2013 and 124 in 2014. You can find all of these cases in the Reshoring Initiative Library.

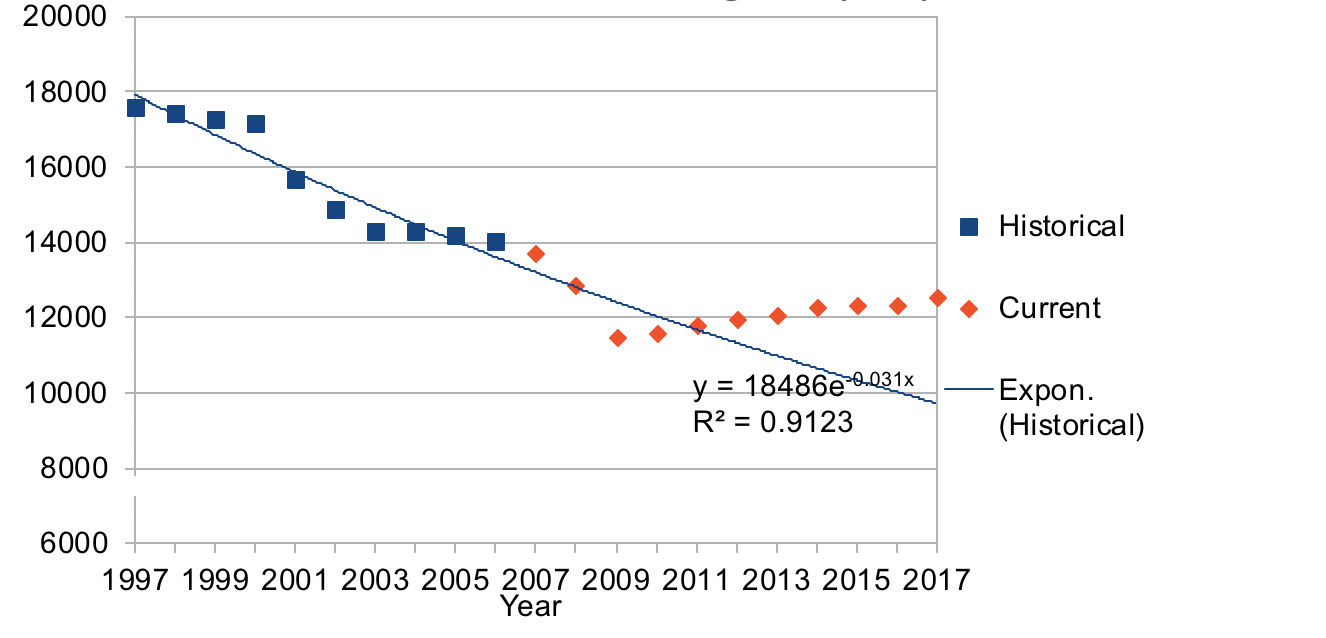

Fig 2. BLS Manufacturing Employment

- Kearney chooses to ignore FDI (foreign direct investment by foreign companies) which is essentially the same phenomenon as reshoring by domestic companies. FDI continued to grow in 2017, but at a slower pace than reshoring.

Conclusion

Kearney seems to be more interested in hype than in the consistent reporting of data. We can find no evidence that the Index was released for 2016 when they admit that reshoring was strong. The Reshoring Initiative reports results accurately and consistently, whether or not the results favor reshoring. “Some A.T. Kearney statements were completely misleading, chosen to get attention,” says Harry Moser, President of the Rershoring Initiative. “They succeeded to the disadvantage of U.S. manufacturing. Recognition of the strength of the reshoring trend is a major factor driving companies to reevaluate offshoring and many individuals to choose manufacturing technology training, helping to fill the skilled workforce gap.”“It is clear that about 25% of what is now offshored would be economically reshored today if companies used TCO (Total Cost of Ownership) instead of wage arbitrage or PPV (Purchase Price Variance) to make sourcing and siting decisions. A.T. Kearney would better serve its clients and country if it helped educate companies rather than discouraging them.”